Proposed A Radical Competitor To Bitcoin And The U.S. Dollar

Bitcoin and cryptocurrency competitors are in vogue at the moment with both social media giant Facebook and China planning their own digital currency projects.

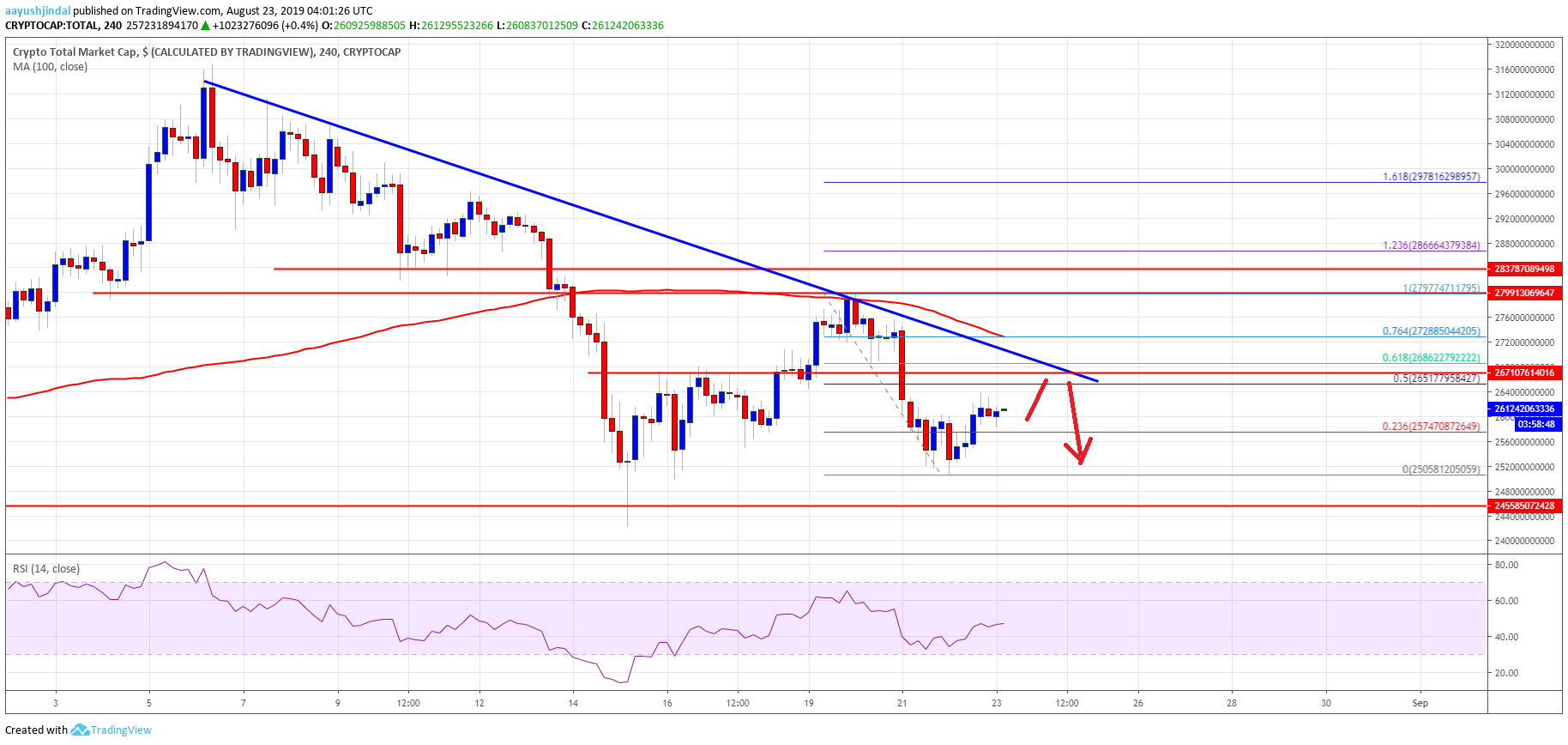

The bitcoin price, despite suddenly plummeting this week, has climbed this year largely because the likes of Facebook and South Korean technology behemoth Samsung have tacitly endorsed bitcoin and cryptocurrency technology, helping it to somewhat recover from a disastrous 2018.

Now, Bank of England governor Mark Carney, who has previously poured scorn on bitcoin and its crypto peers, has said a global digital currency, which sounds remarkably like bitcoin, could replace the U.S. dollar as the world’s reserve currency.

The Bank of England governor Mark Carney has suggested governments work together to create a global digital currency–something which could rival bitcoin and other cryptocurrencies. GETTY IMAGES

"[A digital currency] could dampen the domineering influence of the U.S. dollar on global trade," Carney said in a speech at the gathering of central bankers from around the world in Jackson Hole, Wyoming, it was first reported by the Guardian, a U.K. newspaper.

The U.S. dollar is stockpiled by governments around the world to help protect against any downturns in the U.S. economy.

"If the share of trade invoiced in [a digital currency] were to rise, shocks in the U.S. would have less potent spillovers through exchange rates, and trade would become less synchronized across countries," Carney added.

Carney's comments follow attempts by Facebook to win over global financial regulators to its libra cryptocurrency project, expected to launch some time next year.

Facebook has said it wants libra to act as a global currency and is trying to launch the coin in as many countries as possible, though it's thought to have a focus on emerging markets.

Earlier this month, a senior official at China's central bank said it's "almost ready" to issue its own sovereign digital currency, with new research out this week suggesting it could eliminate the need for bank accounts.

"The dollar’s influence on global financial conditions could similarly decline if a financial architecture developed around the new [digital currency] and it displaced the dollar’s dominance in credit markets," Carney added.

Bitcoin enthusiasts were, of course, quick to point out bitcoin would fulfill many of Carney's requirements.

"Bitcoin largely fits the description of what [Carney] is looking for—something ‘removed’ from country borders and independent of country-specific interest rate policies," Richard Galvin, a former investment banker at JPMorgan Chase and now chief executive of Digital Asset Capital Management, told Bloomberg, a financial newswire.

The bitcoin price has climbed so far this year as interest in bitcoin and cryptocurrencies from some of the world's biggest technology companies has grown.COINDESK

Carney has publicly criticized bitcoin however, last year warning bitcoin could be heading for a "pretty brutal reckoning," and that cryptocurrencies have "all the hallmarks of a bubble."

Despite Carney's dislike of bitcoin, the Bank of England earlier this year said it welcomed Facebook’s libra initiative, adding it could be a useful addition to trading goods and services.

Carney's comments are though likely to put him at odds with U.S. president Donald Trump who recently launched a scathing attack on bitcoin and cryptocurrencies in light of Facebook's plans, branding them "unregulated crypto assets" and based on "thin air."

"We have only one real currency in the U.S.A., and it is stronger than ever, both dependable and reliable," Trump said. "It is by far the most dominant currency anywhere in the world, and it will always stay that way. It is called the United States dollar!"

Billy Bambrough

David Ogden – Http://markethive.com/david-ogden