Rise of Bitcoins causes stir but questions linger

Anthony Mburu and his fiancée Elizabeth John who recently attracted curiosity when he paid part of his dowry using Bitcoins, a form of digital currency, in Naivasha Kenya,considers himself a non-conformist.

Having quit university in 2010 after just one semester of his engineering course, 26-year-old Anthony Mburu does not fancy formal education, for instance.

“Formal education is good. It will give you an average life. You’ll eat, have your mortgage, car loan and all that — live an average life; struggle through life to the end,” he opined.

WALUBENGO: Kenya's uneasy dance with Bitcoin

DOWRY

He currently makes a living out of “mining” Bitcoins and he says that is the source of income that has enabled him buy a parcel of land in Naivasha, stay in a rented house and has given him something to buy and maintain his car among other fortunes.

“Everything is Bitcoin. Where I live, Bitcoin; what I drive, Bitcoin; investment, Bitcoin,” he said.

The computer-generated currency, he says, enabled him pay part of his dowry.

On November 11, as he headed to the home of his fiancée Elizabeth Chege in Naivasha, he had already negotiated with his in-laws that the goats portion of his dowry be settled with Bitcoins.

MOBILE APPLICATION

There are some components of the dowry process he paid for in hard cash.

His father-in-law, John Thion’go Chege, a retired KenGen employee, bought the idea.

They helped him download a mobile phone application that works as a Bitcoin wallet.

“We told him, ‘You just receive this and keep it. In a few months, you will have double the dowry. And if you keep [real] goats, they’ll still be the same goats,’” Mr Mburu said.

Ms Chege, the 6th born in a family of nine children, said her parents did not ask many questions despite the fact that Bitcoin is not a well-known concept in Kenya.

“They can’t refuse because they believe in me,” she said.

CBK

Mr Mburu’s unprecedented action has drawn mixed reactions since Bitcoin is a currency the Central Bank of Kenya has told the public to eschew because it is not backed by any regulator.

In a recent interview, Central Bank of Kenya Governor Patrick Njoroge reiterated his disdain for Bitcoin, saying the way the currency’s value has shot up is proof that it could be a Ponzi scheme.

“Our point is that there is risk and it is important that everybody knows that those risks can come back to haunt us and have financial stability concerns,” Dr Njoroge said.

VALUE

Those who are in Dr Njoroge’s school of thought have been criticising the Bitcoin dowry deal.

“Ikicollapse nayo? Give back the bride…” a commentator on NTV’s YouTube channel joked.

Another viewer wrote: “That family better cash in on those Bitcoins. The Bitcoin bubble will burst… Eventually.”

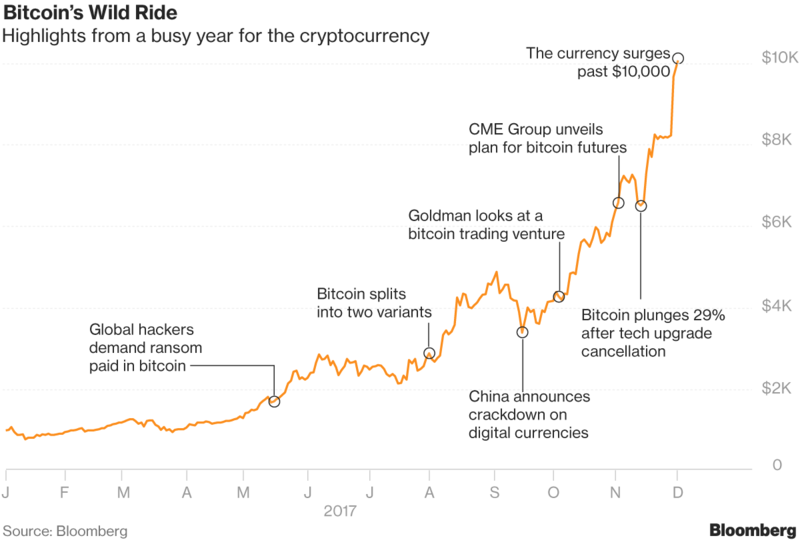

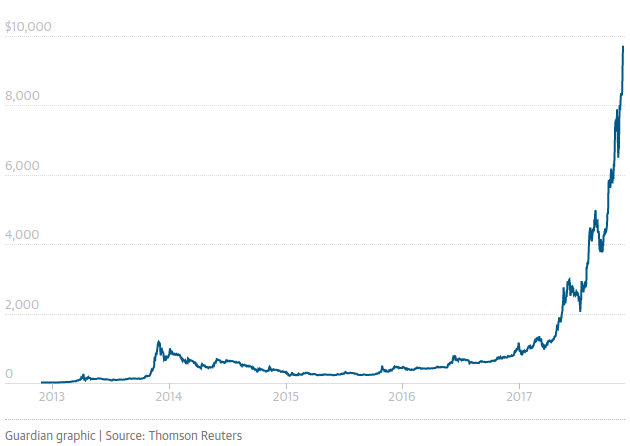

But the currency is fast gaining prominence in Kenya as many people try their luck with this fortune whose value has been sharply rising, much that by Saturday , one Bitcoin was selling for close to Sh900,000 locally.

The value was barely Sh10,000 a year ago.

On the global scale, one Bitcoin was selling at $8,480 (Sh875,984).

SELLERS

On Saturday afternoon on localBitcoins.com, one of the platforms where Bitcoins are sold by Kenyans to other Kenyans, there were at least 10 active sellers.

One in Nairobi was selling 0.150544 of a Bitcoin for Sh140,000, which they wanted to be sent to him via M-Pesa.

Another one in Nakuru wanted Sh250,000 sent to his bank account before he could load any willing buyer’s Bitcoin account with 0.26153363 of Bitcoin.

There are many ways of making money though Bitcoin, and Mr Mburu’s preferred way is through “mining”.

PURCHASE SHARES

He is a member of Bitclub Network, which helps Kenyans and other people across the globe buy shares in the Bitcoin enterprise.

The Kenyan chapter of the club, which has more than 1,000 members, meets in Nairobi every Tuesday, Thursday and Saturday.

Asked what one needs to do to get into mining, Mr Mburu replied:

“Just buy shares. The company dealing with that is Bitclub Network. And one unit is going for $599 (Sh61,876).

"So, you buy Bitcoins worth that much and buy that mining capacity; like you buy a machine. It’s a real machine called Antminer S9.”

He adds: “Once you buy it, it’s stored in our facility in Iceland, and there’s a 30-day period of paying that you’ll not be earning.”

GOATS

Ever since he discovered Bitcoin — which he says brings him at least $5,000 (Sh515,500) per month — he has not looked back and he is planning for a wedding in April 2018. “It will be a Bitcoin wedding,” he said.

Mr Mburu was also dismissive of those who say he might have taken his in-laws for a ride.

“They don’t know what it is. Bitcoin has been there, and it’s going nowhere,” he said.

The Bitcoins he paid were and equivalent of 25 goats. He still has 75 to go “which are yet to be paid in Bitcoins” as he put it.

GROWTH

His fiancée runs a clothes shop in Nairobi and she has also been accepting payment via Bitcoin, though the mode of exchange is yet to gain ground in Kenya.

Mr Michael Kimani, the chairman of the Blockchain Association of Kenya, has been dealing with cryptocurrencies since 2012 and says the field will grow exponentially.

“A lot of opportunities are going to emerge from this and I’m trying to position myself with this industry because I honestly think in the next five years, this is going to be so big that people will forget how we used to live without cryptocurrency,” he said.

Author: ELVIS ONDIEKI

Posted by David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden