Wall Street greets bitcoin with interest and worry

Bitcoin may be the fraud of the century, depending on whom you believe, or it could be a gold mine for early adopters.

Adventurous investors have already bought into the virtual currency and Wall Street is laying the groundwork for more wealth to flow into the cryptocurrency.

But nobody can say how big (or small) the bitcoin story will ultimately become.

Bitcoin still cannot be used to buy even a loaf of bread. It cannot be purchased from a company or sold directly on a major financial exchange and it is backed by no central bank. And it also dissimilar to metals like gold or silver, with universally accepted value.

Yet bitcoin is exchanged like money.

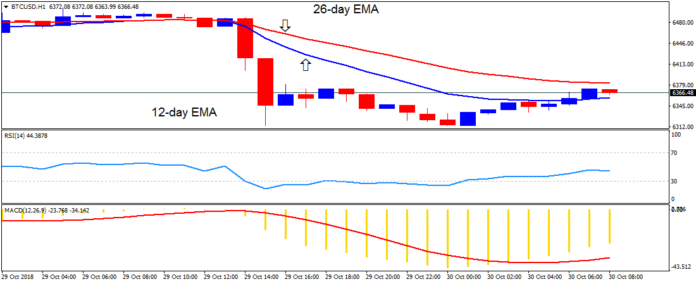

Near the end of 2017, bitcoin reached almost $20,000 in value amid a buying frenzy. It has since come down closer to earth and is now worth around $6,400.

Such volatility is too nerve-wracking for most mainstream investors but the radical price swings hold appeal for short-term traders.

rue believers in the currency, along with these short-term speculators, now have a variety of investment opportunities at various risk levels.

– Debut on major exchange –

The most direct way to buy bitcoin is on an exchange that specializes in cryptocurrencies, although many of those platforms are at risk of hacking.

In late 2017, the Chicago Board Options Exchange became the first major exchange to offer a bitcoin product, a move that gave a legitimacy to the currency.

The Chicago exchange allowed trading on bitcoin futures — not on bitcoin itself — a financial instrument well known among investment professionals.

Another option is to pick an investment vehicle composed of bitcoin, such as the Bitcoin Investment Trust, which is managed by Grayscale Investments. But those interested in such ventures must transact in a private and bilateral basis and typically pay high fees.

Bitcoin believers are still awaiting the green light from regulators for exchange traded funds(ETF) that would track the movements of the virtual currency, a key step that could take the market more mainstream.

“The arrival of a potential bitcoin ETF remains top-of-mind for institutional investors seeking exposure to this emerging asset class,” said Michael Graham, an analyst specializing in Internet, blockchain and digital assets at Canaccord Genuity.

Each time, the SEC expressed concerns about fraud and manipulation, in part because it is still exchanged primarily on unregulated exchanges.

– Broadening acceptance? –

Most of the biggest names in finance are at least studying ways to participate in bitcoin, although the steps so far have been incremental.

Jamie Dimon, chief executive of JPMorgan Chase, the biggest US bank by assets, famously called bitcoin a “fraud” in 2017 and has continued to speak skeptically of it.

Since May, Goldman Sachs has served as a clearinghouse for trading bitcoin futures for clients but has not offered bitcoin investments yet.

But Fidelity Investments, the giant money manager, this month unveiled a new venture, Fidelity Digital Assets, that will execute trades in digital currency for clients and permit them to store bitcoin or other digital assets with Fidelity.

And ICE, the parent company of the New York Stock Exchange, plans to launch its own bitcoin futures contract in November.

Bitcoin platforms continue to have a variety of problems, including lack of transparency, conflicts of interest and weak system safeguards, Christopher Giancarlo, chairman of the US Commodity Futures Trading Commission, said in a mid-October interview on Fox Business.

Yet many pension funds and other mainstream investors are likely to think twice before putting big funds into ventures that could soar — but could also sink.

The US Securities and Exchange Commission has rejected several proposed ETFs, including twice blocking ETFs proposed by the twin Internet entrepreneurs Cameron and Tyler Winklevoss.

“Like all things, it takes time to mature, and with the movement of more institutional investors into the space, I think we’ll see that maturation,” Giancarlo said.

by Juliette MICHEL

New York (AFP) |

David Ogden – Http://markethive.com/david-ogden