.

The Fall of Big Data, The Rise of the Blockchain Economy

There is life after Google says, George Gilder…

Since becoming famous with the arrival of the international bestseller Wealth and Poverty in 1981, George Gilder has remained an artistic pillar in the world of politics, economics, and more so, as of late, technology/innovation. Gilder is an energetic author and correspondent covering not only where we are as a society today, but where we’re as of now heading also. Previously, Gilder has honed in on the innovations of the future and anticipated the diminution of technology that basically isn’t staying aware of the way society is developing.

As an intense author and maybe a periodical polemicist, Gilder is definitely already known to many perusers from his other works, including titles like Microcosm, Life After Television, Telecosm, and the Silicon Eye. Despite one’s own sentiments on his other work as it identifies with social analysis, there’s no denying Gilder’s poignant presence in the world of financial matters, particularly from the conservative-libertarian side of things, and his tech-focused visions for what is to come. With regards to economics, Gilder has even gone so far as to earn the label of being the most referred to author alive, by former President Ronald Reagan.

In his most recent book, Life After Google: The Fall of Big Data and the Rise of the Blockchain Economy, Gilder is now again examining the way humankind relates with technology and how it influences the lives of end-users. We’re existing at a point in history where such a large amount of what we do, what we see, and what we utilize is controlled by an increasingly smaller group of individuals. Gilder doesn’t like that and, more importantly, doesn’t think it’s useful for civilization. Google appears to dominate nearly every aspect of so many individual’s lives, Gilder sees an essential shift in the future. A move away from centralized authority and domination of so much of the internet today. A shift instead to a decentralized method of connecting and communicating with the world around us; a “great unbundling,” perhaps.

Security, Blockchain, and the Coming Disruption

Eventually, Gilder sees a future beyond Google where things are decentralized and blockchain innovation assumes an indispensable position in the manner in which we interact as a society. For Gilder, one of the other worrying aspects of the centralization in the case of Google is the absence of an emphasis on security. Gilder unequivocally expresses that security in a framework isn’t merely an afterthought. It shouldn’t be a patch or an addition made to a platform, but rather a foundation of the platform to begin with. At the end of the day, the question of security is really one of Architecture to Gilder.

In Google’s case, the organization has possessed the capacity to escape without that foundational basis because of how they’ve inverted the traditional relationship between company and consumer. Gilder sees this as a crucial mistake on Google’s part. Basically, Google has changed the relationship between customers and companies which places the would-be consumers in a position significantly more similar to a commodity.

According to Gilder, there is aspiration with the approach and presentation of blockchain technology (a glaring difference to Google’s framework which isn’t security-established in its engineering). Really, blockchain isn’t so much a “hope” as it is a natural progression. The current model practiced by companies like Google won’t be able to survive on its own. To be sure, we’re in for an incredible “unbundling.” Big Data ie, Google operates from control and when they can’t control data they will fail.

Unlike Google’s model, Blockchain technology is essentially based on security. Instead of being an afterthought for a network, it’s a crucial component of how the network is formed in the first place, something undeniably more sustainable in Gilder’s eyes. Ultimately, blockchain technology is exactly the kind of impetus that can lead society to a more decentralized, provable, and trustless future. In contrast to huge organizations with walled gardens, blockchain allows for large distributed systems that aren’t controlled by a third party and can remain stable without one crucial failure point.

A distributed system that is unalterable and can’t be tampered with by an overshadowing authority has extensive-scale significance. Whether pertaining to legal records, property deeds, financial transactions, or any other type of data imaginable, blockchain technology can offer a framework more secure and immutable than those before it. Simply put, blockchain is the future:

George Gilder, featured in the video, is one of the tech world’s more famous and controversial prophets, serves on the board of directors of several technology companies. He believes we can say goodbye to today’s internet and welcome a new “system of the world” that enables a new global economy founded on a new form of internet money and micro-payments, where new companies will emerge to lead the new era.

Will This Effect Social Media Platforms?

Decentralized data will also frustrate social media platforms because they will have no control. Should these platforms go the route of incorporating blockchain technology, will probably be to its demise as they thrive on the data they collect. It would also be a monstrous undertaking considering blockchain really needs to be foundationally introduced, not an add-on. It would seem that technology has somewhat left them on the shelf.

We have a future here where we can operate on a platform of decentralized data. The next 10 years will be about Market Networks.

Markethive is a next-generation Social/Market Network, built on the Blockchain that has positioned itself as a complete ecosystem for Entrepreneurs. Using the latest technology, it provides prosperous solutions for all business owners, marketers, commercial artists who require an online presence.

Markethive’s functionalities include SEO features, Analytics, Customer Management System, Traffic Portals, Capture Page and Lead Creation, Profile Page, e-commerce portals, video conferencing, Blogging Platform and much more. Also included are significant training tutorials and weekly live support meetings.

Focused on Inbound Marketing, Markethive plugs into all Social Media, simplifying your marketing efforts, with automated email campaigns allowing for lead flow into your designated business. Markethive incorporates collaboration building relationships within the community.

Markethive is a social market platform that is essentially a hybrid between the Social Networks, Inbound Marketing, eBay eCommerce, Crypto Exchanges and now a Digital Media site like Cointelegragh. With a consistently improving Alexa Ranking currently at 19,861, it just makes sense to include every aspect to assist your marketing and collaboration efforts. No other alternative utilizes the blockchain the way Markethive does.

Inbound marketing is one of the most sought-after attractive marketing strategies in business today, yet managing a successful campaign requires a high demand of human and technical resources. Here is a platform that can enable you to create, advertise and broadcast, plus evaluate your content’s success effortlessly with complete control and privacy.

Not only are Markethive’s inbound marketing tools free to utilize for your business, you actually get paid for learning and using the system. Markethive embraces gamification thus making it fun and more rewarding by way of the loyalty and bounty program, so not only are you gaining quality leads and customers for your business, you are creating extra income, brand and personal presence in the one and only Ecosystem For Entrepreneurs – Markethive

David Ogden Entrepreneur at Markethive

Telegram @davidogden

FOLLOWS Markethive ON…

Website: https://markethive.com

Token Site: http://markethive.io/

Telegram: https://t.me/markethive_support

Twitter: https://twitter.com/markethive/

Github: https://github.com/markethive /

Reddit: https://www.reddit.com/r/markethive/

Crunchbase: https://www.crunchbase.com/organization/markethive

Medium: https://www.medium.com/@markethive

Bitcointalk: https://bitcointalk.org/index.php?topic=3309067.msg34535452#msg34535452

Telegram News: t.me/Markethive

LinkedIn: https://linkedin.com/company/Markethive

Facebook: https://facebook.com/MarketHive

Youtube: https://youtube.com/Markethive

David Ogden – Http://markethive.com/david-ogden

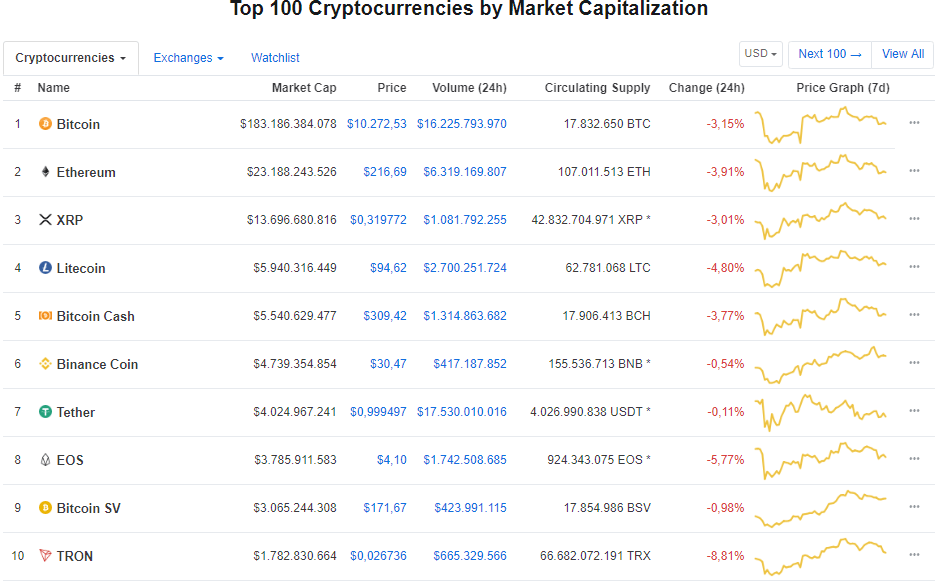

Over the last 30 days, BTC has shown five major price variations. The first variation was a hike of 54.19% and the coin gained 4850 USD between 18th June and 26th June. This hike was followed by a steep fall of 28.96% between 26th June and 02nd July. This fall cost the coin 3999 USD. And over the next one day and 16 hours, the coin again gained 22.41%. The next variation happened over five days from 05th June. This hike added 20.68% to the coin. It was followed by a steep fall of 29.48% between 10th June and 17th June. This fall cost the coin 3853 USD. The Market Cap on 18th June was 162,798,824,411 USD, and the value of each coin was 8951.39 USD. The current market cap and the value of each coin are respectively 6.98% and 9.40% more than the figures for the last month.

Over the last 30 days, BTC has shown five major price variations. The first variation was a hike of 54.19% and the coin gained 4850 USD between 18th June and 26th June. This hike was followed by a steep fall of 28.96% between 26th June and 02nd July. This fall cost the coin 3999 USD. And over the next one day and 16 hours, the coin again gained 22.41%. The next variation happened over five days from 05th June. This hike added 20.68% to the coin. It was followed by a steep fall of 29.48% between 10th June and 17th June. This fall cost the coin 3853 USD. The Market Cap on 18th June was 162,798,824,411 USD, and the value of each coin was 8951.39 USD. The current market cap and the value of each coin are respectively 6.98% and 9.40% more than the figures for the last month. Pay Attention

Pay Attention