Bitcoin Fees Are Down Big – Why It's Happening and What It Means

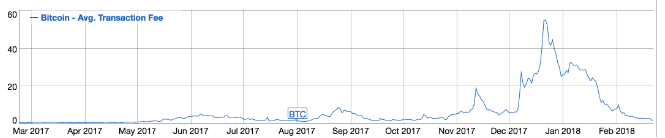

$26 down to $3.

The average cost of sending a bitcoin transaction is cheaper than it's been in a year and a half, showing the price isn't the cryptocurrency's only unpredictable metric these days.

But with all the debate about growing fees, this might come as a surprise. After all, it wasn't so long ago that fees were so high a group of prominent investors and miners created a whole new version of bitcoin mostly to keep fees lower.

Backing up a bit, much of the conflict centered on the fact that while called "fees," these expenses are best considered as transaction costs that are necessary to the network, as necessary as paying for someone to deliver a protocol service, be it SMS, VoIP or email, or even a pizza.

This is because bitcoin is a software that requires all of the many thousands of computers that run it to stay in sync. To do so easily, there's a limit on how much data the network can process at intervals, and users need to pay more to get their transactions in at times of congestion.

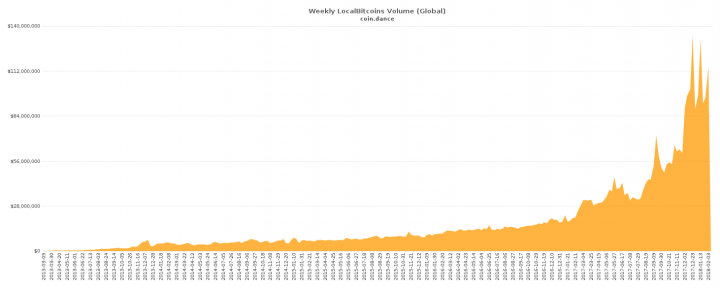

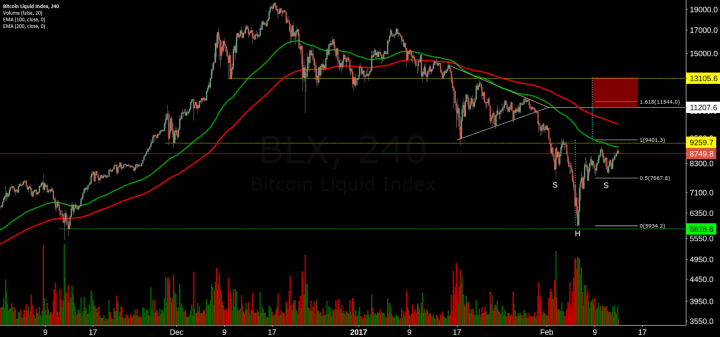

So, as bitcoin grew more popular in the last year, fees skyrocketed to over $25, according to a graph from data website Bitinfocharts.

Bitcoin users, those who truly rely on the protocol for essentials, have been affected by this, as were those who believed bitcoin could be competitive with legacy payment systems.

But, bitcoin fees have fizzled out, declining since the end of December.

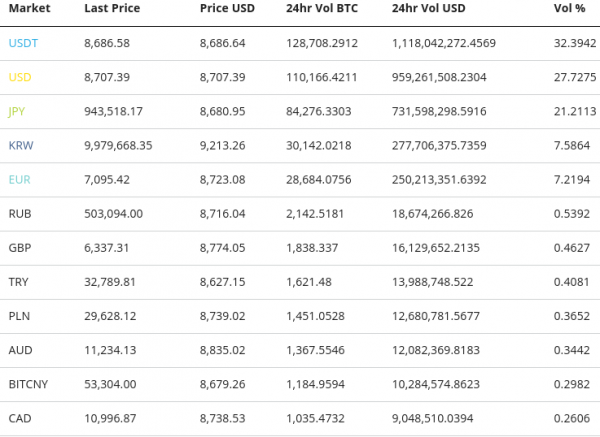

So, why did fees take a nosedive? The simple answer is users are making fewer transactions right now. In December, there were roughly 400,000 transactions per day, while today bitcoin is seeing only 200,000, according to data from Blockchain.info.

"I think its really simple," BitGo engineer Mike Belshe told CoinDesk. "There is substantially less transaction demand."

The question, he added, is why has there been a decrease in transactions?

SegWit and beyond

If Twitter and Reddit are any indication, sentiment on the matter tends to be influenced by personal politics, in this case, where users stand in bitcoin's long-standing block size debate, which, at its core, was about network economics.

Popular Twitter figure "Armin van Bitcoin" cheered that the low fees mean the "scaling debates are now a thing of the past," pinning the development partly on growing adoption of Segregated Witness, a scaling feature at the center of bitcoin's long-raging fee debate.

And there is truth to the claims. SegWit reduces transaction fees and adds more space to the blockchain, but it still isn't widely adopted, so it's hard to say how much it actually helped. There hasn't been much of a recent increase in SegWit use either. For the past several months, only about 10-14 percent of transactions, according to SegWit tracking site SegWit Party.

Plus, SegWit doesn't reduce the number of transactions, it makes each one cheaper.

Another possibility, according to Belshe, is that fee prices "finally forced" some large transaction processors to implement a technology called "batching," rolling many transactions into one, to leave more space on the blockchain.

Indeed, exchanges like Coinbase have said they were working on implementing the feature in the past. And Thursday, cryptocurrency exchange ShapeShift announced it now batches transactions, making a point that it makes up 2 percent of all the transfers that occur on the bitcoin blockchain.

However, it's a theory that's difficult to get hard data on, unless an exchange were to formally announce that they were using this technique. "This is hard to confirm with 100 percent certainty," Belshe said.

Still, he argued that even if just one large exchange started batching transactions, it could have a huge impact on the overall transaction load.

These sorts of technical theories add to the idea that developers and those building services on top of bitcoin can make optimizations in order to free up space on the blockchain, without compromising on some of its core features.

"This is why Bitcoin Core worked so hard to get 'layer-two solutions' working, and why they focus so much on optimization of the size of transaction through various things like Schnorr and Bulletproofs," XO Media CEO John Carvalho said.

"They are doing everything to minimize the footprint of every type of transaction attached to bitcoin because they are all stored forever," he added.

Ditching bitcoin

Others, especially those critical of how bitcoin developers favor a smaller blockchain and limited transaction space, argue the lower fees are a consequence of people that are sick and tired of the high fees leaving bitcoin.

"Bitcoin isn't useful for anything that involves low fees so people are migrating to alternatives. this has the consequence of lowering the fees on bitcoin," said Ryan X. Charles, founder of Yours, a media startup building on bitcoin cash.

Charles notably moved his startup off of the bitcoin blockchain last year, migrating to alternatives before building on bitcoin cash.

It's possible that some users are doing the same. Payment processor Stripe stopped accepting bitcoin in January payments due to the high fees, and BitPay, a startup that offers payment services over bitcoin has differentiated into supporting multiple protocols for its merchants.

Yet, if they are pushing users elsewhere, it's not clear where they're going. Bitcoin cash, the cryptocurrency created as a cheaper alternative to bitcoin, still has about 10 percent the number of transactions bitcoin currently does.

"Apparently [high fees] don't incentivize folks to switch to bcash," BitGo engineer Jameson Lopp said.

Bitcoin developer Meni Rosenfeld doesn't think so either. In fact, he disagrees with both of the above theories.

"The main reason for the drop in [bitcoin transaction] fees is not SegWit adoption, and it's not people moving to [bitcoin cash]. It's simply that the craze for buying cryptocurrencies in general has calmed down," he tweeted.

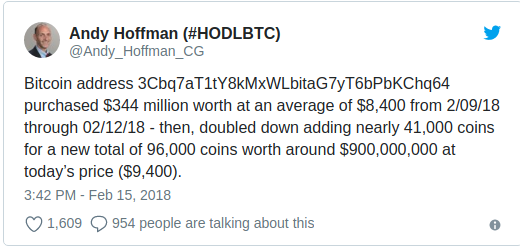

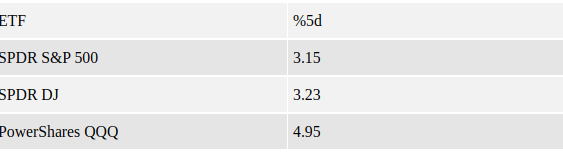

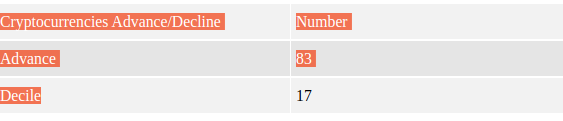

Indeed, there's been a downtick in outside interest in bitcoin. A lower price has less new investors searching for bitcoin on Google and coming in to buy and trade the cryptocurrency.

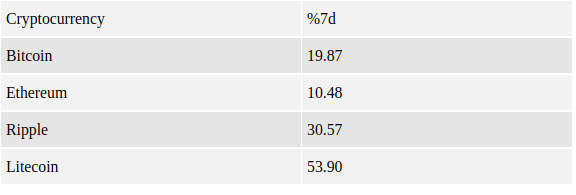

This view seems supported by the fact that the second most valuable blockchain by market cap, ethereum, has also seen a dramatic drop in fees in recent months. The same goes for litecoin, clocking in at number five, and XRP, at third place.

Charles also argued it's possible crypto's waning hype cycle has contributed to lower fees.

"I wouldn't be surprised if ethereum is also lower due to the decline in market value. There may simply be less demand for sending transactions across all blockchains. We went through a hype cycle," he told CoinDesk.

And it's always possible the low fees were caused by a mix of the factors described above.

Fees forever

What do lower fees mean for users? In short, it shows that under the current setup, fees might fluctuate over time.

The hope is that – eventually – fees will always be "low," with the word low having somewhat of a relative definition. After all, a low-cost airline flight may be better than an expensive bus ride.

In this way, supporters hope that bitcoin will one day offer the best of both worlds, supporting high demand and "low" fees that reflect the quality of service, while also supporting miners, computer operators who devote real-world costs to securing transactions.

"The fee market is necessary as a counterweight to market price. [Theoretically,] demand for blockspace is infinite, so there must be levers to manage it," Carvalho said.

In the meantime, fees could continue to decline, creating a new standard of "low" that might be friendlier to today's internet users. Carvalho and Rosenfeld, for instance, think the much-touted Lightning Network will help get bitcoin to that point, as it moves more transactions off of the main bitcoin blockchain.

If Lightning really takes off, then low fees may become another problem, as they might not be enough to defray mining costs when the network finally produces all 21 million bitcoin.

For this reason, developer Greg Slepak had an almost ominous-sounding view of the future, arguing that users should "take the opportunity" of today's lows fees, adding:

"It might not come again."

Author Alyssa Hertig Updated Feb 23, 2018 at 02:11 UTC

Posted by David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden