John McAfee – The Entrepreneur, Philanthropist, and Prankster

There are many sides to John McAfee. The Silicon Valley multi-millionaire, Entrepreneur, Philanthropist, the party animal, prankster, the international fugitive, presidential candidate, cybersecurity guru and now considered a crypto expert where his advocacy for many ICO’s is largely sought after.

Back in the 1970s and 80’s John McAfee developed a serious drug habit, including while he worked as a programmer at NASA. He even “dealt” drugs for a while but says he has not touched drugs for 35 years. Some would argue but to me, he just seems to be high on life.

John McAfee pioneered anti-virus software bearing his name that is still used by millions of computers today. John said he created the McAfee anti-virus software in less than two days and 4 million people were using it within a month. He made his fortune when he sold his security software company. Over the years he spent millions on properties, fine arts, and vintage cars.

After the 2008 Global Financial Crisis, McAfee publically announced in 2009 that he lost most of his fortune. He did sell a Rodeo and a property in New Mexico but later said he was just “using” the media when he said he lost his fortune. He even staged auctions to try and fool the media.

“I’ve had 200 lawsuits because my name is John McAfee. No, I did not lose everything. I wanted to stop people trying to sue me”, MacAfee said. “No, I did not lose my fortune! I’m not that stupid.”

The Seachange

Later in 2009, McAfee took a Carribean seachange and bought a home in Ambergris Caye, a little island off the Belize mainland where he lived with his what some call a harem of ladies, an entourage of armed guards and a pack of guard dogs. He also bought a secluded property, deep in the jungle in Orange Walk where he was working on a plant-based antibiotic.

John had no expertise in this area but being the entrepreneur that he is, it was a topic that interested him greatly so he built a laboratory, hired a microbiologist to help manufacture what he believed to be the next innovation in health care. Perhaps the next wonder drug.

McAfee – The Philanthropist

McAfee was happy in the fact he was also helping the locals by feeding poor families and providing them with jobs. The philanthropic part of his nature. It was either generosity or self-interest that prompted McAfee to also donate masses of equipment to the Belize police. Equipment consisting of guns, tasers, handcuffs, pepper spray, batons, etc. He even built them a police station in the town of Orange Walk. McAfee said they would often drive by his house waving their weapons and saluting with gratitude. “It empowered them,” he said.

But then, McAfee was starting to ruffle some feathers as he was employing thugs and ex-criminals for his security team. He appointed himself as a crimefighter to chase off the local drug dealers and had some success. But his troubles really began when he refused to pay a bribe to a senior politician.

He claims that the politician was probably close to $2 million a year out of pocket he was getting from the drug trade before McAfee threw the drug dealers out of the area, so the politician’s way of thinking was that McAfee owed it to him. At that point, the politician went away, all went quiet and McAfee thought that was the end of that saga.

A week later when McAfee thought all was going well and he was on the verge of something with the development of his antibiotics project when the politician along with the Belize government caused a raid on his lab in 2012 by the police department’s Gang Suppression Unit for suspicion of manufacturing methamphetamine in his lab at Orange Walk. McAfee’s lab was destroyed. He says the raid was retribution for his refusal to be extorted by the government.

He also claims the Sinaloa Cartel runs the Belize government and they want him to shut up as he knows too much about the corruption there. No law enforcement agency would corroborate his claims.

Notably, no methamphetamine was found at the lab and he was never charged. McAfee abandoned the jungle and moved back to his home in Ambergris Caye.

Many people of the town were working at the lab or collecting flowers for processing antibiotics, so they knew it wasn’t a drug lab, but they had to have some legal reason to obtain the warrant so the authorities arrested him with weapons charges. They then released him after they held him for hours in handcuffs. They also shot his dog in front of his eyes. McAfee is still seething at the injustice.

Paranoia Or Preparedness

John McAfee has since had a meager lifestyle seeking out safe havens in which he feels he has total control of his surroundings. Some say John McAfee is paranoid, but he says “it’s not about paranoia but about being prepared”. Although he is the first to admit that maybe he must be a little paranoid to be able to develop the security software. (Tongue in cheek)

Since he started McAfee, his software company, he has carried weapons for protection. McAfee says “I have no fascination with guns, I have a fascination with survival.”

The Prankster

McAfee is a renowned prankster so he created this satirical video on how to uninstall the McAfee Anti-virus software. Throughout the video, he makes light his harem of 7 ladies that lived with him in Belize and of his affinity with weapons and drugs. The company that now owns the software that still bears his name called the video ludicrous and said it has no basis in reality.

When asked in an interview why he makes these bizarre videos, his reply at that time to the media who he considered his most recent enemy was,

“Why not? Because I’m 67 and bored is one reason. It’s a lot of fun, I get to hang out with scantily clad cute gals is the second reason, and the third reason is, I get to say something that the world will actually listen to that you can’t edit”.

The running theme in McAfee’s life is the danger posed by “others.” This is possibly why he was able to not only diagnose computer viruses before anyone else but also prescribe an antidote being the McAfee anti-virus.

John McAfee’s consistent and passionate warnings about cybersecurity need to be heeded…

“Our freedoms are being restricted," he said. "Our security is being eroded, and we have no more privacy. If we lose privacy, we lose civilization and we will certainly lose our humanity.”

McAfee is quite the enigma and he probably summed it up best when he was asked…:

How would you define yourself? Are you a madman? Are you paranoid? Are you an entrepreneur? Who are you?

“All of the above," McAfee answered. "I mean, I’m a mad man to some people because, I don’t follow the normal rules, you know, the drummer that leads me is an odd drummer. But I follow the sound.”

He has been involved in a tremendous amount of nastiness during his life but beyond that McAfee is charming. He speaks with a tone that alternates between confidential and menacing. He’s very polite and prone to physically taking people under his wing. He wraps his arm around them as he talks. He talks fast and when he talks about the things he cares about his voice cracks with passion.

To be continued…

Deb Williams

Market Manager for Markethive, a global Market Network, and Writer for the Crypto/Blockchain Industry. Also a strong advocate for technology, progress, and freedom of speech. I embrace "Change" with a passion and my purpose in life is to help people understand, accept and move forward with enthusiasm to achieve their goals.

David Ogden – Http://markethive.com/david-ogden

t

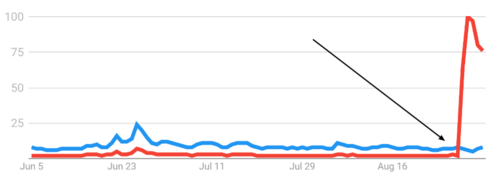

t Searches for "BTC" (red) have never been higher, with Romania a possible the source of the surge. GOOGLE TRENDS

Searches for "BTC" (red) have never been higher, with Romania a possible the source of the surge. GOOGLE TRENDS