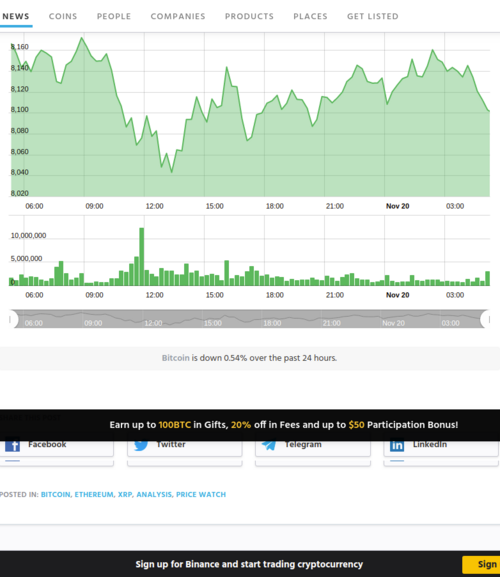

Bitcoin falls to six-month low, trades below $7,000

Bitcoin sank nearly 10 percent to the lowest level in six months, extending last week’s slide past the weekend on concerns about a crackdown on cryptocurrency operations by China.

The digital currency plunged as much as 9.8 percent from Friday’s close and was trading just above $6,700 as of 11 a.m. in Hong Kong, according to Bloomberg composite pricing. It’s the first time since May that Bitcoin traded below the key $7,000 psychological level.

The world’s largest cryptocurrency is also on track for eight straight days of declines, tying a record losing streak from 2014, according to Bitstamp pricing going back to August 2011 and including weekend trading.

“Investors can find more joy in traditional markets without the aggressive volatility and opaque markets,” said Jeffrey Halley, senior market strategist for Asia Pacific at Oanda Asia Pacific Pte. “A sustained rally in Bitcoin would require a complete breakdown in the trade negotiations to happen as financial authorities across the world continue to circle the wagons against digital currencies.”

On Friday, the People’s Bank of China told businesses involved with cryptocurrencies to correct any improper actions and asked investors to be wary of virtual currencies. Earlier this month, watchdogs in Shanghai issued notices calling for a cleanup of companies involved in crypto trading, while one in Beijing warned against illegal exchange operations.

There are plenty of other possible explanations for the drop. Traders are blaming low volumes and citing attractive returns from traditional assets, eToro UK market analyst Adam Vettese wrote in a note Friday. Smaller miners are also getting squeezed out by the falling price, causing further selling toward the break-even level of around $5,600 to $6,400, Vijay Ayyar, Singapore-based head of business development at crypto exchange Luno, said Monday.

“We’re seeing what is called miner capitulation and that has indicated previous large drops in the price of Bitcoin,” he said. “At this time, the cost of production could be indicated to be in the $6,000 range and hence we’ve seen the price dip to that range last week.”

Bitcoin is still up substantially in 2019 — it ended last year at $3,674. After a meteoric rise from April to June, when it soared above $13,000, it lost momentum and has been gradually dropping since.

Joanna Ossinger and Eric Lam

Bloomberg

Singapore / Mon, November 25, 2019 / 11:28 am

David Ogden – Http://markethive.com/david-ogden

.png)

.png)