Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, IOTA, EOS – Price Analysis, 4th May

Goldman Sachs, one of the biggest investment banks in the world, is taking the plunge into the exciting world of cryptocurrency trading. The bank’s decision was made because of the overwhelming client requests.

This is a very positive sign for the crypto market’s future along with the news about analysts from BlackRock, an American global investment management company, leaving the firm to fund a Blockchain-focused venture capital fund. Other places where the banks or institutions are still pondering over their decision, the analysts are quitting to open their own ventures. Investors plowing money into these funds shows a growing interest.

After the decline from the frothy levels in December 2017, the investors are getting a favorable entry opportunity. In the past few weeks, the volatility has also reduced, which is an added attraction to get in early.

While the number of crypto optimists has increased, there is no dearth of the naysayers as well. Economist Nouriel Roubini continued his criticism of cryptocurrencies. While he may have forecast the 2008 Financial crisis correctly, his crypto prediction seems to be way off.

But there are positive predictions as well. Alexis Ohanian, a co-founder of Reddit, claims that Ethereum is on its way to $15,000 this year.

We already hold a few positions. Let’s see if the charts present us any fresh buying opportunities?

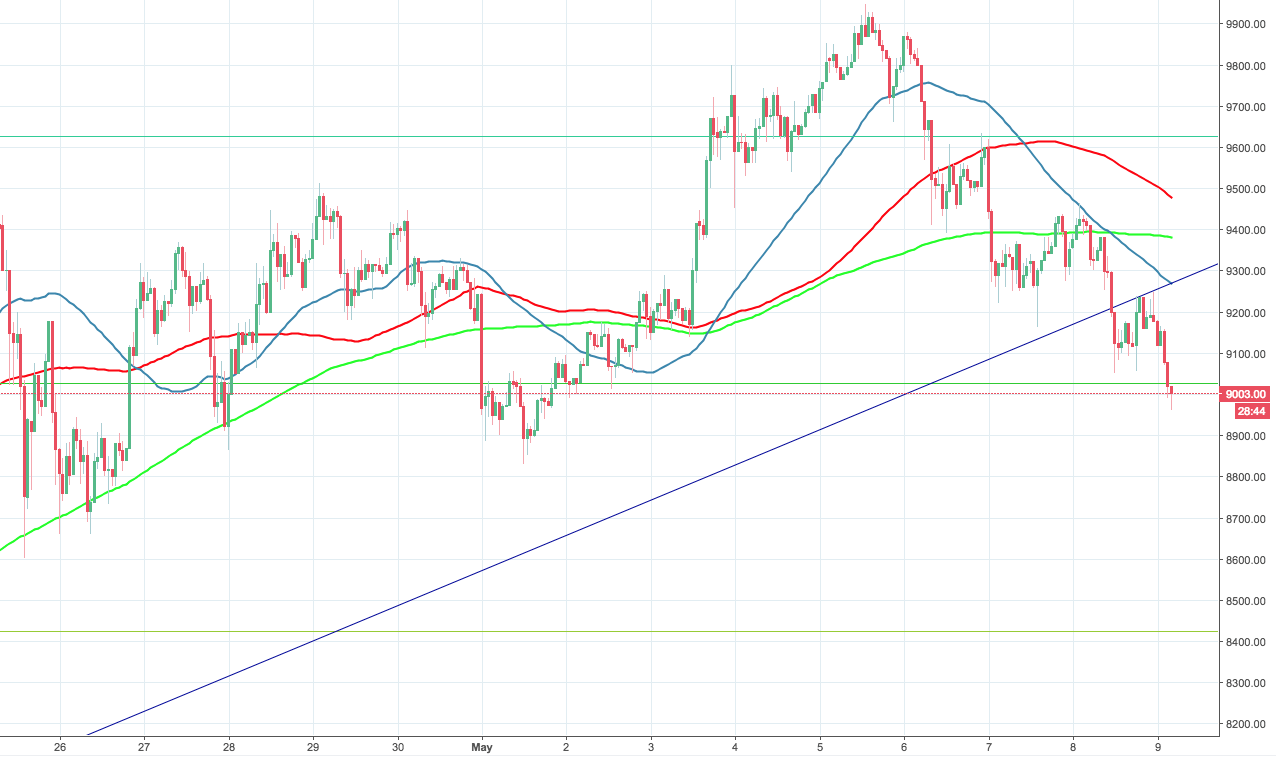

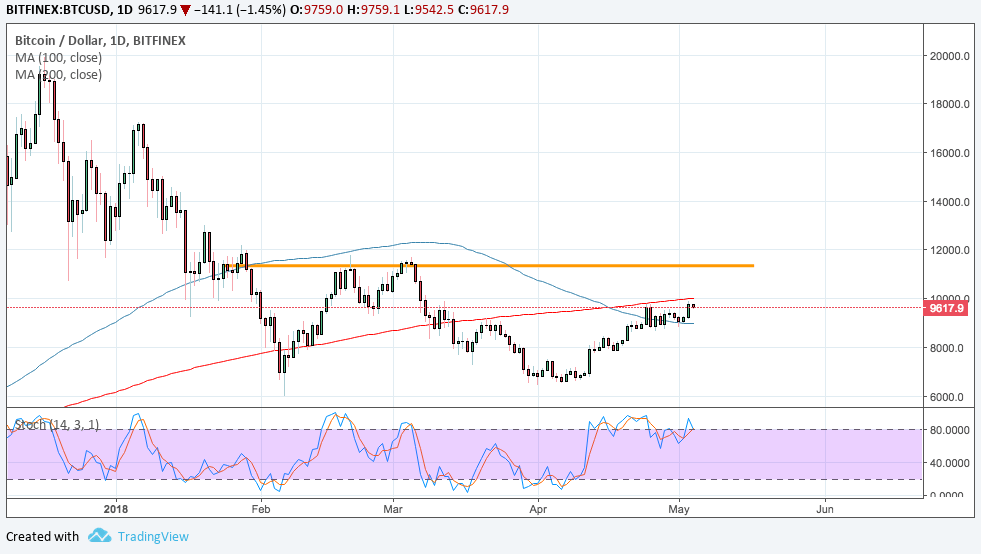

BTC/USD

Bitcoin broke out of the small symmetrical triangle pattern and entered the ascending channel on May 03, which is a bullish sign. Currently, it is facing resistance close to the April 25 highs, but we remain bullish because it has not given up ground.

If the digital currency rises from the support line of the ascending channel, it increases the possibility of a break out above the immediate resistance zone of $9,800 to $10,000.

Following the breakout, the first target is $11,000, and the next target is $12,000. We anticipate a strong resistance at the $12,172.43 mark.

On the downside, if the BTC/USD pair breaks below the support line of the ascending channel, it can fall to $9,178 and then to the 20-day EMA, close to $9,000 levels.

The up move will be in danger only on a break below $9,000 levels. Therefore, we suggest raising the stops on the long positions from $8,600 to $8,900.

ETH/USD

Ethereum broke out of $745 on May 03, which completed a ‘V’ shaped bottom formation. This bullish set up has a pattern target of $1,130, with minor resistances at $900 and at $1,000.

On the downside, $745 will act as the first support. If this breaks, the bulls will defend the trendline close to $700 and the 20-day EMA at $645. The trend will turn bearish or range bound only if the ETH/USD pair sustains below $700.

Traders can wait for a retest of the breakout levels and buy if the $745 level holds. The stop loss can be placed just below the 20-day EMA at $640. Traders should confirm that the levels are holding before entering long positions. No trade should be initiated if the digital currency closes (UTC) below $700.

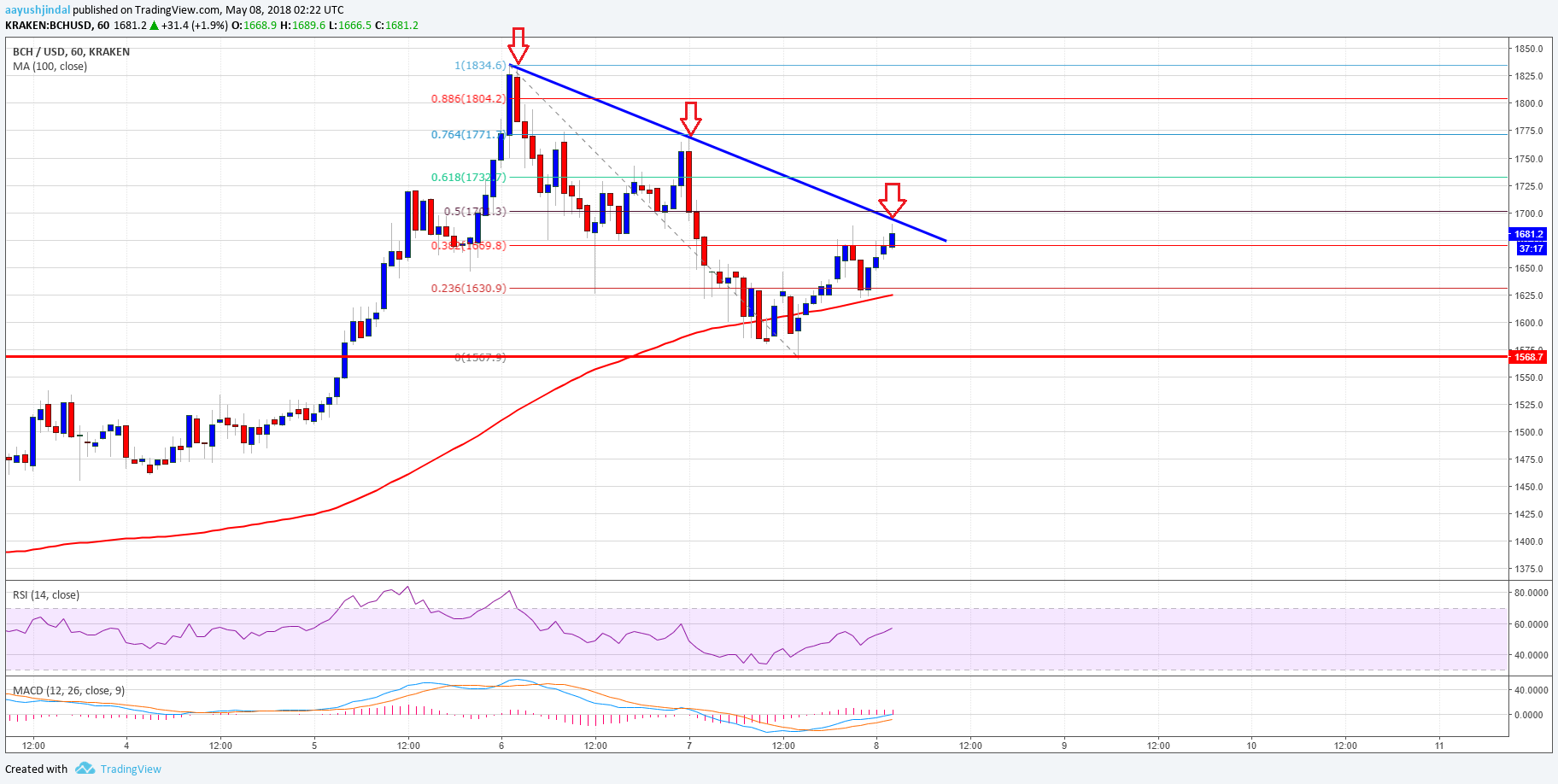

BCH/USD

Bitcoin Cash has reached close to the upper end of the range at $1,600, which should act as a stiff resistance. If the price fails to break out of this level, the range-bound action between $1,221 and $1,600 will continue.

The BCH/USD pair will become positive if the bulls break out and close (UTC) above $1,600. The immediate target objective is a move to $2,000; above it, the rally can extend to $2,400 levels.

Aggressive traders can buy on a close (UTC) above $1,600 and keep a close stop loss of $1,400. Due to numerous overhead resistances, we consider this as a risky trade, hence, keep the allocation size less than 50 percent of usual.

XRP/USD

Ripple continues to trade inside the range of $0.76 to $0.93777. A break out of this range will indicate bullishness, and a rally to $1.229 is likely.

If the XRP/USD pair fails to break out of $0.9377, a few more days of range-bound trading can be expected.

On the downside, support exists at the 20-day EMA and below that at the lower end of the range at $0.76.

The longer the cryptocurrency trades inside the range, the stronger will be the ensuing breakout. We propose waiting for it before entering any long positions.

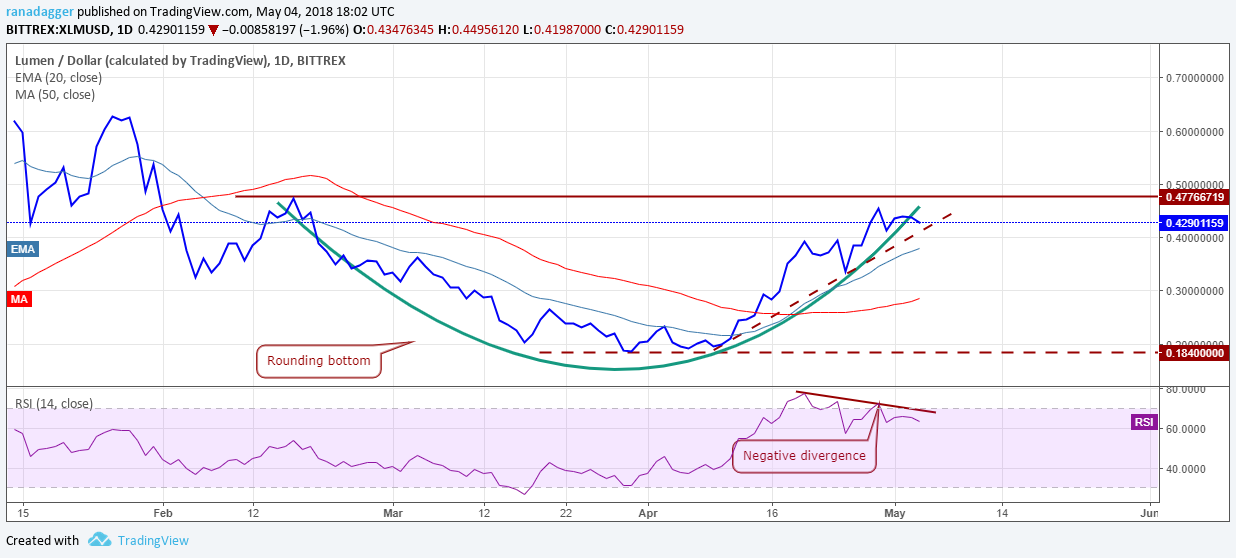

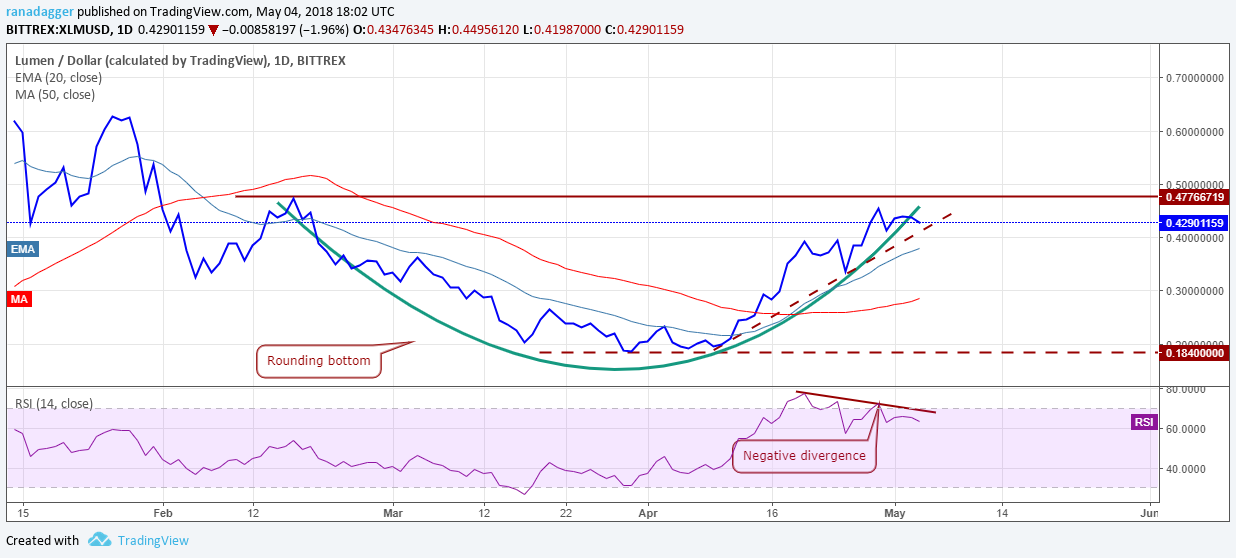

XLM/USD

Stellar is facing a stiff resistance at the $0.47766719 mark. Though it has failed to cross above this level, it is undergoing a shallow pullback.

he XLM/USD pair should find support at the trendline, but if it breaks, a slide to $0.335 is probable. The negative divergence on the RSI is a bearish development, hence, traders should wait for a breakout and close (UTC) above the overhead resistance of $0.47766719 before initiating any long positions.

LTC/USD

After remaining in a tight range for the past few days, Litecoin finally scaled above the overhead resistance of $160 on May 03. However, it could not reach our target objective of $180, as the bears strongly defended the April 24 highs of $167.399.

If the LTC/USD pair doesn’t breakout within a couple of days, it will continue to be range bound. On the downside, any break of the $141 levels will be a negative sign.

Therefore, we suggest retaining the stops at $140. We shall trail the stops higher once the digital currency breaks out of $168.

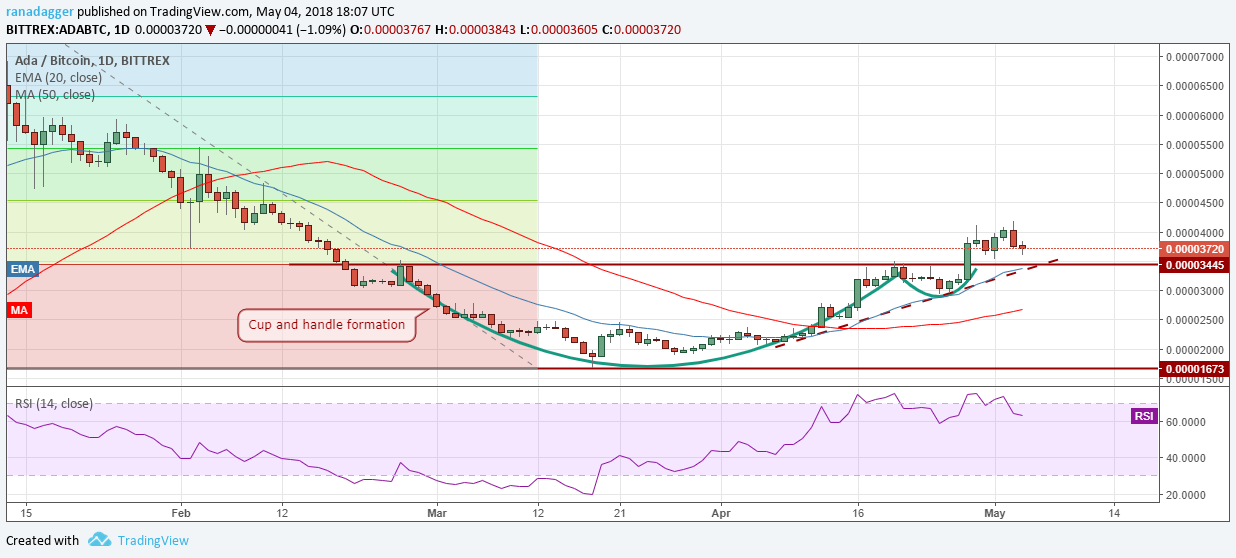

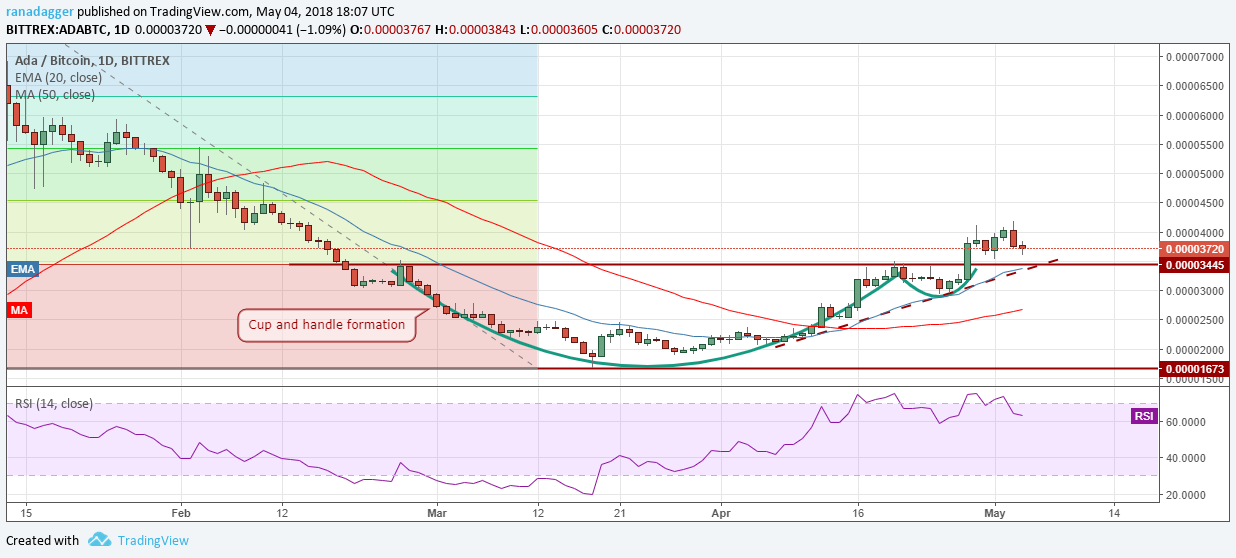

ADA/BTC

Cardano has failed to extend its uptrend after breaking out of 0.00003445. We had suggested raising the stops higher if the virtual currency crosses above 0.000042 levels, but it did not happen.

The ADA/BTC pair should now find support at the 0.00003445 levels because there are three major supports close to it.

The first level is the horizontal support, the second one is the trendline support, and the third is the 20-day EMA.

We shall retain the stops at 0.000029 until we see a rally above 0.000042 levels.

Our target objective on the upside is a move to 0.000045, followed by 0.00005217 levels.

IOTA/USD

IOTA broke out of the overhead resistance at $2.2117 on May 02 and followed it with another up move on the next day. However, it couldn’t break out of the resistance line of the ascending channel.

Currently, the IOTA/USD pair is retesting the breakout levels of $2.2117. If the level holds, the bulls will try to break out of the channel and push prices towards $3 and $3.5.

If the digital currency breaks below $2.2117 but finds support close to $2 levels, then the ascending channel will be in play, and a move to the resistance line of the channel can be expected.

Due to the uncertainty, it is better to wait for a couple of days and then buy if the support levels hold. Presently, we don’t have any buy recommendation.

EOS/USD

EOS, after the recent rally, has entered into a period of consolidation. Though it found support at the 38.2 percent Fibonacci retracement level on May 01, it could not scale the $20 levels in the ensuing up move.

On the downside, $16 should act as a strong support, below which, the EOS/USD pair can slide to the 20-day EMA.

We shall wait for the consolidation to play out and a new buy setup to form before recommending any fresh long positions.

By Rakesh Upadhyay

David Ogden – Http://markethive.com/david-ogden