Bitcoin price analysis – BTC/USD recovery attempts capped by $6,200; Bitcoin not as volatile as it may seem, research shows

- BTC/USD movements are contained by $6,100-$6,200 range.

-

Researchers proved that Bitcoin volatility matches traditional markets.

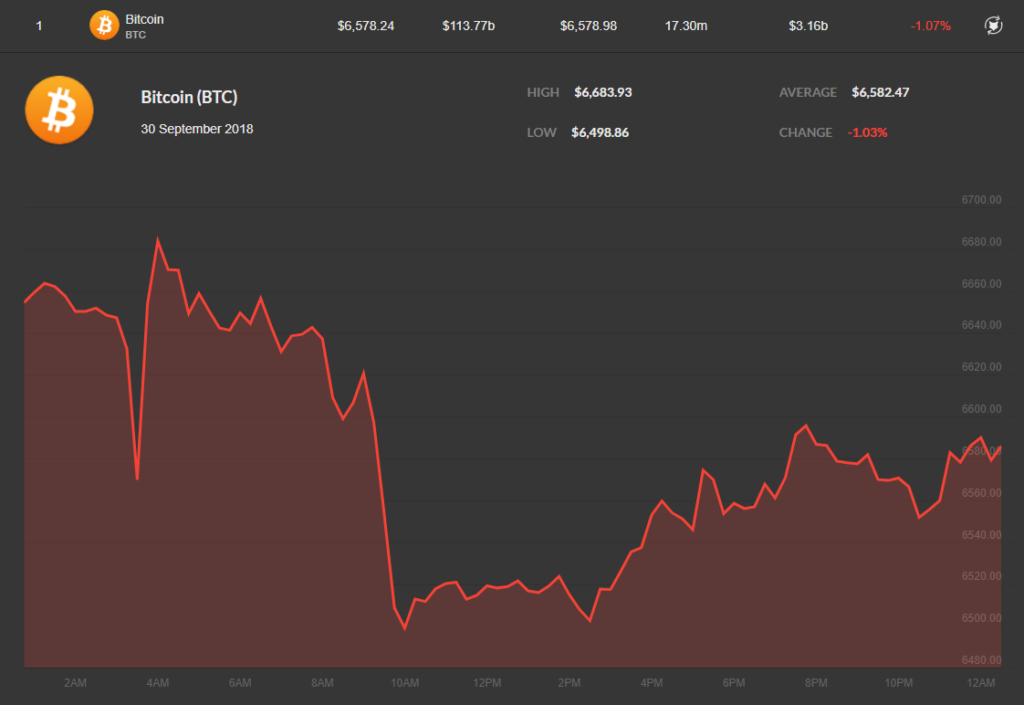

After a short-lived dip to $6,060 low on Thursday, BTC/USD found a floor at $6,100. The recovery attempts have been limited by $6,216 handle so far, which means that a stronger trigger is needed to push the coin out of this range. BTC/USD is changing hands at $6,190, mostly unchanged in the recent 24 hours.

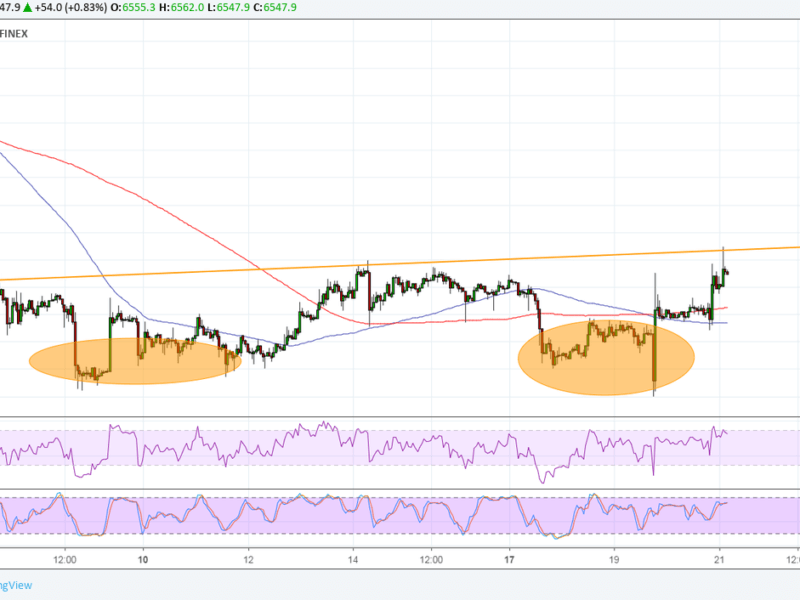

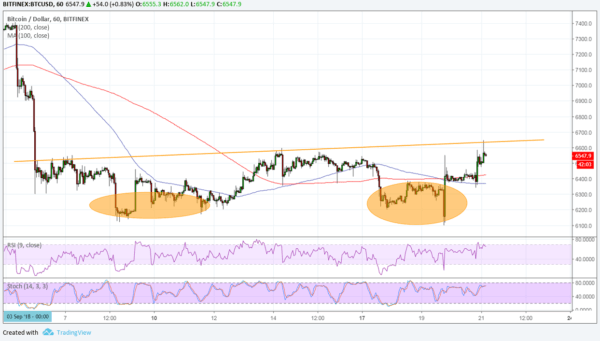

Bitcoin's technical picture

A sustainable movement above $6,200-$6,216 congestion zone will open the way towards $6,300 followed by SMA50 (1-hour) at $6,340, where fresh selling interest is likely to appear. However, if this area is cleared, the upside movement will start gaining traction with the next aim at the broken downside trendline at $6,480 strengthened by SMA200 (1-hour) and psychological $6,500.

On the downside, the critical support is located at $6,100, strengthened by Thursday's low at $6,060, Once below, the sell-off will continue to $6,000

Pretty stable

A recent study performed by Stanislaw Drozdz from the Institute of Nuclear Physics of the Polish Academy of Sciences revealed that Bitcoin is much more stable than it might seem. The researcher found out that the coin market is very similar to traditional financial markets in terms of stability.

“When new emerging financial markets started to appear in Central and Eastern Europe after the collapse of socialism, the question of their stability naturally arose. A number of statistical criteria were identified at that time, making it easier to assess the maturity of the market. We were curious about the results we would get if we used them to look at the Bitcoin market, currently valued at hundreds of billions of dollars,” Stanislaw Drozdz wrote.

The research team analyzed Bitcoin prices in a period from 2012 to April 2018 and the rates of return over the same timeframe. They found out that the volatility of rates of return is comparable to mature markets.

Tanya Abrosimova

FXStreet

David Ogden – Http://markethive.com/david-ogden

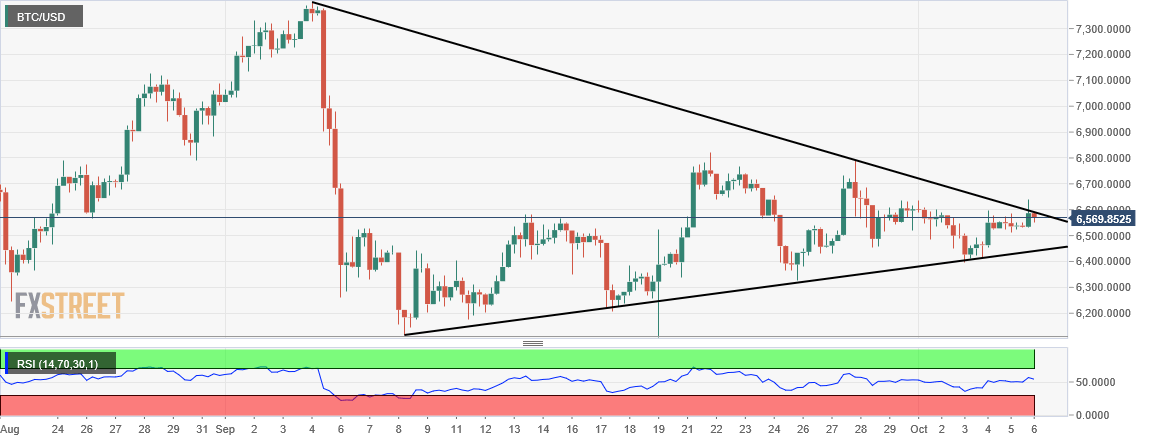

Bitcoin daily price chart on September 30, provided by Coincap.io

Bitcoin daily price chart on September 30, provided by Coincap.io