Up 33% – Bitcoin's Price Just Had Its Best Month of 2018

Bitcoin's price rose 33 percent against the U.S. dollar in April, making it the best month of 2018 for the world's largest cryptocurrency.

Data from CoinDesk's Bitcoin Price Index (BPI) shows that May began with bitcoin's price at the $9,244.32 mark – a 33 percent jump from its April 1 start of $6,926.02. This marks the greatest rise in bitcoin's price this year, and one of only two months where it rose at all within the period.

Bitcoin's price fell overall in January and March, and only rose 1.4 percent in February, according to BPI data.

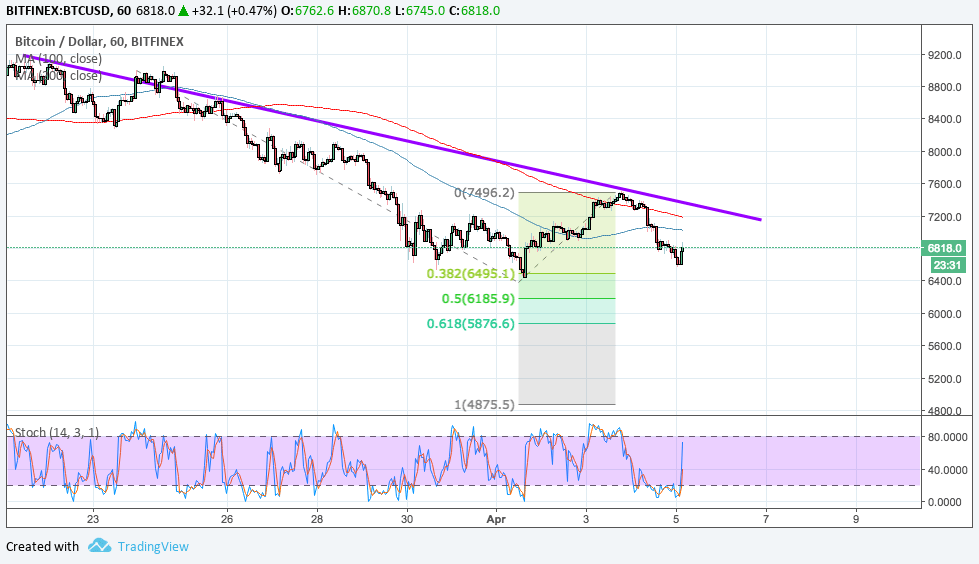

Indeed, bitcoin fell by nearly a third in each of the negative months, dropping from $13,860 on January 1 to $10,166 on February 1, and even more drastically – from $10,309 to just below $7,000 – in March. While bitcoin has rallied this past month, it has yet to recover to the $10,000 mark, which it last fell below in mid-March.

That being said, these numbers hide the fact that bitcoin actually rose to past $17,000 in January before falling by nearly half to its February 1 level.

Similarly, bitcoin reached a low below $6,000 before recovering, as shown by the BPI. In other words, while it may have begun spending periods of time trading sideways, it remains volatile year-to-date,

Notably, bitcoin's transaction volume jumped by 93 percent month-over-month, while the number of off-chain transactions through exchanges jumped by a similar 95 percent. However, fees saw a similar jump, rising 90 percent in April, according to data collected by CoinDesk.

Bitcoin derivatives had a similarly positive month. Both the CBOE and CME saw their futures contracts trading volume spike this month, with CBOE in particular seeing more than 18,000 contracts traded in a single day on April 25, as previously reported.

Similarly, CME saw more than 11,000 contracts traded that day, roughly double its daily average.

Author Nikhilesh De Updated May 1, 2018 at 20:21 UTC

posted by David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden