Young investors make thousands from bitcoin but experts warn amateurs could lose everything

Anyone seeking the hottest investments will have been watching developments in cryptocurrency with a discerning eye.

Bitcoin, the king of the breed, has soared in value since launching in 2010. Thirty dollars’ worth of bitcoin bought at launch would have made you a millionaire by now.

But the digital currency is also susceptible to wild fluctuations. Less than two weeks ago, the price of bitcoin collapsed by 15 per cent in a single day amid speculation that China was about to impose a crackdown on the currency.

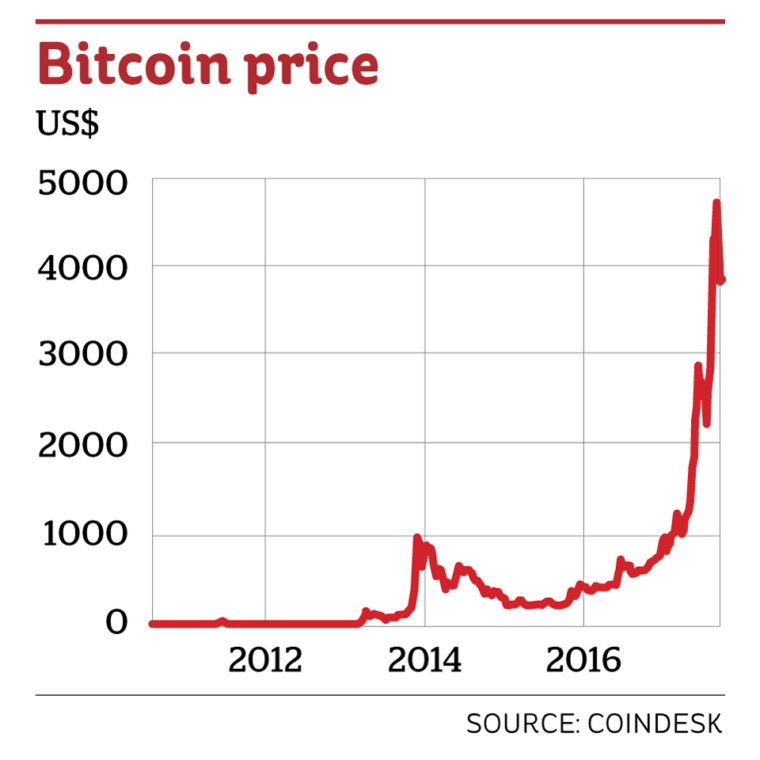

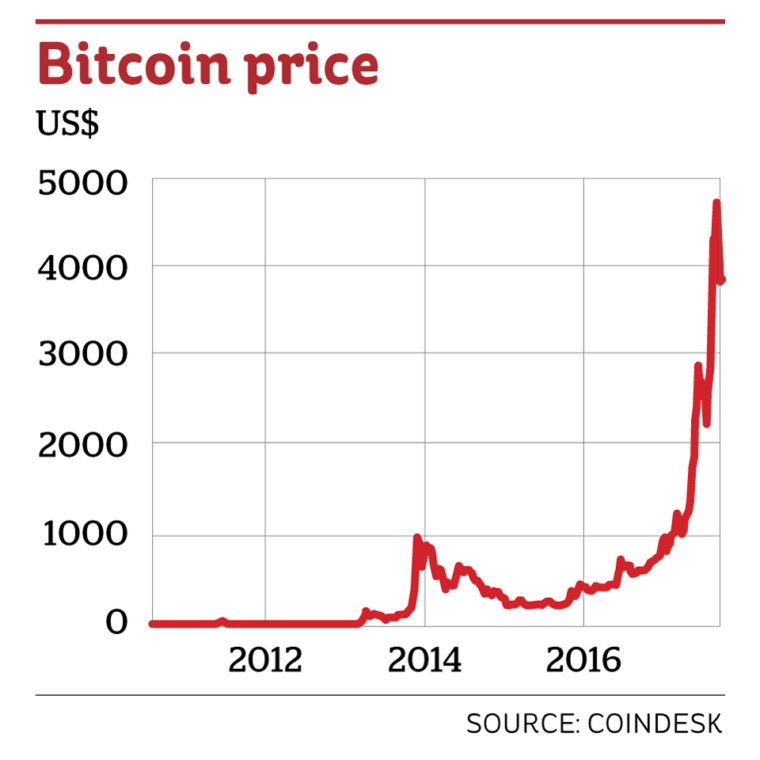

Veteran investors and financial advisers will warn you to steer clear of such a risky product. But whether the experts like it or not, the value of cryptocurrency is growing at an astonishing rate. Bitcoin, which is priced in US dollars, was worth less than 10 cents in October 2010. By November 2013 the value had jumped to $980, and it leapt again to a new high of almost $5,000 (£3,700) early this month.

The likes of bitcoin can hit dizzy heights.

They can also fall precipitously Today a single coin is worth more than $4,200. The jump in value has been fuelled by growing demand from buyers around the world. In particular, it appears to have captured the interest of young people who see cryptocurrency as a way to get involved in investing.

Alessandra Sollberger, the 29-year-old founder of London-based “superfoods” company Evermore Health, got in at the right time. She bought around 400 coins for less than $9 in mid-2012 after hearing about the currency through her work at a private equity firm.

The Oxford University graduate, who grew up in Switzerland, sold 250 coins when the price hit $82 in March 2013, making her more than $20,000. She then sold another 100 for $600 in 2014, netting her a further $60,000.

She used the money to launch her own business last year and still holds four coins, which have a current market value of almost $17,000. “Obviously with hindsight I should have put everything into it, but I’m happy with the returns I got,” she says.

Alessandra Sollberger, 29, used the money she made from bitcoin to start a business

Ms Sollberger, who is also an adviser to a cryptocurrency hedge fund in the US, believes virtual currency has a long-term future.

She is backing ether and ripple as other successful currencies, although she says investing is not for the faint-hearted. “There’ll be so much volatility. It takes a strong stomach and fundamental conviction to hold one of these in the long term.”

Beware of hackers

Cryptocurrency has no physical shape or form. The coins are created and stored electronically and transactions are made between individual users, bypassing banks. Advocates say this is the future of money – but others are concerned.

One big issue is security. Because the coins are stored electronically, the system appeals to hackers. People may also simply forget their account details or password, losing access to their coins.

Justin, a graphic designer for an architectural practice in Bath, bought 6.5 bitcoins in June 2015 for less than £1,000. The 43-year-old, who declined to give his surname, now has a portfolio worth £20,000.

But he is not planning to cash in any time soon. He plans to reassess his bitcoins in 2025, by which point he will have held them for 10 years. He has also been putting more in this year. “Rather than stick spare money at the end of the month into a savings account, I spend it on bitcoin,” he says.

Andrea Casino, 22, is new to cryptocurrency

Andrea Casino, a 22-year-old Master’s student, only starting investing in crypto two months ago. He put $2,000 in two newer crypto coins – OmiseGo (OMG) and Lisk.

“I was up about $600 in my first week. But then the concerns about China happened and the value dipped to $1,500. Now I’m $400 in profit,” he says. “I don’t do any other form of investing. It’s a bubble but holding now is the wisest thing to do.”

How to buy:

Partly for the purposes of researching this article – as well as being curious about the growth potential of bitcoin – I recently became a buyer.

The first thing you need is a wallet to store the “coins”. Investors willing to spend a lot of money should really get an offline wallet (similar to a hard drive). I went for a free online wallet at Blockchain.info.

After you have signed up for a wallet, you will be given your own bitcoin address – a unique set of numbers that is similar to a bank account number. Once you have copied down your address, head to an online exchange to buy some coins. I used Bittylicious.com after reading several favourable reviews online. It also offers a very competitive commission rate.

You can buy various currencies on Bittylicious, although Blockchain will only host bitcoin and ether in the wallet at the moment. You buy the coins by paying cash direct into the seller’s high-street bank account.

You don’t have to buy a whole bitcoin; it can be as small a portion as you want. There are some places in the UK where you can spend your bitcoin – see wheretospendbitcoins.co.uk/map.

Have you missed the boat?

There is no doubt that bitcoin’s growth has slowed over the past month. However, investors will know that any investment should be made with the long term in mind.

In bitcoin’s case, no one knows what the value of the coins will be in 10 years’ time. The currency could soar by more multiples, or it could collapse and become another failed financial product that economists will analyse for years to come.

Should you invest?

What the experts say

Gretchen Betts, Magenta Financial Planning

The high returns are clearly attractive to young people. However, this market is unregulated and susceptible to fraud and hackers – with no compensation if this happens. So as an investor, you could lose everything.

Cryptocurrency should be considered very high risk and only for sophisticated investors who can afford to speculate with money they are prepared to lose. The volatility means losses of 20 per cent in a day are not unusual; most people can’t afford to lose that much.

As an unregulated asset, bitcoin is not something I would recommend as an investment. There are also some ethical concerns to consider – the anonymous nature of cryptocurrency makes it attractive to criminals and for money laundering.

William Hobbs, Barclays

To make the case for an asset’s inclusion in a portfolio, it needs to have a positive expected return over the long term, and act as a diversifier.

Bitcoin potentially satisfies both criteria. With the increasing digitisation of the economy, we may see a greater shift towards non-cash transactions executed through digital means. This would, increase the utility of cryptocurrency, potentially leading to price appreciation and a positive expected return. Besides that, bitcoin is unlike most traditional asset classes.

Of course, correlations should be interpreted with caution, given how unstable they can be.

Nevertheless, current patterns suggest, in theory, that bitcoin may be, in theory, a useful diversifying asset.

Author: Elizabeth Anderson

Posted by David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden