Bitcoin Outdoes Itself; Moves Beyond $4,000

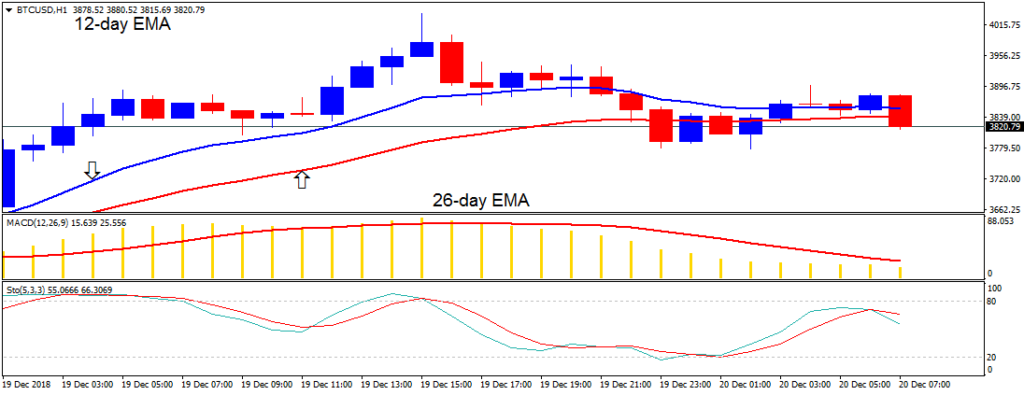

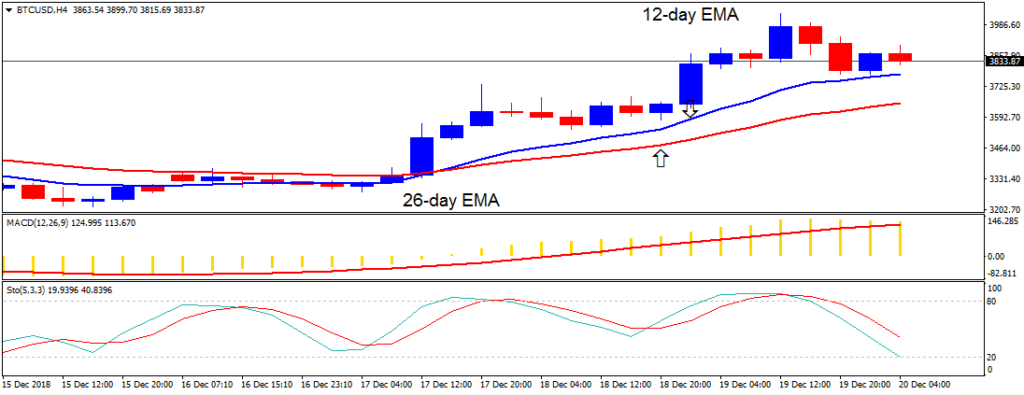

At press time, bitcoin has pushed beyond the $4,000 mark for the first time in two weeks. What has started out as an ongoing “slump ride,” the asset has seemingly found enough strength to challenge present resistance levels and fight back against the ever-present bears.

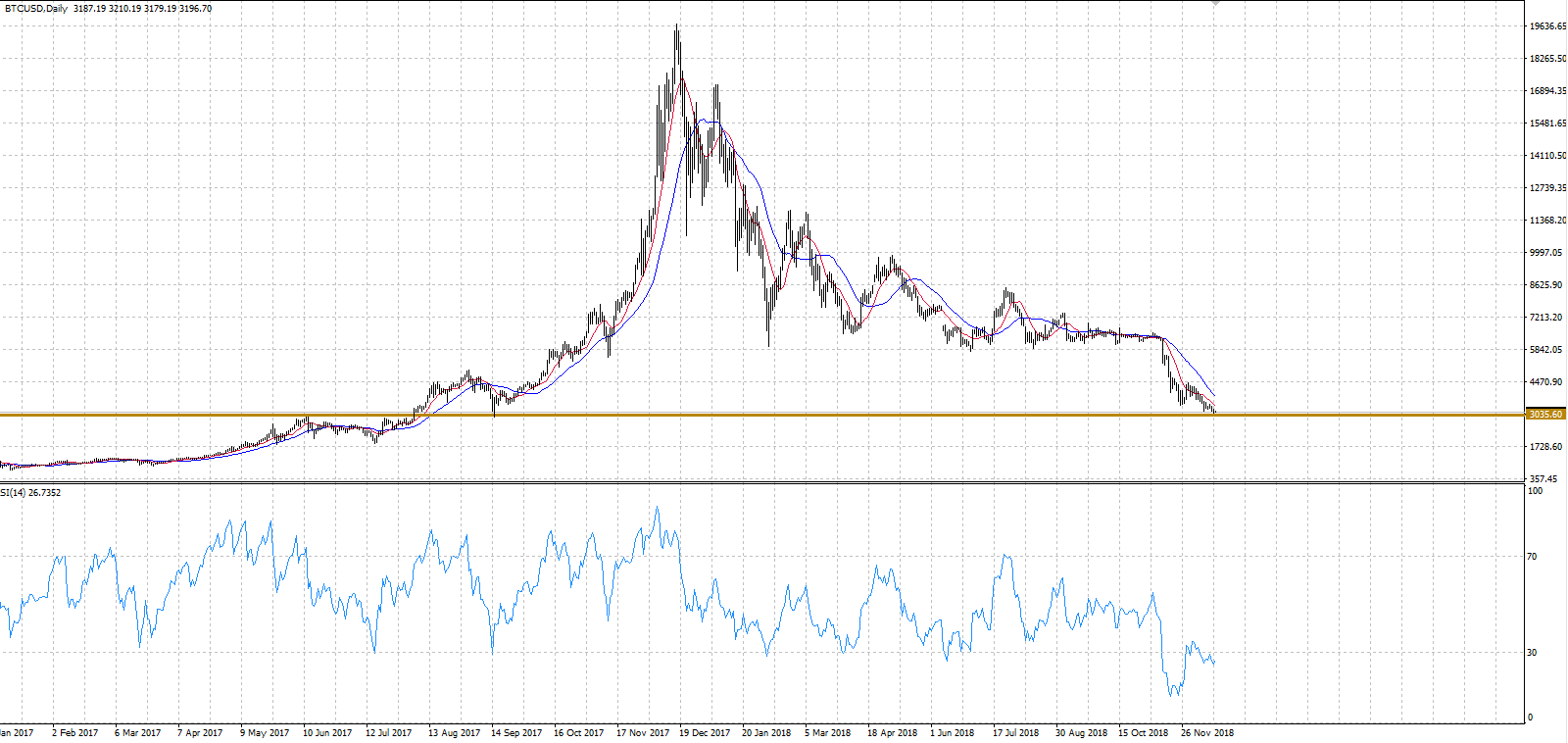

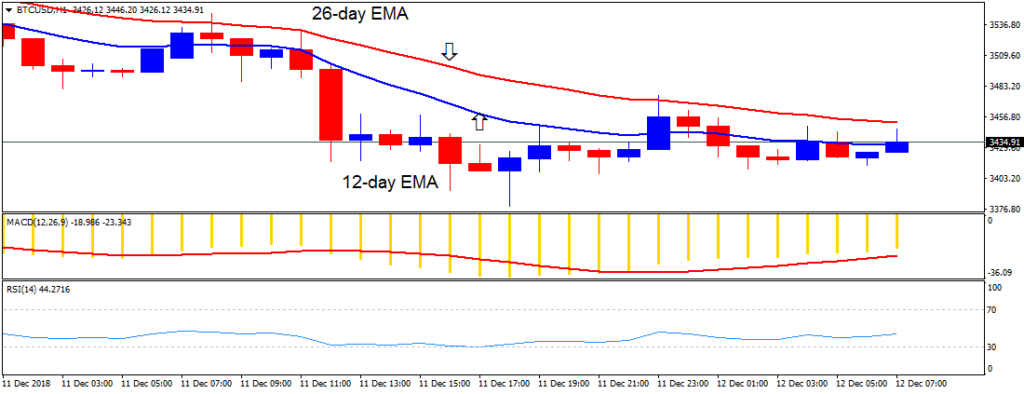

Bitcoin has been performing poorly for about a month. Trouble began in early November when the currency fell from the $6,000 range – where it had been all summer and autumn – down to the high $5,000s, likely in anticipation of the upcoming bitcoin cash hard fork that occurred prior to Thanksgiving week. From there, the currency fell into the $4,000 range, and then $3,000 once the fork occurred.

Bitcoin Is Gaining Some Ground

Bitcoin cash pitted several industry leaders, i.e. Craig Wright and Roger Ver, against one another. Though it has forked in the past, none of those events led to the controversy enthusiasts witnessed this time around. The atmosphere in the crypto space has been one of confusion and skepticism, partially leading to further drops in bitcoin’s price. Several analysts saw the asset falling to $1,500 or less before signs of recovery would potentially appear.

Just last week, the father of crypto fell to approximately $3,175, its lowest position in approximately 15 months. However, with this sudden (and meteoric) rise in such a short amount of time, the currency appears to be challenging the barricades that have placed themselves in its path. The big question is whether it can keep this momentum going, or if things will crash and burn further.

Interestingly, these good price waves are also affecting bitcoin cash. The currency fell to the low $300s following the controversial fork, but the descent didn’t quite stop there. Eventually, it had made its way below the $150 and $100 marks.

At the time of writing, however, the currency has managed to retain its position as a leading asset and is now testing the $150 resistance level against the U.S. dollar. It is also being reported that percentage gains for bitcoin cash are higher than those of major competitor’s like Ethereum and Ripple.

In the past, we have seen similar December rallies for bitcoin and its crypto cousins. Last year, for instance, is when the currency reached its all-time high of nearly $20,000. For the most part, it’s still in a relatively low position, but figures like Charles Hayter – chief executive of Crypto Compare – suggest that now is the time to get back in and buy. Could this mark the beginning of a very positive 2019?

Should You be Buying Bitcoin Again?

Speaking with CNBC, Hayter explained:

“The maxim of buy when there’s blood on the streets could be influencing some to gain exposure at this nadir prior to the new year.”

NICK MARINOFF · DECEMBER 21, 2018 · 12:00 AM

David Ogden – Http://markethive.com/david-ogden

c

c