BITCOIN REVOLUTION – Is it legit or a scam?

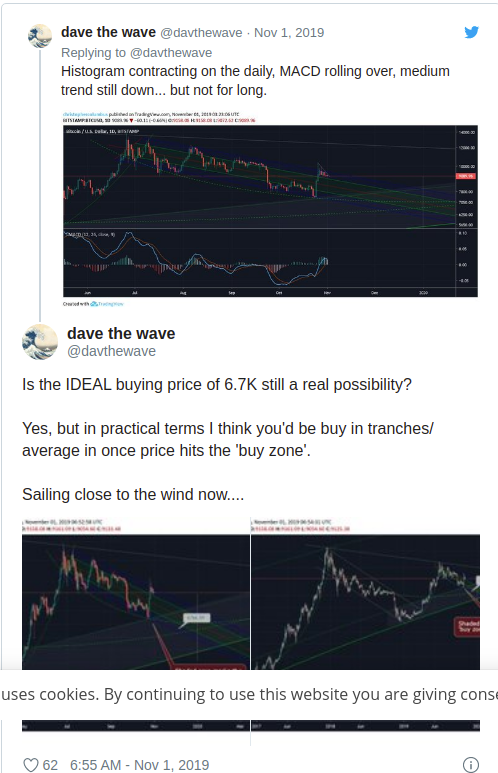

Bitcoin Revolution is an investment scheme that has been operating online for several years and, despite the growing number of warnings, there are still plenty of people around the world who think that it just might be for real.

Anyone who has spent time in the crypto trenches knows to stay away from Bitcoin Revolution, but that hasn’t stopped less savvy people from falling prey to its claims of earning massive profits for a minimal investment.

Interest in the investment scheme appears to be especially pronounced in Australia and Europe, where searches for ‘bitcoin revolution’ have climbed higher than 12,000 per month in some countries.

In Australia, Google Trends reports that over the past week, two of the five most searched for Bitcoin-related search terms are related to Bitcoin Revolution.

.png)

Most of the searches appear to be related to researching the scam, with phrases like ‘is bitcoin revolution legit’ and ‘bitcoin revolution review’ leading the pack.

A flood of fake celebrity endorsements

One tactic that Bitcoin Revolution uses is to promote its investment scheme through the use of fake celebrity endorsements which frequently appear on Facebook, Instagram, and other platforms.

A laundry list of celebrities have unwittingly had their name and image used to promote Bitcoin Revolution, including actors Kate Winslet and Hugh Jackman, TV personalities Simon Cowell and Jeremy Clarkson, and even political figures like Goh Chok Tong, the former prime minister of Singapore.

Facebook has come under fire for allowing the ads, which typically feature a well-known celebrity or public figure waxing enthusiastic about how much they have made through their investments on the platform.

Governments warn against Bitcoin Revolution

Just last week, the Malta Financial Services Authority (MFSA) issued a warning about a scam called Bitcoin Future.

In the warning, the agency noted that “this entity appears to present the same deceitful characteristics as another entity, Bitcoin Revolution.”

The MFSA had previously issued two separate warnings about Bitcoin Revolution in January and August of this year, cautioning its citizens that “information available to the MFSA suggests that Bitcoin Revolution is likely to be an international “get-rich-quick” cryptocurrency scam.”

“The public should, therefore, refrain from undertaking any business or transactions with the entity operating under the name of Bitcoin Revolution,” it added.

In the United Kingdom, the Financial Conduct Authority issued its own warning about similar scams last year.

While it did not specifically mention Bitcoin Revolution, the FCA did warn about a similar scam called Bitcoin Loophole.

A closer look at Bitcoin Revolution (Evolution)

To decide for myself whether or not Bitcoin Revolution was legit, I created dummy accounts at three separate websites running the same-named scam.

Scam A: the-bitcoinrevolution(dot)com – I found this one searching Google for ‘bitcoin revolution’.

Scam B: profittoday(dot)net/ck/bitrevolution/ – I found this stumbling across a fake ad in which actor Robert De Niro purportedly claims to be earning “tens of thousands of euros a day” from the investment scheme.

Scam C: securelywealth(dot)com/bitcoinevolution/ – This comes from the same fake ad in which actor Hugh Jackman supposedly announced his retirement from acting due to the massive amounts of money he was making.

Note: Since Micky originally reported on the Hugh Jackman story, the website has since changed its name from Bitcoin Revolution to Bitcoin Evolution.

All three websites make the same claims – in fact, I would estimate that 80% of the content is identical from one website to the next.

Using “proprietary” automatic trading software, the websites claim that users can expect to earn as much as $1,000 to $1,300 per day.

The software is so powerful, the scam states, that some users “earned their first million within just 61 days.”

Same scam, three different platforms

Using a fake name, email address, and phone number, I created accounts on all three websites.

The signup process was quick and simple – no proof of identification or other KYC steps needed.

Once logged in, the first thing I noticed was that each website had different software powering its trading platform.

Scam A was the only one that appeared to have its own platform. Scams B and C use third-party software from MonumentTrade and GeneralTrade, respectively.

Scam A also had a demo version of their platform, which was nice. I pretend-earned over US$200 in less than fifteen minutes.

Had I actually decided to deposit money into those accounts, Scams A and B would have required me to speak with a broker or account manager. Scam C uses a payment processor called VoguePay to enable deposits using a Visa, Mastercard, or existing VoguePay digital wallet.

All three websites boast that their trading software has won “numerous awards” including “first place in the Trading Software category for the US Trading Association,” which is odd considering that no resident of the United States can use the websites.

I tried to ask for help and got nothing

None of the websites listed any contact or business registration information and a WHOIS search on all three domains showed that each owner was hiding behind a proxy service.

The only reference at all to support or customer service was on Scam A’s website. In the FAQ section at the bottom of the page, it reads:

“At Bitcoin Revolution, we are always here for you and our professional and responsive customer service team can be contacted at any time.”

Unfortunately, the only means of contacting them is through a contact form that returns an error whenever an email is submitted.

Scam B’s contact page doesn’t even exist and an email sent via the contact form on Scam C’s website has yet to send the promised confirmation email and the ticket link they provided was broken as well.

So is Bitcoin Revolution legit or is it a scam?

I’m going to have to go with a resounding SCAM on this one. There are enough red flags surrounding Bitcoin Revolution to cover a football field.

Just to recap:

- Fake celebrity endorsements

- Impossibly outrageous profit claims

- Multiple governments issuing warnings about it

- Scheme operating under multiple domain names

- Each copy of the scheme uses different trading platform software

- No business registration information

- No functioning means of contacting anyone

As Bitcoin scams go, Bitcoin Revolution / Evolution is particularly prolific and has been running in one form or another since at least 2017.

No sooner does one site get taken down than another one pops up.

Sadly, as interest in cryptocurrency continues to grow, so too will Bitcoin Revolution’s victim pool.

Don’t be one of them – do your due diligence before making any investment decisions.

By Cynthia Turcotte -November 5, 2019

David Ogden – Http://markethive.com/david-ogden

.png)

%20(1)-637087007113718622.png)

.png)

.png)