Bitcoin price prediction – BTC/USD bears have a hard time at $3,550 – Confluence Detector

-

BTC/USD is well-supported at the current price level.

-

The bulls need to take out $3,650 to put Bitcoin back on the recovery track.

BTC/USD has steadied below $3,600 handle as the bullish enthusiasm proved to be short-lived. The largest digital coin has been rangebound with downside bias for a few days, singling the loss of the recovery momentum.

A steady flow of positive fundamental news did little to support the prices or engineer a new bullish trend. The industry seems to be humming along, but the market remains skeptical. Traders are in no hurry to push Bitcoin and other digital assets out of the recent ranges and to new highs.

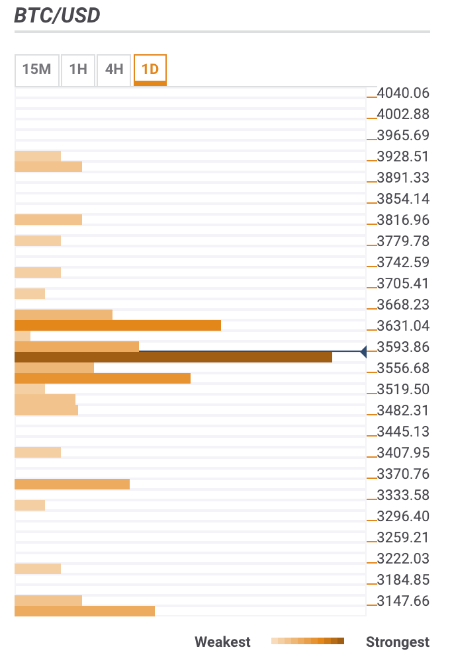

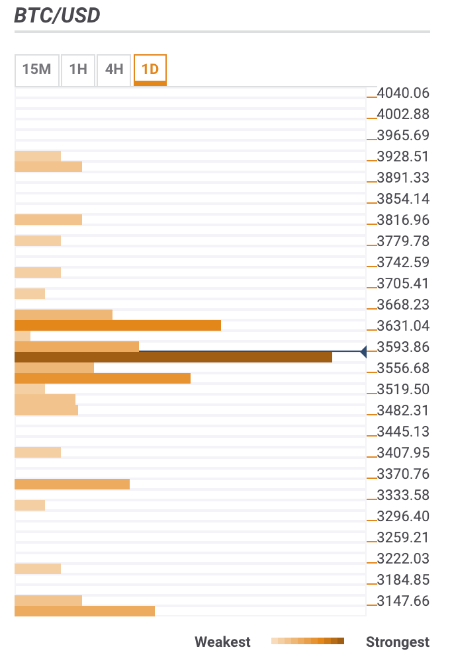

BTC/USD the daily confluence detector

Bitcoin bears may have a hard time pushing the price lower, considering a thin layer of strong technical indicators clustered right under the current price. They include a host of short-term SMA levels, the midline of 1-hour Bollinger Band, 38.2% and 61.8% Fibo retracement on a daily chart, 38.2% Fibo retracement weekly.

Once this barrier is out of the way, the price will bump into another support zone, created at $3,540-$3,520 by a confluence of 23.6% Fibo retracement monthly, SMA200 and SMA50 4-hour and Pivot Point 1-day Support 1.

This area is followed by psychological $3,500. A sustainable move lower may trigger strong sell-off with the next focus at $3,338, which is the lowest level of the previous week.

On the upside, the recovery is capped by a psychological $3,600, which is closely followed by DMA50 at $3,624. This is a strong resistance area that also contains 23.6% Fibo retracement weekly, 161.8% Fibo projection weekly and Pivot Point 1-day Resistance 2.

A minor resistances is also registered on approach to $3,650 (38.2% Fibo retracement monthly, pivot Point 1-day Resistance 3). By taking this hurdle out, Bitcoin bulls will effectively clear out the way towards $4,000 as there is little in terms of technical levels there.

BTC/USD, 1D

Tanya Abrosimova

FXStreet

David Ogden – Http://markethive.com/david-ogden