Investing.com – Bitcoin and other major cryptocurrency prices gained on Monday. Fundstrat Global Advisors’ Thomas Lee’s comments received some focus as he said there is a strong correlation between emerging markets and virtual coins.

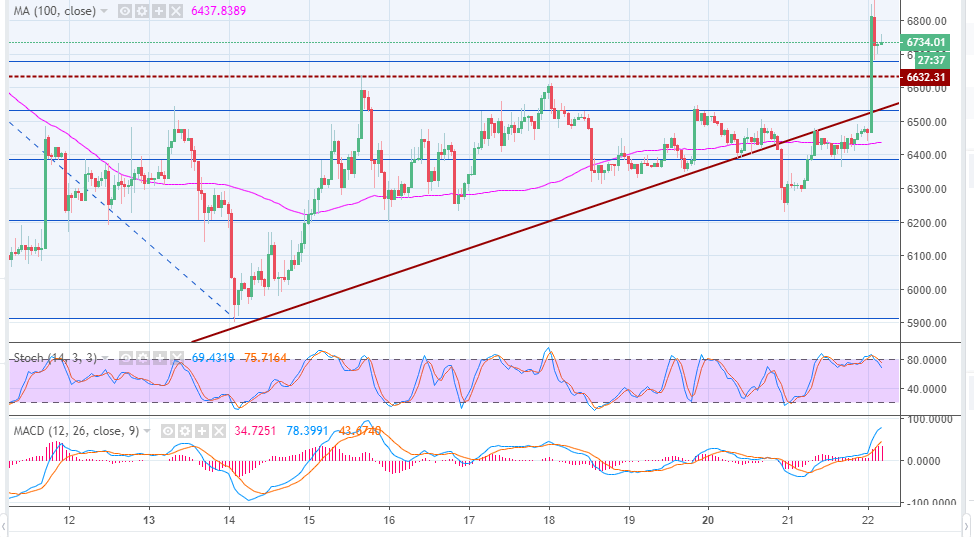

Bitcoinââ¬Â¯wasââ¬Â¯up 0.8%ââ¬Â¯to $6,668.9ââ¬Â¯at 11:55AM ET (03:55ââ¬Â¯GMT)ââ¬Â¯on theââ¬Â¯Bitifinexââ¬Â¯exchange.ââ¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯

Ethereumââ¬Â¯edged up 0.1%ââ¬Â¯to $272.4ââ¬Â¯on theââ¬Â¯Bitifinexââ¬Â¯exchange.ââ¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯

XRPââ¬Â¯traded up 0.3%ââ¬Â¯toââ¬Â¯$0.32328ââ¬Â¯in the last 24 hours on theââ¬Â¯Poloniexââ¬Â¯exchange, whileââ¬Â¯Litecoinââ¬Â¯was also up 0.6% to $56.654.ââ¬Â¯Ã¢â¬Â¯Ã¢â¬Â¯

Lee said hedge funds are not buying risk when emerging markets sell-off, while the recent slump in digital assets suggested the funds are not buying crypto either.

"Both really essentially peaked early this year, and they both have been in a downward trend," Lee said in an interview with CNBC. "Until emerging markets begin to turn, I think in some ways that correlation is going to hold and tell us that sort of the risk on mentality is those buyers aren't buying bitcoin."

Lee added that he believed the bear market could come to an end soon, especially if the dollar weakens and the Federal Reserve slows its interest rate hike policy, and that he thinks bitcoin could surge to $25,000 by the end of the year. "I still think it's possible," said Lee. "Bitcoin could end the year explosively higher."

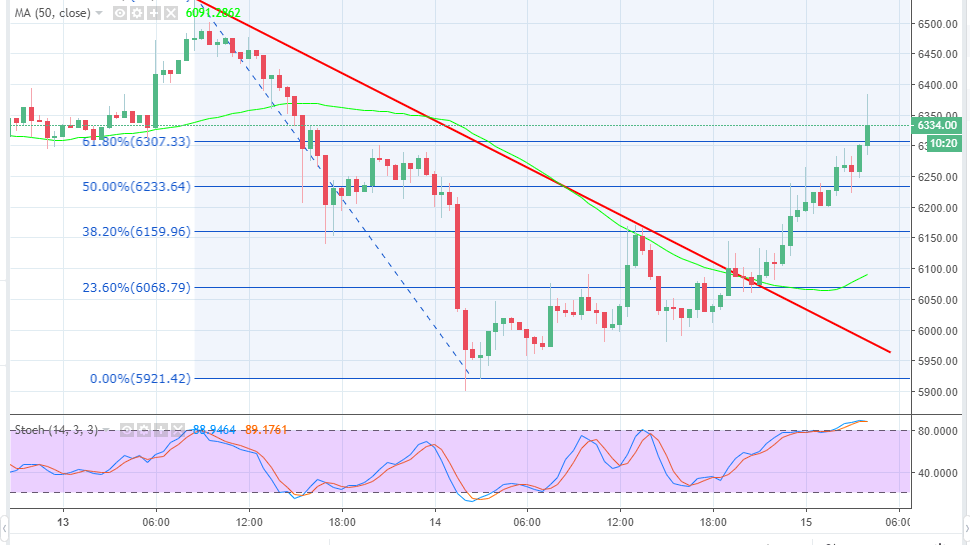

Cryptocurrency prices received some support on Friday after the U.S. Securities and Exchange Commission (SEC) said it would review a decision to reject the applications of Bitcoin exchange traded funds, after its staffs rejected the applications from nine companies to list their Bitcoin ETF funds on Wednesday, citing concerns about fraud and manipulation of bitcoin markets.

David Ogden – Http://markethive.com/david-ogden