Crypto Markets Crash $30 Billion In Epic Bitcoin Sell Off

In what has been one of the largest 24 hour market dumps this year over $30 billion has been dumped from crypto assets. Bitcoin reached the end of its bearish triangle pattern and dumped hard down to a three month low at $8,000.

Bitcoin Crashes 17%

Many had predicted a huge drop to long term support around $8k this week but it is still a shock to see it happen. Bitcoin had been sliding since late last week when it dropped below five figures again and failed to recover. Bakkt was underwhelming and markets did not react though they were not expected to.

The move have when BTC reached the apex of the large descending triangle that has formed since the top out in late June. The downwards momentum started to accelerate as soon as support at $9,500 was broken. Next came two almighty red candles which dumped Bitcoin back to $8,000 according to Tradingview.com.

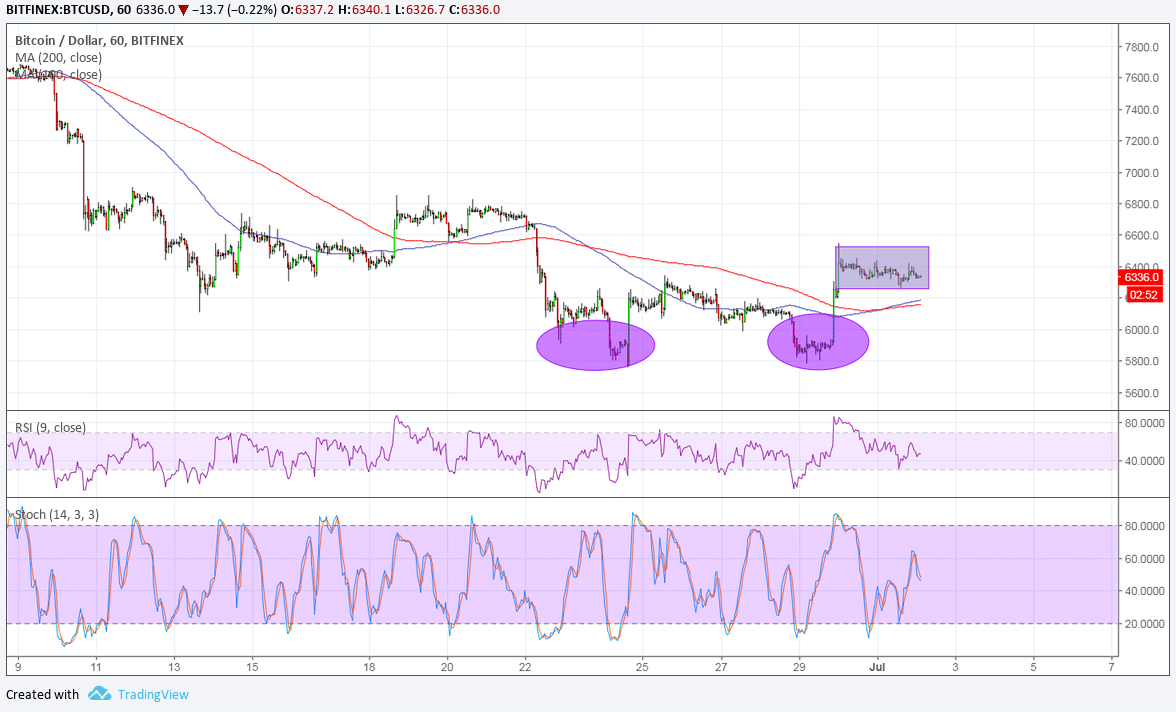

BTC price 1 hour chart – Tradingview.com

This area is a massive support zone and as expected a lot of buys were triggered there resulting in the hourly closure back up at $8,600. It appears to have settled in this zone for the time being.

The dump was so large that the Bitcoin bashers wasted no time on twitter. Goldbug Peter Schiff was one of the first to react calling for an even lower slide.

“Bitcoin has finally broken below the support line of the large descending triangle it has been carving out for months. This is a very a bearish technical pattern, and it confirms that a major top has been established. The risk is high for a rapid decent down to $4,000 or lower!”

The $4k call is a little extreme but to be expected from those that are anti-crypto. A more balanced prediction came from analyst Josh Rager who identified some of the larger buying zones.

“If Bitcoin fails to break above the current level, we’ll get another retest of the support below – which has bounced once and could hold. But if this isn’t a bear trap I do see price heading down to low $7ks. Lots of buyers are waiting between $6180 & $6500”

Altcoins Annihilated

With Bitcoin getting smashed the situation for the rest of the crypto markets is grim to say the least. Ethereum has been eclipsed 15 percent in a slump back to $170 where it is currently holding support.

XRP has hit a new yearly low below $0.24 in an 11 percent slide and Bitcoin Cash has been crushed to $230 in a massive 20 percent dump.

Tether has regained fifth spot in terms of market cap as Litecoin got axed 15 percent in a fall below $60. EOS has dumped 22 percent in an epic crash to $2.90 and Binance Coin is hurting at $16, down 16 percent on the day.

September 25 has been one of the largest crypto market dumps of the year.

Martin Young

David Ogden – Http://markethive.com/david-ogden