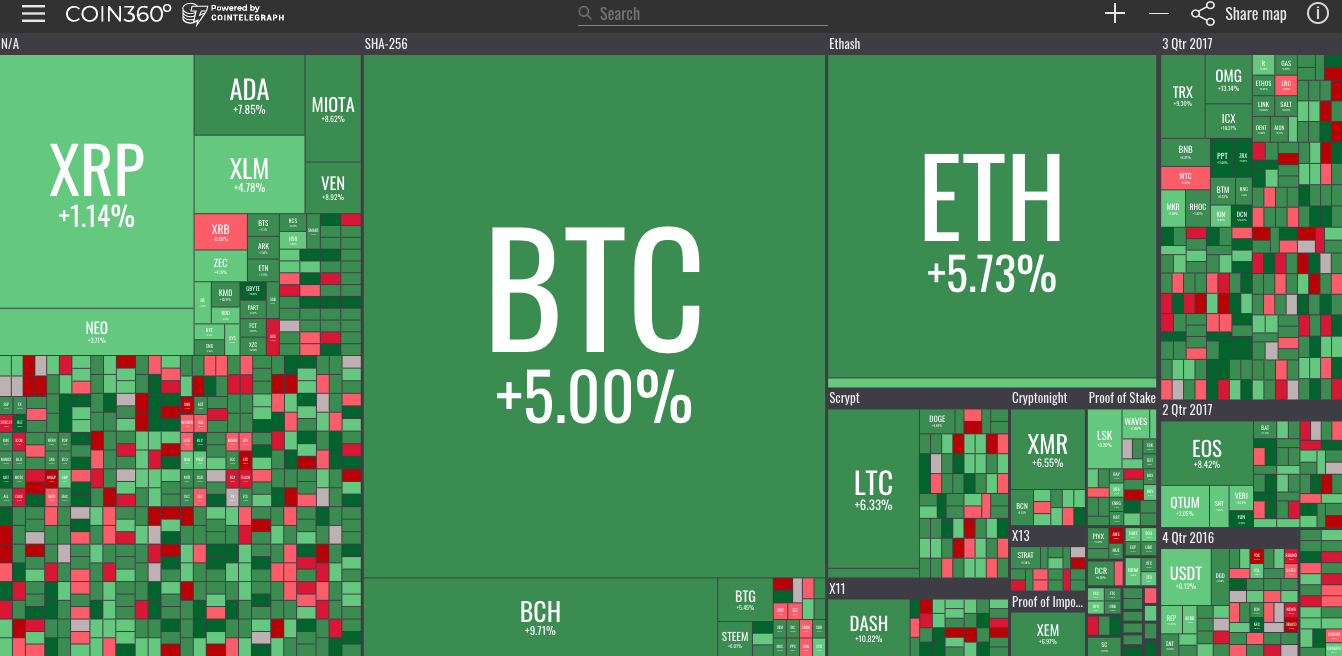

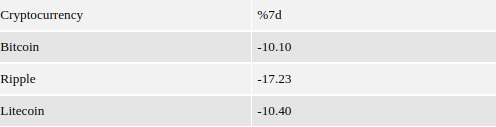

Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, NEO, EOS – Price Analysis, March 06

Harvard economist Kenneth Rogoff believes that Bitcoin’s value will drop to $100 in a decade. He stated that increased regulation is one of the aspects that will bring down the value of Bitcoin. We, on the other hand, have an opinion that in a decade, the cryptocurrencies will have much more use cases and that it will increase their demand, propelling prices higher.

Bitcoin’s entrepreneurs have taken up the task of rebuilding the Puerto Rico economy that has been hit by natural disaster, and a shortage of funds. This is a new experiment, and in case it succeeds, it will be implemented at many other places.

Additionally, increased involvement of large companies with the crypto world shows their growing acceptance, which is a bullish sign.

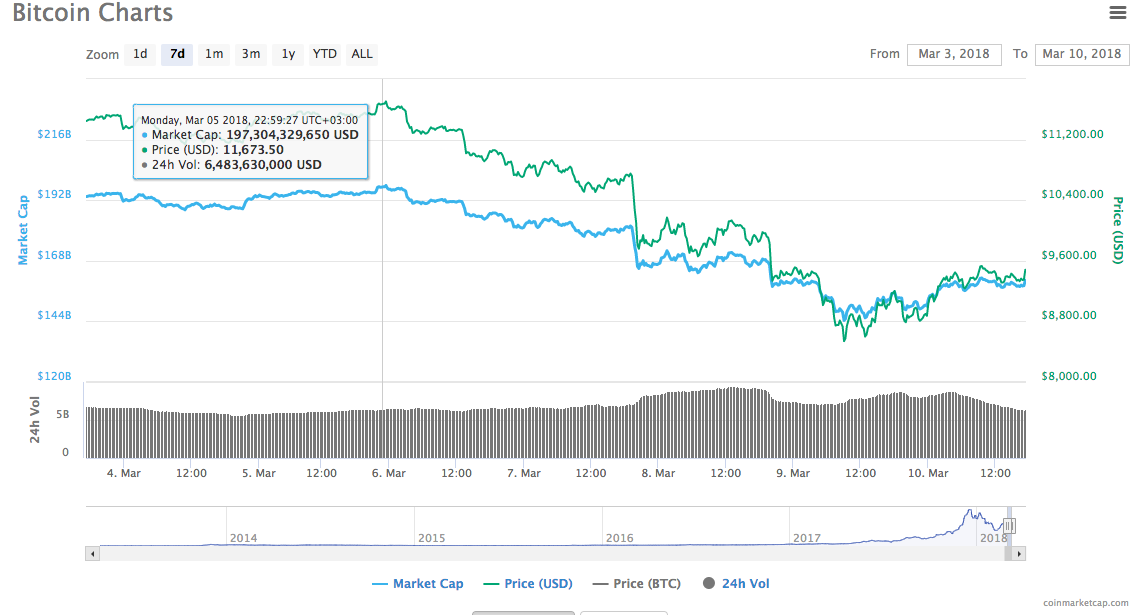

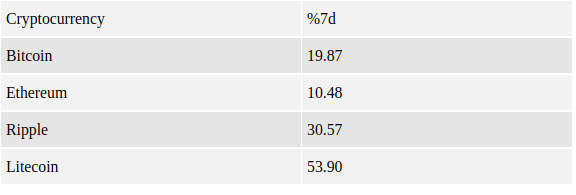

BTC/USD

We had been expecting Bitcoin to break out of the neckline of the inverse head and shoulders pattern and move towards the target objective of $13,000. But the bears strongly defended the $12,200 levels.

Yesterday, Feb.5, the BTC/USD pair reached a high of $11,934.08 but could not break out of the overhead resistance. Currently, the cryptocurrency is pulling back and is likely to find support at the trendline of the ascending channel at $11,100. If this support breaks, the next support lies at the 20-day EMA and below that at the 50-day SMA.

Therefore, traders can raise their stops to $11,000 on the remaining half-position. Once the price sustains below the channel, we expect it to stay range bound between $9,500 and $12,200.

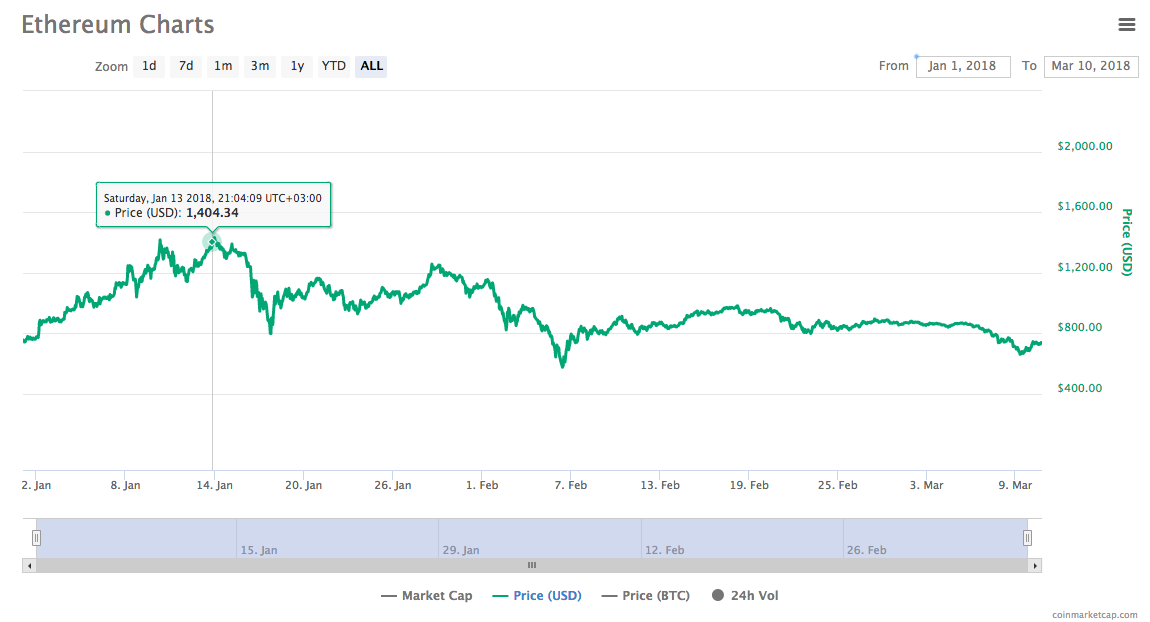

ETH/USD

We had recommended traders to raise their stops on Ethereum to $830 in our previous analysis, which was hit today, Feb.6. The bulls have failed to break out of the 20-day EMA for the past nine days.

As the price is below both the 20-day EMA and the 50-day SMA and is turning down from the resistance line of the descending channel, the bears have an upper hand.

Now, chances are that the bears will push the ETH/USD pair towards the $780 levels. If this level breaks, the next support is at $723.

BCH/USD

We had recommended buying Bitcoin Cash on a breakout above the range, however, the bulls could not push prices above the 20-day EMA and the overhead resistance.

Now, the bears are likely to push prices to the lower end of the range at $1,150. If the BCH/USD pair breaks below this support, it is likely to fall to the pattern target of $950.

Our bearish view will be invalidated if the cryptocurrency breaks out of $1,355.

XRP/USD

In the previous analysis, we were unsure about Ripple’s price action. Yesterday, March 05, the price broke out of the overhead resistance, but it could not clear the 50-day SMA.

Prices turned down sharply, and the XRP/USD pair is now likely to continue trading in the range once again. If the bears push prices back below the $0.85 level, it can extend its fall to $0.72.

We don’t find any trade setups on it at the moment.

XLM/USD

Stellar continues to trade in the range because the bears were not able to break down below the $0.32 levels.

On the upside, the XLM/USD pair is facing resistance from the 20-day EMA. If it breaks down of $0.32, we might observe a fall to the support line of the descending channel at $0.22.

The bulls will continue to face resistance from the 20-day EMA, the 50-day SMA and the upper end of the range.

LTC/USD

Though Litecoin continues to trade above the 20-day EMA, it has lost its momentum. Both moving averages have flattened out, which points to a range bound action in the next few days. We recommend traders to retain the stop loss at $200, at breakeven.

Yesterday, March 05, the bulls attempted to break out of the downtrend line, yet, they could not sustain above the line.

The LTC/USD pair is likely to correct towards the 50-day SMA. If this level breaks, a move towards $175 is also possible, where we expect strong buying to emerge.

We should turn bullish if the cryptocurrency sustains above $225.

ADA/BTC

Cardano has been holding above the critical support level of 0.00002460 for the past four days, but a lack of buying at the support level shows that the bulls are not interested in buying even at these levels.

If the price breaks down of 0.00002460, it can slide to 0.00001690 levels.

On the upside, the ADA/BTC pair will face resistance at the 20-day EMA and the 50-day SMA.

We need to wait for buying to emerge before recommending a trade on it.

NEO/USD

We expected the $108 levels to provide strong support but we were proven wrong, and NEO broke below our suggested stop loss of $105.

The NEO/USD pair is now likely to fall to $93.5 levels. The zone between $86 to $93.5 might offer strong support. If it breaks, the cryptocurrency will become negative.

On the other hand, the price will become positive on a sustained move above $140.

EOS/USD

EOS has broken down of the symmetrical triangle, which is a bearish development. Currently, the price is holding at the horizontal support of $7.5.

If this level also breaks, a retest of the Feb. 06 lows is likely. On the upside, the bulls will face resistance at the 20-day EMA and the 50-day SMA.

We shall turn bullish when the EOS/USD pair breaks out of $10.1190 levels.

Author: Rakesh Upadhyay

Posted by David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden