Despite Bitcoin's 'Sell-Off' The Cryptocurrency Space Continues To Attract Investors

Volatility, volatility, volatility. Traders certainly love it. But the volatility witnessed of late among many leading cryptocurrencies – including the ‘Big Daddy’ of them all in the shape of Bitcoin as well as Ethereum – has been a "double-edged sword" according to some pundits. Price swings can occur dramatically and result in big profits, should you catch it right.

Equally, significant losses can be sustained should your timing be all awry, there is negative newsflow around the crypto space and/or particular digital currencies.

Bitcoin’s Halcyon Days?

One might say you pays your money and takes your chances in the “Wild West” of crypto land. More succinctly, caveat emptor (buyer beware). And, according to Jordan Hiscott, chief trader at ayondo markets, a brokerage in The City of London, in a note from last week (March 27) said: “Certainly the halcyon days of performance gains [for Bitcoin] from 2017 seem long gone.”

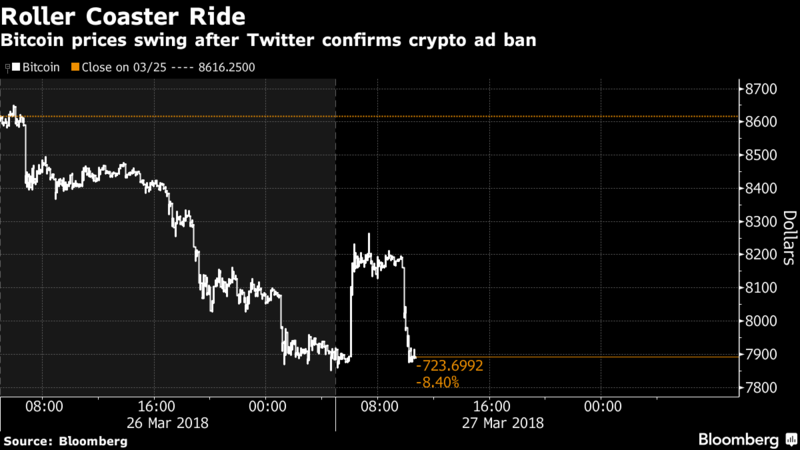

Bitcoin moved lower early last week on Tuesday and was trading at around the $7,900 mark. However, this was in stark contrast to the level of $13,275 at the start of 2018. Hiscott’s view expressed at the time in late March was that the situation around the current soggy price level could persist for “at least six months.”

He added: “My theory is based around the situation regarding the liquidation of the Mt Gox Exchange, and the appointed trustee to handle the bankruptcy. Colloquially, this individual is known at the "Tokyo Whale", and having already sold around $400 million worth of both Bitcoin and Bitcoin Cash, he is likely the main catalyst for this year’s move down.”

Interestingly, there still remains around three times that amount of Bitcoin to potentially to hit the market. “With this kind of volume yet to surface, in my view, prices on Bitcoin will remain depressed until this situation has been resolved,” ayondo’s Hiscott posited.

New Investors

The wild run on the crypto scene starting from late last year may have created a few sob stories for new investors, as those who bought in during the all-time highs are likely to have incurred losses due to February’s massive correction. Some might even be ruing the day they ever decided to dive in and invest.

In fact, recent statistics indicate that most people who got into bed with and invested in Bitcoin did so at a significantly higher price than the current market price, which is now well below the $10,000 market. This is a remarkable turnaround.

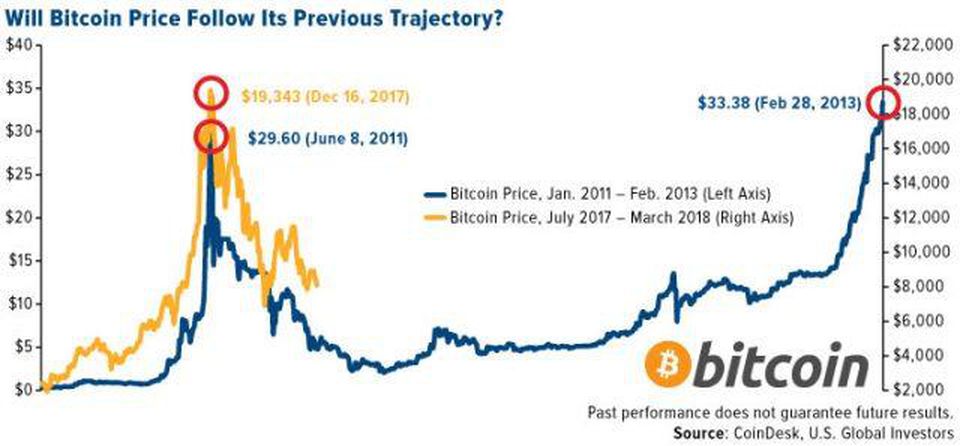

Having reached just slightly north of $19,000 a pop on December 17, 2017, in a something of a feeding frenzy from the month before (seeing the currency’s value almost quadruple from $5,857.32 on 12 November), Bitcoin’s price retreated and has fallen back to around $6,500 as of today (April 1) – and that’s no joke. Since the peak it equates to a decline of 65% in a matter of fifteen weeks.

Bitcoin was not alone in seeing a price a substantial correction from its peak.

Ethereum’s price, which was standing at around $366 as April 1 is down from over $1,330 – the currency's peak – reached on January 14 this year, while it’s a similar picture declining prices from their highs for Bitcoin Cash, Litecoin and Ripple.

Top Cryptocurrencies: Trading Prices

Dec 17, 2017 April 1, 2018

Bitcoin

$19,086.64 $6,493.84

Ethereum

$717.29 $366.09

Bitcoin Cash

$1,939.93 $633.68

Litecoin

$332.59 $110.86

XRP (Ripple)

$0.76 $0.4713

Source: CoinDesk Inc. Prices in US dollars as of April 1, 2018, 15.20 UTC.

There were stories that many had invested using their credit cards. And, some plucky investors even re-mortgaged their homes. What they are thinking now is anyone’s guess. But if you play high risk markets then there is also the possibility of getting burned big time.

And, if there is one lesson from all this, it is not to believe in all the hype that surrounded cryptocurrencies when the prices were getting pretty frothy and frankly some people were getting ahead of themselves.

This was especially so just prior to Bitcoin futures being traded on the Chicago derivative exchanges, the CBOT and CME. Between the point when it was announced late last October that futures in the cryptocurrency would commence during the fourth quarter 2017 – until Bitcoin’s peak in December – the price had surged by 211%. And, now for Bitcoin we are broadly back at those levels seen when the announcement was made first disseminated to the market by the CME.

Looking back it was unrealistic and unsustainable to expect Bitcoin and other leading cryptocurrencies to continue their explosive runs – ever upwards. And, while not wishing to say I told you so, it is something I had pointed out in some of my previous posts on Forbes. Namely that it didn’t exactly look too healthy or sustainable. Some out there think though there will be correction upwards to where it was before and well beyond, given the recent trading lows over the last 50-day trading period.

Now there has been a tightening of regulations. One of the latest examples being from the European Securities and Markets Authority (ESMA), the Paris-based financial regulator, with its communique on 26 March concerning leverage on derivative products related to cryptocurrencies amongst other financial products. Regulators in South Korea and China have also weighed in with pronouncements on bans for Initial Coin Offerings (ICOs) and other crypto prohibitions over recent months.

It was fortunate perhaps that the latest G20 meeting in Argentina did not bear down on the crypto space as they could have, which had been flagged up as a distinct possibility by French and German central bankers along with Mark Carney, Governor of the Bank of England and head of the Basle-based Financial Stability Board (FSB).

Investor Appetite?

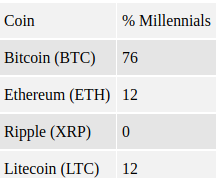

All of this, however, does not appear to have dampened investors’ drive to be part of the crypto space. Hundreds of millions of dollars in tokens continue to be traded on exchanges. ICOs also continue to rake in the big bucks. Indeed, just three months into 2018 and $4.8 billion in funding has already been raised through various token sales so far.

Blockchain is widely considered to be the next disruptive technology. As such, many believe that the crypto space is a high-potential growth area that could provide massive returns of investment. For early adopters of coins like Bitcoin and Ether, it most definitely has. Although for later ones the jury is out.

As pointed out above, if you bought when the mania gripped at the end of last year you will be nursing a hefty loss. Of course, one might see this as ripe time to buy back in and average out your crypto holdings.

Even established companies are making their respective plays in crypto investing. Trading platform eToro recently secured $100 million in a Series E funding round to support its global expansion and further support of crypto and blockchain. The platform already supports major tokens including Bitcoin, Ether, Litecoin and Ripple.

But the funding round hints at the adoption of blockchain technology for its own use. Crypto exchange Poloniex was also recently bought by Circle, a fintech firm backed by Goldman Sachs, which underscores how traditional institutions acknowledge crypto’s impact.

Such developments only help inspire investor confidence, or so some pundits argue. And, even if coins remain far from their all-time highs, backers continue to stake in blockchain and crypto.

And, in that vein here are five reasons as to why the crypto space still continues to encourage more investors to participate.

1. The Promise of Blockchain

It’s tough to argue against blockchain as a technology since there is value in the immutable and transparent record keeping that it provides. But it should be pointed out that Blockchain projects and their protagonists have had a nasty habit of over promising and underdelivering. And, the number of ICOs that failed to deliver in 2017 isn't exactly something to shout about.

Several projects though have already made headway in the areas of finance, healthcare and security. Blockchain’s distributed nature also helps mitigate security and reliability issues that plague other technologies.

Blockchain’s appeal is even bolstered by the emergence of smart contracts and cross-chain interoperability. The possibilities for developing new applications based on blockchain now seem boundless according to the view of some. Because of this, there is no shortage of new and promising ventures building their projects on blockchain.

And, I for one can certainly vouch that hardly a day passes when I do not receive a slew of press release ICO launches in the crypto space. It seems never ending.

Traditional institutions and large enterprises are also committed to adopting the technology. Even banks are forming consortia that would enable them to use blockchain for their various services. Due to this demand, IT providers like IBM and Microsoft are even compelled to offer blockchain-related products and services and blockchain-as-a-service.

2. Unicorn Potential

This next wave of tech companies is attempting to bring disruption to a variety of verticals. New projects have now extended beyond blockchain’s typical use cases and have found their way even in sectors like social networks, media and gaming – all of which are billion-dollar industries.

Casting a wider net could help these ventures catch bigger fish. And, for investors, backing such companies early on could deliver significant returns down the line.

Some may be labeling this boom a bubble, in much the same way as happened with a whole host of dotcom ventures back in the naughtiest (2000’s). While this may be true in some regard, one should not dismiss the likelihood that winners can emerge – even if the bubble bursts.

And, in hindsight, who would not have wanted access to Google or Amazon stocks at pre-IPO or at IPO prices? There is always a chance that this slate of crypto-based projects may include future unicorns.

3. Early “In”

Clearly, not everyone is a venture capitalist (VC) or an angel investor who could find early “ins” to startups. This typically requires a certain amount of clout and reputation in the business community as well as significant wealth in the war chest. The only way ordinary people were able to invest in new companies was to wait for a public offering.

Today, ICOs have allowed just about anyone to invest early in new projects. ICOs now generates 3.5 times more capital than VC funding. This is largely due to how ordinary investors could invest even relatively small amounts right at the start, based on the promise of returns once the token hits exchanges or when the venture eventually flies.

4. Fundamentals Start to Matter

More investors are also realizing that they should not be rash in spending their money on any ICO that comes their way. It does take disciplined due diligence to spot potential unicorns. But even a good idea does not necessarily come to fruition until the service goes live and the market takes to it.

Fortunately, more investors are learning to look into a project’s fundamentals. The uniqueness and value of the concept, the token economy, the potential for target verticals to be disrupted by the technology, the strength of teams behind the projects, and other factors are now being considered by investors.

This rising focus on fundamentals can eventually help minimize speculation and the market’s volatility and even encourage traditional investors to participate.

5. Global Reach

Traditional investing has largely been geographically limited due to the regulatory constraints. ICOs, however, have opened up the game, allowing investors from all over the world to participate. This is also becoming increasingly easy given how established platforms are supporting more cryptocurrencies.

While some countries have already put up stringent regulations to limit and even ban crypto investing, many countries still only advise their citizens to be cautious when investing in crypto. Investors from these certain countries are otherwise unbridled to trade cryptocurrencies.

Risks and Rewards

At the end of the day, investing as a financial activity entails risks and rewards. While crypto investing seems to carry more risk due to the technology and space’s infancy, the rewards can also be significant.

Fortunately, the crypto space appears to be headed – some believe – towards normalcy as regulation and a focus on fundamentals are helping lessen speculation. Increasing support by traditional trading platforms and the participation of other established organizations also helps bring legitimacy to crypto activities, which ultimately should inspire investor confidence.

Add to all this, the space continues to make significant money. And, as long as this is the case, it will continue to attract enterprising parties from all over. But watch this space.

Roger Aitken , CONTRIBUTOR

Posted by David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden