Bitcoin (BTC) Price Analysis – Neckline Test Taking Place, Upside Break Looming?

Bitcoin is at a crucial level as it waits to confirm a reversal pattern with an upside break.

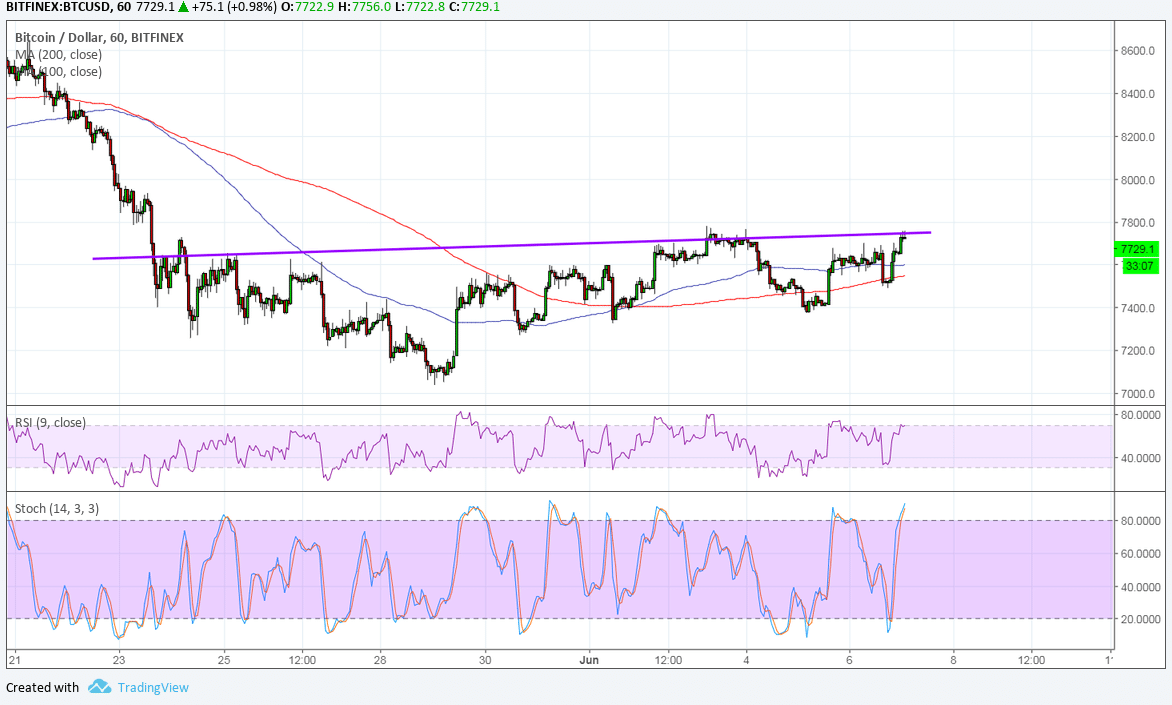

Bitcoin appears to have completed the complex inverse head and shoulders reversal formation and is currently testing the neckline to confirm the potential uptrend. The chart pattern spans $7,000 to $7,800 so an upside break could last by the same height.

The 100 SMA is above the longer-term 200 SMA to signal that the path of least resistance is to the upside. In other words, the uptrend is more likely to resume than to reverse. However, the gap between the two is narrowing to signal weakening bullish momentum.

RSI is moving up to indicate that buyers still have some energy to push for more gains but the oscillator is nearing overbought levels to suggest a slowdown as well. Similarly stochastic is pointing up to reflect bullish pressure but is also approaching overbought conditions.

The latest bounce in bitcoin is being attributed to the rise in volumes from Venezuela as the country’s crisis is pushing citizens to look into alternative financing. This has been similar to the case in Greece when banks and exchanges were shut down in the aftermath of the debt crisis.

Apart from that, persistent Brexit issues appear to be haunting financial markets again while trade war fears linger. The UK is facing an important cabinet vote that could set the course for UK laws in the Brexit transition period and it looks like lawmakers are at odds with PM May’s backstop proposal. Meanwhile, tariffs recently announced by the US are keeping jitters in place ahead of the weekend G7 meeting.

The dollar has also been on weak footing, which explains some safe-haven flows to cryptocurrencies. Note that the US currency has been unable to sustain a bounce even after seeing upbeat data recently, which suggests that the trade factor has been keeping gains limited, leaving other assets like bitcoin to take advantage.

Author Rachel Lee On Jun 7, 2018

David Ogden – Http://markethive.com/david-ogden