Bitcoin Price Tapped $10,600 in Fourth Largest Bull Move Ever

For now, Bitcoin (BTC) bulls seem to have decimated the bears. As of the time of writing this article, the leading cryptocurrency is at $9,800 — up over $2,500, some 38%, in the past 36 hours. This is around $800 short of the daily high of $10,600.

This rally has gotten so out of hand that BitMEXRekt, a Twitter bot dedicated to updating Crypto Twitter to liquidations on its namesake platform, has crashed.

Related Reading: Bitcoin Price Rips Past $9,000, Now Up 20% On the Day

Bitcoin Up 40% on the Day

According to Alex Kruger, Bitcoin, as the time of his tweet, was up 42% on the day. This purportedly represents the asset’s fourth-largest gain in its history, and the largest since May 10th, 2011.

Alex Krüger

So, what caused this move?

The seeming catalysts vary from analyst to analyst.

But according to Gabor Gurbacs, who summarized the narratives well, there are three reasons why Bitcoin surged: 1) the latest CME’s Bitcoin futures contract expired, something that has traditionally led to volatility, often in the upward direction; 2) President Xi Jinping of China revealed that he supports the development and adoption of blockchain technologies in China; and lastly 3) the chief executive of Crypto Capital, a firm offering financial services to industry companies including Bitfinex, was arrested, which Gurbarcs claims will allow clients of the firm to “get some of [their] seized [money] back.”

Slight Reversal Possible

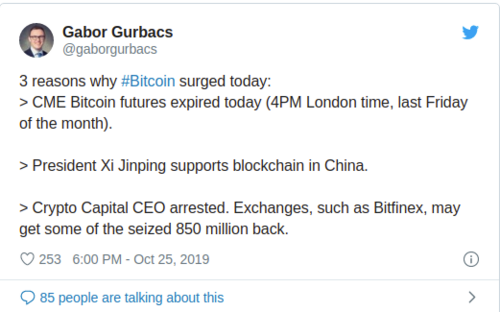

While this is move is undeniably bullish, some are starting to expect a pullback. Popular analyst Nunya Bizniz pointed out that Bitcoin’s latest four-hour candle, which reached as high as $10,600 on BitMEX, is a “perfected Tom Demark Sequential 9.”

Bizniz notes that “a TD 9 typically indicates trend exhaustion,” implying that there may be some stagnation or a healthy pullback before a resumption of the uptrend.

Indeed. He added that according to Tone Vays’ take on the indicator, “we may see a one to four candle pullback (four to 16 hours) and then resume up.”

Nick Chong

David Ogden – Http://markethive.com/david-ogden