How Bitcoin Miners Fueled the Bear Market Trend of 2018

When the financial industry was left astounded by the downward spiral of Bitcoin in 2018, questions as to the cause largely went unanswered even though some analysts had one or two things to say about it. Nevertheless, there is no need to search further as recent data has revealed who to hold responsible for the market’s continued degradation, and that is Bitcoin Miners.

The Action that Triggered the Downtrend

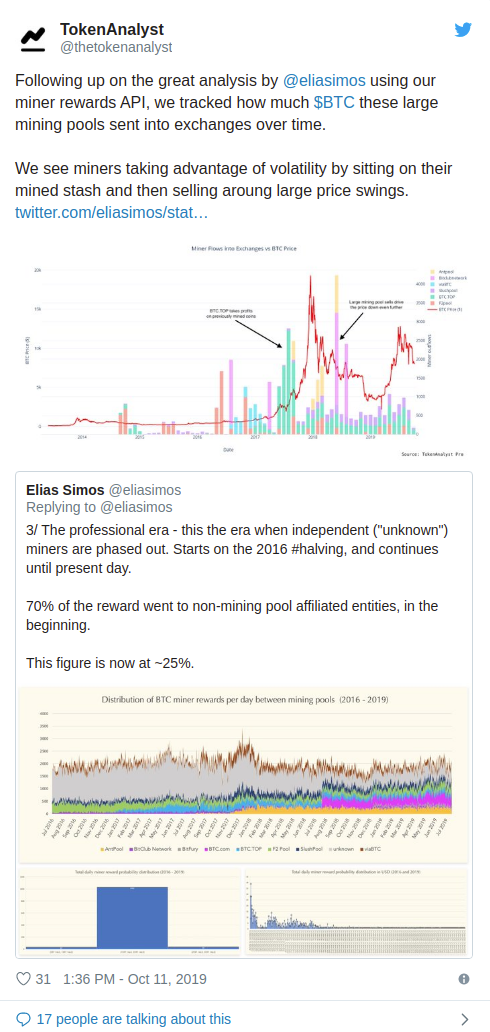

Token Analyst uploaded a new study that showed the role miners played in the fall of Bitcoin. The analysis, which was shared on social platforms on October 11, stated that the moment miners began to sell coins directly, things began to go wrong for Bitcoin.

It is not a coincidence that the moment BTC/USD crashed to $3,100 was the same time miners were orchestrating a massive sell-off. June and August recorded a massive transfer of coins to exchanges, which depreciated even further what was left of the Bitcoin price.

Token Analyst stated: “We see miners taking advantage of volatility by sitting on their mined stash and then selling around large price swings.”

Miners and their Quest for Price Control

Already there are assumptions that point to miners as having a hand at the collapsed Bitcoin price of 2018, and now, the data released by Token Analyst has confirmed them.

The unusual event is not also lost to the popular industry commentators who have been following the issue for a long time now. One of them, PlanB, has shown via his stock-to-flow Bitcoin price model that the influence of miners over Bitcoin price should not be taken lightly.

Another group of commentators, which include Cole Garner, Filb Filb, and others, believe that miners encourage minimum BTC prices.

Miners and what the Future Holds

Garner, who is in support of the concept, has backed up his belief by repeating what Satoshi Nakamoto, the creator of Bitcoin, said back in 2010, which is that production cost plays a vital role in the price of a commodity. He further added that:

“If the price is below cost, then production slows down. If the price is above cost, profit can be made by generating and selling more.”

Therefore, these statements may be geared towards preparing the minds of the crypto community members for a new Bitcoin price floor projected to be around $6,400, because it is improbable that miners will sell below the price.

The next block size halving expected to happen in May 2020 will determine a lot of things for Bitcoin enthusiasts, just like it did in 2016. With block reward dropping to 6.25 BTC per block, everyone should buckle up for new price highs.

by Adedamola Bada October 12, 2019 in Bitcoin News

David Ogden – Http://markethive.com/david-ogden