Market Network Meets Blockchain

A New Way Is Here And Thriving

Market Networks are doing something in an entirely new way. They are unburdened by the traditional confines of any given industry and provide a value that is different from, and maybe even better than, the standard way. Coupled with the technology of the Blockchain creating a more transparent, immutable and autonomous environment with complete privacy. This new way is more flexible and immediate – for the user and the providers.

Opportunities for these market networks exist wherever there are groups of service professionals supporting an industry vertical. Organizing this way could have a significant impact on how millions of people work and live, and how hundreds of millions buy services.

What Is a Vertical Market?

A vertical market is a market encompassing a group of companies and customers that are all interconnected around a specific niche. Companies in a vertical market are attuned to that market’s specialized needs and generally do not serve a broader market.

The Early Vertical Market Networks comprises of groups of resources specializing in the various products, technologies, or services that constitute the inputs of a particular industry, organized around a market that focuses on monitoring and managing the critical contingencies faced by the network participants in that market.

What Is A Market Network?

A new business model has emerged. Market-networks are hybrid animals: part social network, part marketplace, part SaaS.

Market networks represent a different way to do business compared to sites like Airbnb or Uber that simply aggregate demand. In that model, neither the seller nor the customer matter. A market network elevates the relationship, the reputation, the value. Fees are lower and contracts are simplified. Market networks have stronger retention and engagement than marketplaces

These market network businesses have the potential to disrupt traditional markets by doing something in an entirely new way. They are unburdened by the traditional confines of an industry and provide a value that is different from, and maybe even better than, the standard way.

Thanks to innovation and new technology Markethive has combined the three pillars of the NEW Market Network including but not limited to having a Marketplace, similar to Amazon, Freelancers, eBay you get the picture. This Marketplace is populated with buyers (Markethive subscribers) and sellers (Markethive Entrepreneurial upgrades) and connected in a social network similar to Facebook and LinkedIn the well known social networks; all integrated with a fantastic advanced proprietary set of Market tools (Inbound Marketing platform) known as SAAS (Software as a Service) the Workflow.

What’s unique about market networks is that they:

-

Combine the main elements of both networks and marketplaces

-

Use SaaS workflow software to focus action around longer-term projects, not just a quick transaction

-

Promote the service provider as a differentiated individual, helping to build long-term relationships

The Marketplace Defined

-

An open square or place in a town where markets or public sales are held.

-

The marketplace is the interpreter of supply and demand.

-

Where buyers and sellers connect.

Marketplaces benefit from powerful network effects – supply and demand follow each other – it’s often a high-stakes battle for leadership: when one marketplace achieves undisputed leadership, it can generate huge profits, retain customers and keep competitors at bay.

An online marketplace (or online e-commerce marketplace) is a type of e-commerce site where product or service information is provided by multiple third parties, whereas transactions are processed by the marketplace operator. Online marketplaces are the primary type of multichannel e-commerce and can be a way to streamline the production process.

In an online marketplace, consumer transactions are processed by the marketplace operator and then delivered and fulfilled by the participating retailers or wholesalers (often called drop shipping). Other capabilities might include auctioning (forward or reverse), catalogs, ordering, wanted advertisement, trading exchange functionality and capabilities like RFQ, RFI or RFP. These types of sites allow users to register and sell single items to a large number of items for a "post-selling" fee.

In general, because marketplaces aggregate products from a wide array of providers, the selection is usually wider, and availability is higher than in vendor-specific online retail stores. Also, prices may be more competitive.

Since 2014, online marketplaces are abundant since organized marketplaces are sought after. Some have a wide variety of general interest products that cater to almost all the needs of the consumers, however, some are consumer specific and cater to a particular segment only. Not only is the platform for selling online, but the user interface and user experience matters. People tend to log on to online marketplaces that are organized and products are much more accessible to them.

“Marketplaces” provide transactions among multiple buyers and multiple sellers — like eBay, Etsy, Uber, and LendingClub.

Social Networks

The number of worldwide social media users has reached 2.34 billion and is expected to grow to some 2.95 billion by 2020.

“Social Networks” provide profiles that project a person’s identity, then lets them communicate in a 360-degree pattern with other people in the network. Think Facebook, Twitter, and LinkedIn.

Networks themselves have different purposes, and their online counterparts work in various ways. Loosely speaking, a social network allows people to communicate with friends and acquaintances both old and new.

Definitions of social networks can vary depending on what the network itself offers. One thing that all social networking websites have in common is the ability for users to post a profile. These profiles are basically lists of information that you wish to share with your connections.

Profiles serve to give friends and acquaintances basic information about you at a glance. They list things like your profession and work history, current contact information, likes and dislikes, and your location. Most of this information is protected and can be optional, though it does serve to help others find you more easily.

Social networking is not a static thing. Networks are growing and changing all the time, with new ones popping up at a fast rate. Many networking websites are geared towards users with specific interests and needs, while others encourage everyone to join.

Since this form of networking is always evolving, the definition of a social network will also be fluid. At its heart, however, an online social network is a meeting place for people to extend their reach and stay in contact with their connections.

What Is Unique About A Market Network

A market network often starts by enhancing a network of professionals that exists offline. By moving these connections and transactions into software, a Market Network makes it significantly easier for professionals to operate their businesses and clients to get better service.

Market networks target more complex services. In the last six years, the tech industry has obsessed over on-demand labor marketplaces for quick transactions of simple services. Companies like Uber, Mechanical Turk, Thumbtack, Luxe, and many others make it efficient to buy simple services whose quality is judged objectively. Their success is based on “commodifying” the people on both sides of the marketplace.

People matter. With complex services, each client is unique, and the professional they get matters. Would you hand over your tax planning to just anyone? Or your corporate identity program? The people on both sides of those equations are not interchangeable like they are with Lyft or Uber. Each person brings unique opinions, expertise and relationships to the transaction. A market network is designed to acknowledge that as a core tenet — and provide a solution.

Collaboration happens around a project. For most complex services, multiple professionals collaborate among themselves — and with a client — over a period of time. The SaaS at the center of market networks focuses the action on a project that can take days or years to complete.

Market Networks help build long-term relationships. Market networks bring a career’s worth of professional connections online and make them more useful. For years, social networks like LinkedIn and Facebook have helped build long-term relationships. However, until market networks, they hadn’t been used for commerce and transactions very effectively.

Referrals flow freely. In these industries, referrals are gold, for both the client and the service professional. The market network software is designed to make referrals simple and more frequent.

Market Networks increase transaction velocity and satisfaction. By putting the network of professionals and clients into software, the market network increases transaction velocity for everyone. It increases the close rate on proposals and expedites payment. The software also increases customer satisfaction scores, reduces miscommunication and makes the work pleasing and beautiful. Never underestimate pleasing and beautiful.

Market Networks exist wherever there are groups of service professionals supporting an industry vertical. Organizing this way could have a significant impact on how millions of people work and live, and how hundreds of millions buy services.

Markethive – The Ultimate Market Network Meets Blockchain

Markethive is a social marketing platform for entrepreneurs that has the combined power of Facebook/LinkedIn, Marketo/Hubspot and Amazon/eBay along with Crypto News Sites like Cointelegraph/Bitcoin.com.

Delivering a dynamic social network, integrated with Inbound Marketing (SAAS), numerous commerce platforms, multiple traffic portals, built on the blockchain.

Markethive is a next-generation Social Market Network, built on the Blockchain that has positioned itself as a complete ecosystem for Entrepreneurs. Using the latest technology, it provides prosperous solutions for all business owners, marketers who require an online presence.

Markethive's functionalities include SEO features, Analytics, Customer Management System, Traffic Portals, Capture Page and Lead Creation, Profile Page, E-commerce portals, video conferencing, Blogging Platform and much more. Also included are significant training tutorials and weekly live support meetings.

Creating a “Universal Income” for entrepreneurs. Using their state-of-the-art integrated inbound marketing platform by delivering an infinity airdrop incentive to new subscribers and setting up the entire system to utilize a faucet like rewards for using the system.

Focused on Inbound Marketing, Markethive plugs into all Social Media, simplifying your marketing efforts, with automated email campaigns allowing for lead flow into your designated business. Markethive incorporates collaboration building relationships within the community.

Market Disruption

Market Networks have the potential to disrupt traditional markets.

Who Loses

With any disruptive idea, like the Internet was, not every company will benefit or embrace this trend. Where are the music stores, the book stores, the video stores, the clothing stores today? Not on Main Street! They, as well as millions of other markets, are now operating on the Internet.

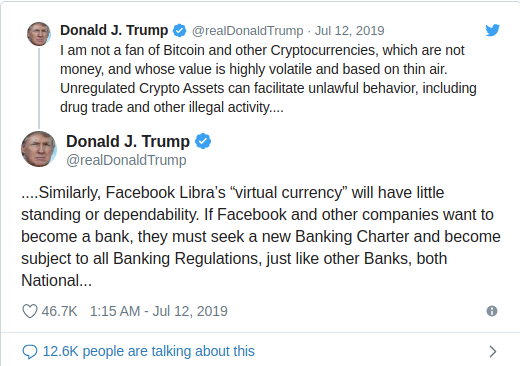

Banks are clearly in the path of the disruption of the blockchain, the Big Data social network systems, the online auction, and shopping centers are as well. And companies that resist these trends, blockchain as well as combining the social network fabric with tools into their services are soon to become relics and a footnote in history.

Who Wins

Forward-looking companies that convert to the blockchain to improve the privacy and security of their data and create an environment that is unfettered from political and nefarious agendas, will be the winners on top. As people migrate to better solutions for privacy and security, as the news continues to reveal the agendas of Big Data companies like Facebook and Twitter manipulating their system to favor their agenda and to diminish those who contradict them, as new blockchain companies share the profits via their coins, a new environment will grow with these winners as the losers quickly collapse into obscurity.

The Power Of Blockchain Technology

Just about every company that migrates to the blockchain and new companies launch built upon the blockchain, will prosper, as long as they deliver with the benefit of their customers the prime agenda.

Markethive is positioned and dedicated to being a leader in this new business environment of the people, by the people, for the people in this Blockchain revolution.

Market Networks are also becoming mainstream in a wide range of vertical markets, whereas, the social fiber will become integral with any dynamic vital company out there, like Huber, Tesla, eBay, Overstock, Media, news journals, you get the picture.

Markethive will become the next giant as the next 10 years will be run by blockchain dominated by Market Networks. Markethive is first to market this hybrid in this new brave world.

FOLLOW US ON…

Website: https://markethive.com

Token Site: http://markethive.io/

Telegram: https://t.me/markethive_support

Twitter: https://twitter.com/markethive/

Github: https://github.com/markethive /

Reddit: https://www.reddit.com/r/markethive/

Crunchbase: https://www.crunchbase.com/organization/markethive

Medium: https://www.medium.com/@markethive

Bitcointalk: https://bitcointalk.org/index.php?topic=3309067.msg34535452#msg34535452

Telegram News: t.me/Markethive

LinkedIn: https://linkedin.com/company/Markethive

Facebook: https://facebook.com/MarketHive

Youtube: https://youtube.com/Markethive

David Ogden

Entrepreneur @ Markethive, a global Market Network. Also a strong advocate for technology, progress, and freedom of speech. I embrace "Change" with a passion and my purpose in life is to help people understand, accept and move forward with enthusiasm to achieve their goals.

David Ogden – Http://markethive.com/david-ogden