IRS to Require 150 Million Filers to Disclose Crypto Activities

The U.S. Internal Revenue Service (IRS) has unveiled a new draft tax form used by some 150 million people in the country to file tax returns. It has a section that requires them to answer whether they have received, sold, sent, exchanged, or acquired any financial interest in any cryptocurrencies during the year.

New Tax Form

The IRS published a draft of the new 1040 tax form containing a question about the tax filer’s crypto-related activities on Friday. The move follows the release of the agency’s long-awaited tax guidance which was published on Wednesday.

The 1040 form is the main tax form used by all filers in the U.S. According to the IRS, over 154 million tax returns were submitted using this form in 2018, and over 152 million in 2017. The new 1040 form, when implemented, will be used to file taxes starting in 2019. The IRS emphasized that “This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information,” adding:

We generally do not release draft forms until we believe we have incorporated all changes, but sometimes unexpected issues arise, or legislation is passed.

The 1040 instructions, also published Friday, has a section on “virtual currency.” The IRS explained that taxpayers must check the “yes” box if they have “engaged in any transaction involving virtual currency.”

The tax agency added that any comments regarding the draft, instructions or publications can be submitted, but “we may not be able to consider many suggestions until the subsequent revision of the product,” the IRS wrote.

All US Taxpayers Will Be Asked

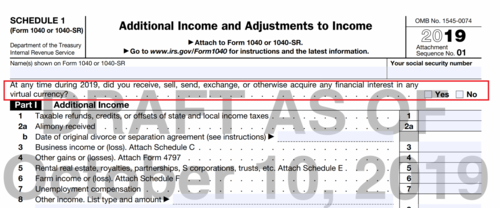

According to the draft of the new 1040 tax form, Schedule 1 will now include a question about the tax filer’s crypto activities. Schedule 1, entitled Additional Income and Adjustments to Income, is filed alongside the 1040 form. It is used to report income or adjustments to income that cannot be entered directly on Form 1040.

The first question on the new Schedule 1, according to the draft, will be a yes or no question which reads:

At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?

According to the tax agency, such a transaction includes “The receipt or transfer of virtual currency for free (without providing any consideration), including from an airdrop or following a hard fork; an exchange of virtual currency for goods or services; a sale of virtual currency; and an exchange of virtual currency for other property, including for another virtual currency.”

Draft of Schedule 1 of Form 1040.

Furthermore, the IRS reiterated that taxpayers must use Form 8949 to figure out their capital gain or loss, and report it on Schedule D of Form 1040, if they have “disposed of any virtual currency that was held as a capital asset” during the year.

For taxpayers who received any cryptocurrency “as compensation for services” or disposed of any coins held for sale to customers in a trade or business, the IRS emphasized that they must report the income as they would other income of the same type. “For example, W-2 wages on Form 1040 or 1040-SR, line 1, or inventory or services from Schedule C on Schedule1,” the IRS exemplified.

Lastly, taxpayers who did not engage in any crypto transactions during the year do not need to do anything if they are not filing Schedule 1. Otherwise, they only need to check the “no” box on the form.

What do you think of the IRS asking about cryptocurrency on the main U.S. tax form? Let us know in the comments section below.

by Kevin Helms

David Ogden – Http://markethive.com/david-ogden