Can the Bitcoin (BTC) Price Surge 72% to Hit $16,000?

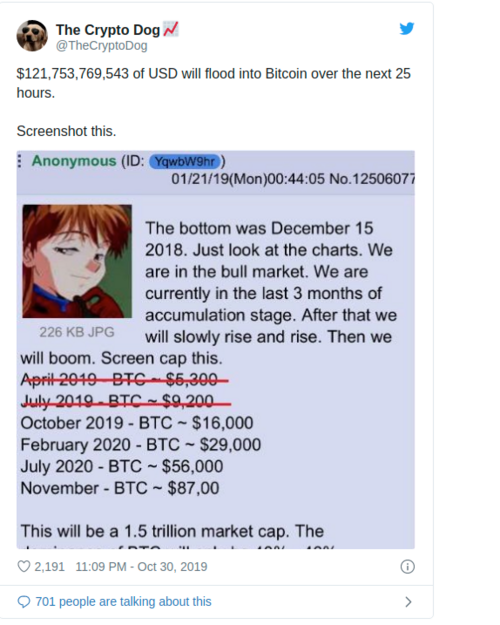

Last week, crypto investors were making much ado about a Bitcoin prediction that stated that the cryptocurrency would surmount $16,000 in October. As you likely know, this didn’t come true, with the cryptocurrency ending the month at around $9,300 — dozens of percent shy from the $16,000 predicted by the anonymous 4Chan predictor.

While this was a crushing blow to the Bitcoin optimists, there is still hope that the leading cryptocurrency will soon hit $16,000. That would represent a 72% rally from the current price of $9,200.

A $16,000 Bitcoin?

Changpeng “CZ” Zhao, the much-beloved chief executive of Binance, recently noted that Bitcoin may “see $16,000 soonish.” More specifically, he wrote that:

Lol, price predictions are easy. It’s just hard to be right about the timing. We will see $16k soon-ish. 1.4 billion people working on it as we speak.

The prominent cryptocurrency entrepreneur looked to the fact that China has just embraced blockchain technologies, which many analysts expect to have a positive trickle-down effect on decentralized cryptocurrencies and blockchains like Bitcoin and Ethereum. As one individual put it, blockchain is the gateway drug to BTC.

While CZ may be seen as too optimistic by cryptocurrency investors, there are some analyses that predict that BTC will soon begin to approach that range.

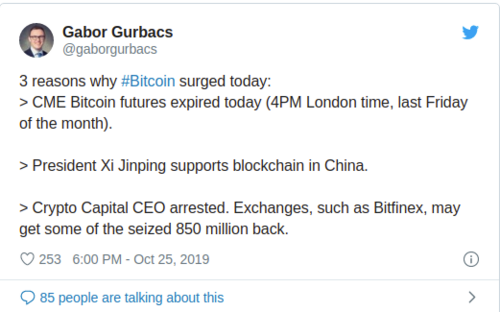

As reported by Ethereum World News, BitcoinGuru said that a massive head fake that Bitcoin just saw clearly satisfies a fractal — when historical price action plays out on current time frames at a different magnitude — that he has been tracking for a while now.

The fractal suggests that the recent drop and subsequent recovery is predicting a massive resurgence, one that will bring Bitcoin higher than its $14,000 year-to-date peak. He wrote that if Bitcoin closes around current levels, he expects for $16,000 to be reached by November 16th.

That’s far from the end of it. Trader HornHairs has noted that he “likes the chance we hit $14,000 before $7,000.” He remarked in a recent tweet that with BTC bouncing strong and holding above the one-month bullish breaker, the 0.618 Fibonacci Retracement of the entire cycle, the Point of Control as defined by the volume profile, and the yearly pivot, BTC is leaning rather bullish.

Nick Chong by Nick Chong November 4, 2019in Bitcoin News

David Ogden – Http://markethive.com/david-ogden

.png)

.png)

.png)