BLOCKCHAIN EVOLUTION –

A Global Revolution

It should be clear by now that the blockchain and distributed ledger technology will play a very important role in our future, but it’s not. Blockchain adoption statistics show that half a percent (0.05%) of the human population is currently using blockchain technology, or somewhere around 40 million people. According to an HSBC survey, 59% of consumers have never heard of blockchain and 80% of those that have heard of blockchain don’t understand it.

According to even the most conservative estimates, this number is expected to quadruple in 5 years, and in 10 years, 80% of the population will be involved with the blockchain technology in some form. It’s just a matter of education on a simple level where the mainstream community can grasp the concept and understand that this technology stands for freedom, privacy and equality on every level in every country worldwide.

WHAT IS BLOCKCHAIN? How Would It Serve Us??

courtesy of Blockgeeks

Firstly, let’s take a historical look at how this all came about. Was it just a coincidence? Society has been indoctrinated for so long and tends to stay within the status quo or have become complacent putting up with the way things are. It’s time to educate ourselves and be ready for a major shift from the world as we know it. This will benefit our quality of life and the lives of every living soul on the planet.

Do you know what fiat currency is? Many people do not or at least don’t understand what it means. Here is a short explanation of how it has become detrimental to the economic system we all rely on today;

What Is Fiat Money?

Fiat money or paper money has been defined as any money declared by a government to be legal tender. State-issued money which is neither convertible by law to any other thing, nor fixed in value in terms of any objective standard. Intrinsically, it’s valueless money used as money because of government decree.

Throughout history, fiat currencies have had the order of rising and eventually collapsing, often due to devaluation. Initially, paper money gets introduced into an economy whereby it creates an economic boom. Over time, however, it gets overprinted, slowly building inflation and losing value.

Fiat money is a government-issued currency that isn't backed by a commodity such as gold. Essentially it gives governments' central banks greater control over the economy because they control how much currency is printed.

We all know that money is an entity that can be used in exchange for goods and services and then, of course, there is another system to keep track of its ownership and transactions?—?who owns what, who has what, and who owes how much to whom.

Historically, it has been widely accepted we need a third-party trusted entity to keep track of money, to keep those transactions and deal with the conflicts, if applicable. But that trusted party being central banks and the Government comes with a cost in terms of efficiencies, the potential for corruption, extra fees and so forth.

The GFC Of 2008 – A Prime Example

In simple terms, let’s go back and see the money flow in a specific scenario in the USA during 2008 where the trust model did not work that well –

People were earning more money and stored it with a central authority (i.e. banks).

The central authorities/banks started to facilitate risky loans to attract new customers and faced significant defaults on such loans. Due to the inability of the people to pay back the money, many banks collapsed and filed for bankruptcy.

Banks were also using people’s money to invest and lost all the money that the customers had trusted them with. In a nutshell, the banks lost the money that the customers deposited with them, leaving the customers no way of recovering their money.

With the banking system on the brink of collapse, the Government tried to save or bailout some institutions by offering the people’s money (i.e. tax revenue). That created extra expense and of course exceeded the Government’s budget or income, so to alleviate this, the Federal Reserve chose to print more money. There seems to be this trend of printing money to “fix” problems. Theoretically, there is no fixed limit to the amount of money a government can print. A couple billion here, a few hundred billion there, and pretty soon you have a real liquidity crisis; the kind where you are drowning in money, none of which is worth much of anything.

The Gold Standard Kept “Them” Honest

In the past, in the USA and many other countries, Gold was used as the standard where the authorities could not print more money than the gold reserves and it seemed to be a good way to ensure that we use our economy like debit cards so as to keep inflation in check. Basically, you can’t spend what you don’t have. But now we have credit cards and can spend what we don’t have. Whatever the perceived intentions Roosevelt and Nixon had to cut ties with Gold initially, there have since been ramifications. So effectively, now the Government can print as much money as they want which brings a multitude of issues.

Primarily, with more money being printed, the value of money is reduced and the economy is impacted. As an example, if you have $100 and the country has a total of $ 1000, you own 10% of the money. If the Government prints an additional $1000, you only own 5% of the money and that decreases the value of your money.

This is what happened in the crisis of 2008. Banks giving bad loans were the cause. Printing the money was a mitigation that helped in this specific case.

Central banking is immoral. Fiat money and its inevitable inflation are theft; the banking monopoly robs people of opportunity and prosperity; the punishment of financial dissenters, such as black marketeers, negates freedom by denying individuals the use of their own property. Central banking’s structure has become so transparently unstable and fraudulent that people have lost their confidence and sense of security in it.

Technology Rises To The Fore

Only six weeks after the crisis, on Nov 01, 2008, a new concept and technology came to light that will positively impact society, business and reshape the financial world. ?A person (or persons) by the name of Satoshi Nakamoto created a decentralized cryptocurrency known as Bitcoin and pioneered Blockchain technology. The idea was to create a world where no central authority can control all the money.

“I’ve been working on a new electronic cash system that’s fully

peer-to-peer, with no trusted third party.”?—?Satoshi Nakamoto

So, What Is A Blockchain?

Blockchain has been defined as a digital ledger in which transactions are recorded chronologically and publicly. Interestingly, Satoshi Nakamoto, who developed and released the first blockchain never actually used the word “blockchain”. Only the words block and chain.

A blockchain consists of a number of blocks, hence the term. Each block is a record of transactions of specific data, which can contain anything from Cryptos to voting records to medical data. When one block is completed and can no longer be updated with new data, it is added to the chain and another, new block, is formed.

All the information on the blockchain is publicly available, as it’s a decentralized system. Decentralized literally means that the information is stored on many computers distributed around the globe, and there’s no specific party or authority to control it.

Visualizing Blockchain Technology

You could think of blockchain as the Google Docs service – this is a very clever metaphor from William Mougayar.

Do you still remember the good-old-times when people used to create separate Word documents, save them, and then forward them to others for editing? You might, and some of you may still be doing it.

These days, it’s much easier to use a Google Doc, which allows us to create, view, comment, and edit the information in a live document online, given that we have the link and know where it’s located.

In a similar way, blockchain allows for the distribution of information. So, there we have a Google Doc – a block – that is duplicated thousands of times across a large network of computers around the world – a chain of blocks. The network is set to update every single document or block as and when it changed.

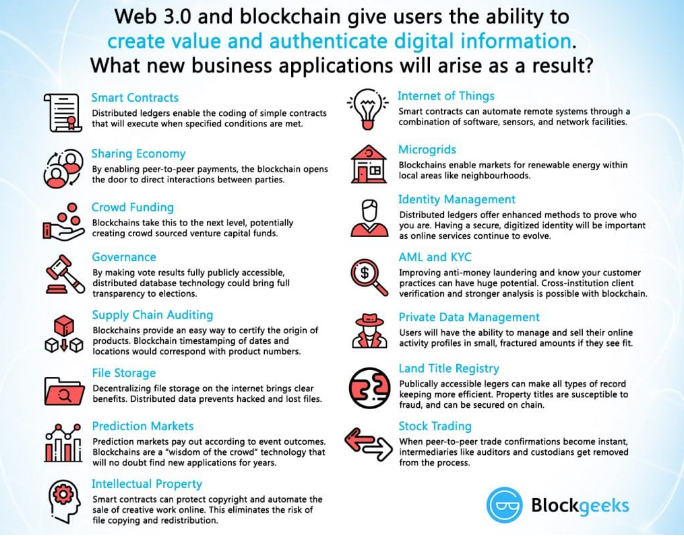

Blockchain – More Than Crypto

The blockchain is an undeniably ingenious invention and has since evolved into something greater. Blockchain technology created the backbone of a new type of internet. Originally devised for the cryptocurrency, Bitcoin, the tech community has now found other potential uses for the technology.

Image Courtesy of Blockgeeks

The Problem with Centralized Infrastructure

Today on the Internet, we must constantly trust one another with sensitive data, transactions, and records. Most of our interactions on the Internet run on centralized web servers, and massive amounts of user data often exist in a single database. Current databases are designed to be controlled by “trusted” admins who can read, alter, block, and even delete data. The centralized architecture of the Internet today is not only inefficient but vulnerable to censorship and targeted attacks by both hackers and internal bad actors.

The Value of Decentralization

The decentralized architecture of a blockchain is a global network of computers simultaneously running the software and validating the chain of transactions is what ensures that the transaction record is never compromised. Decentralization is critical as an architectural principle. It makes a blockchain network less likely to fail, harder to attack, and harder for bad actors to game the system.

Conclusion

There are so many benefits to being on the blockchain and as more companies and industries adopt this technology the fairer, more honest and prosperous the world will become. The users of Social Media at this stage are particularly vulnerable to the issues that come with centralization being lack of privacy, data harvesting, fraud, and corruption to name a few. In the next article, we will go deeper into how the blockchain works, what industries are utilizing it and how it can positively impact social media and market networks.

References: Blockgeeks Hackernoon

David Ogden

A Crypto/Blockchain enthusiast and a strong advocate for technology, progress, and freedom of speech. I embrace "change" with a passion and my purpose in life is to help people understand, accept and move forward with enthusiasm to achieve their goals.

David Ogden – Http://markethive.com/david-ogden

.png)

.png)

.png)

.png)