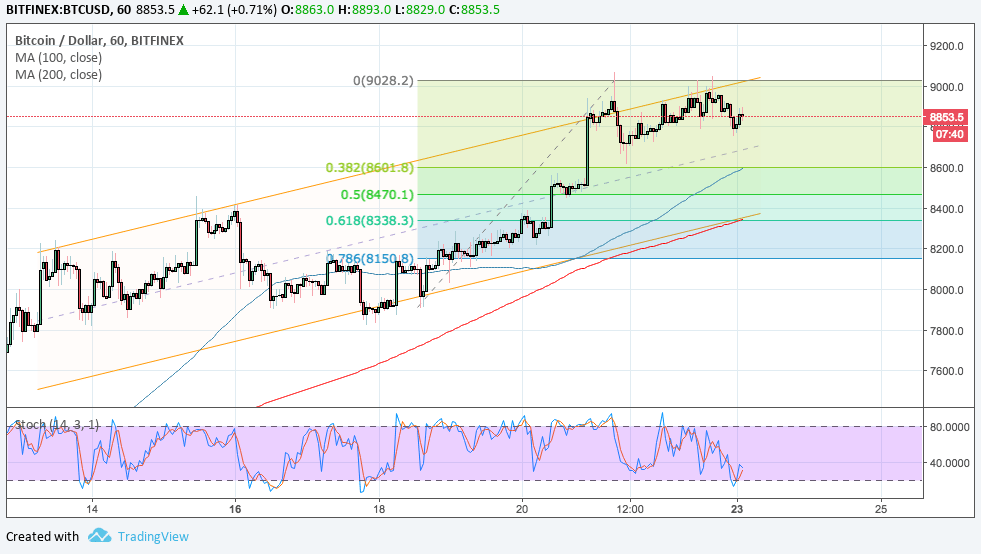

Bitcoin Price Technical Analysis 23 April – Bulls Back in Action

Bitcoin Price Key Highlights

-

Bitcoin price has gained some traction since breaking past its inverse head and shoulders neckline.

-

Price is now trading inside an ascending channel and testing the resistance.

-

A return in bearish pressure could take it back down to support around the Fib levels.

Bitcoin price is trending higher but might be due for a pullback to its channel support.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA to signal that the path of least resistance is to the upside. This indicates that the uptrend is more likely to resume than to reverse.

Applying the Fib tool to the latest swing low and high shows that the 61.8% retracement level lines up with the bottom of the channel at $8338.30. The 38.2% retracement level is close to the mid-channel area of interest at $8600.

The 100 SMA is above the longer-term 200 SMA to confirm that the path of least resistance is to the upside. In other words, the uptrend is more likely to continue than to reverse. The gap between the two is also widening to reflect stronger bullish momentum.

Stochastic looks ready to turn up from the overbought zone to signal a return in buying pressure. In that case, bitcoin could even attempt to break past the channel resistance or swing high at $9000 to establish a steeper climb.

Market Factors

Exchanges are reporting that buy orders are nearing 92% of activity, drawing even more investors in so as to not get left behind in the rally. Some predict that bitcoin could surge past the $20,000 highs within the quarter.

Risk appetite has also been mostly supported in the markets, which means that traders are willing to place bets outside of traditional assets like stocks and commodities. Sentiment in the cryptocurrency industry itself has also improved significantly over the past couple of weeks, spurred by news about big hedge funds and acquisitions in the space.

Author SARAH JENN | APRIL 23, 2018 | 5:37 AM

Posted by David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden