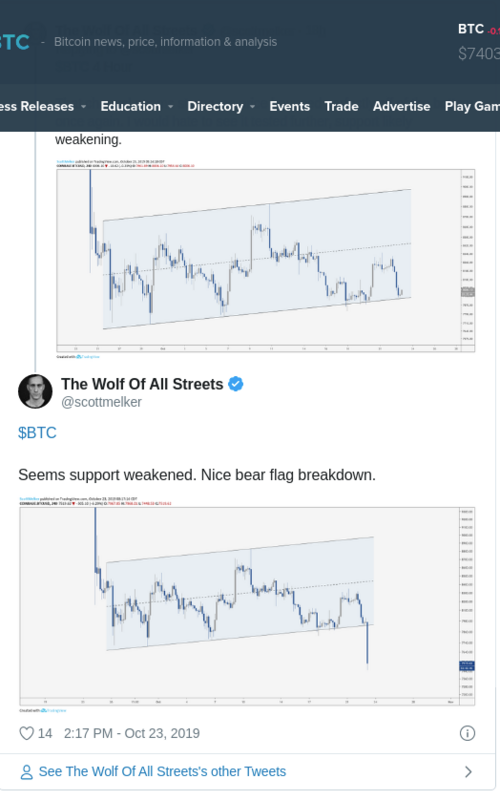

Bitcoin (BTC), Ethereum (ETH) and XRP Must Hold These Key Levels to Avoid Further Crypto Collapse – Technical Analysis Roundup

Technical analysts are mapping out key levels that leading cryptocurrencies Bitcoin, Ethereum and XRP now need to hold onto to avoid another rapid plunge.

Daily analyst Josh Rager says BTC’s first level of support is now around $7,120.

Due to low volume and historical precedent, Rager thinks BTC is poised to fall further in the short term, with big demand for BTC sitting at around $6,000.

“Where do we think buyers are going to step in at? Because it really comes down to supply and demand…

I do believe that we can have a nice strong bounce in between around $6,000 all the way to around $6,500. I believe that we’re going to continue to move down. Why do I believe we’re not going to go sideways and move back up?

That’s because typically you don’t go sideways for almost a month just to move down an extra 9-10% in a day… We’ll probably range again for a few days, maybe only a couple of days or maybe a couple of weeks.”

Despite the pullback, Rager says Bitcoin has not exited its overall uptrend that began in April of 2019.

“I still think we’re in a macro uptrend. If you were to look at the chart and look at the monthly and the yearly chart, you’re going to notice that Bitcoin is in a strong uptrend and we should continue to uptrend over time. But we’re going to have down markets in between.

And so whenever you have that down market, if you know how to put a short on your Bitcoin holdings toward the top, you’re going to maintain the value of what you have. And then you can just buy more at the bottom.”

Meanwhile, analyst SalsaTekila tells his 28,000 followers on Twitter that Ethereum (ETH) bulls are struggling to hold on after hitting resistance at around $163.

If bulls can’t get back above that line, he’s predicting a further breakdown.

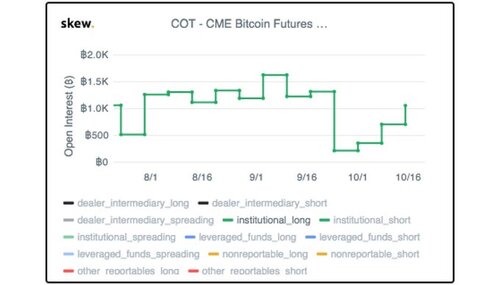

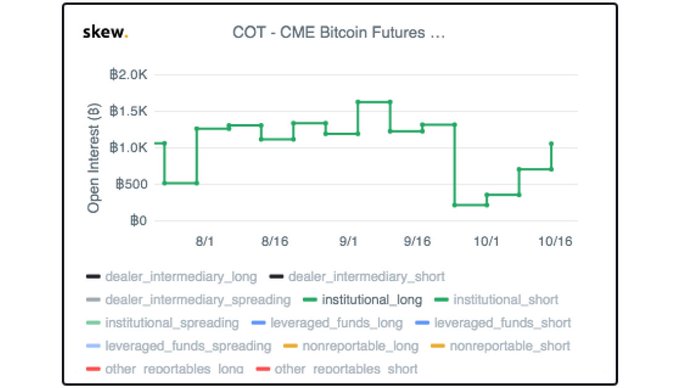

Eric Choe, who won CME Group’s annual trading competition in 2016, predicted Wednesday’s crypto crash.

He’s standing by his forecast on XRP and says there could be a short-term bounce to $0.32 if it can hold above $0.24.

Right now, Bitcoin is down slightly while the altcoin market is seeing green.

Here’s a look at the overview on COIN360 at time of publishing.

David Ogden – Http://markethive.com/david-ogden

.jpg)