Experts See Bitcoin Rallying to $20,000 Before End of the Year – Here are the Reasons

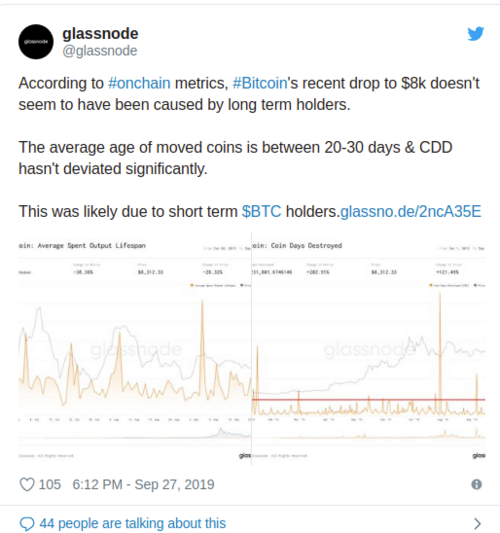

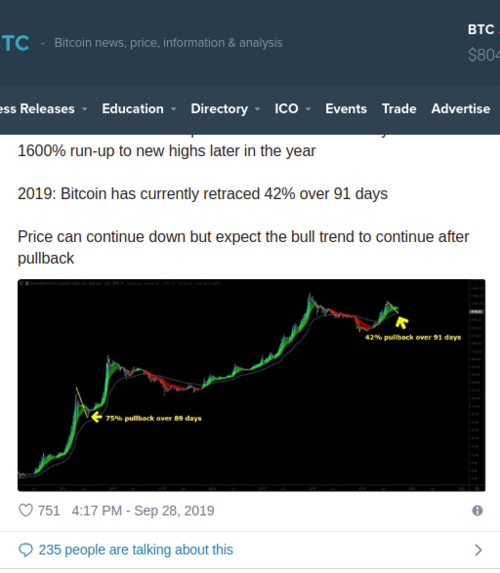

Bitcoin is down by over 40% from the 2019 high of $13,880. Any other asset plunging by 20% or more would have been in a bear market. But not the king of cryptocurrencies.

Bitcoin has retraced by more than 40% in previous bull runs and many market participants are comfortable holding the cryptocurrency.

To prove our point, we asked experts what are their year-end target for the top cryptocurrency. We were surprised to see that many of them are bullish on bitcoin and believe that it will regain the all-time high of $20,000 before this year expires.

$10,000 Appears to Be the Conservative Target

Experienced traders are not fond of doling out extreme target prices. They believe that it encourages some retail traders to think of how much money they can make instead of protecting their capital. This strategy often leads to tremendous losses.

Hence, some traders gave us conservative price targets. For instance, Elliotician Benjamin Blunts sees bitcoin recovering $10,000. He said,

I think we can be back at $10,000 by year end provided we get a strong bounce from the $7,500 support zone on [the] daily.

Crypto trader Beastlorion supports the call of Benjamin Blunts. The analyst told CCN,

Well, between $10,000 – $12,000.

Michael Terpin, founder and chief executive of Transform Group, also chimed in. He said,

The price of bitcoin historically advances sharply two quarters before the halving and has also averaged triple-digit gains in the fourth quarter if you remove the corrective years following all-time highs. This Q4 should most closely resemble Q4 2015, which saw an 85 pct gain in the quarter, which would put the price of BTC at $15,400.

In addition, the widely-followed Trader Mayne is sticking to his call. When asked about his year-end target, the trader said,

$16,000.

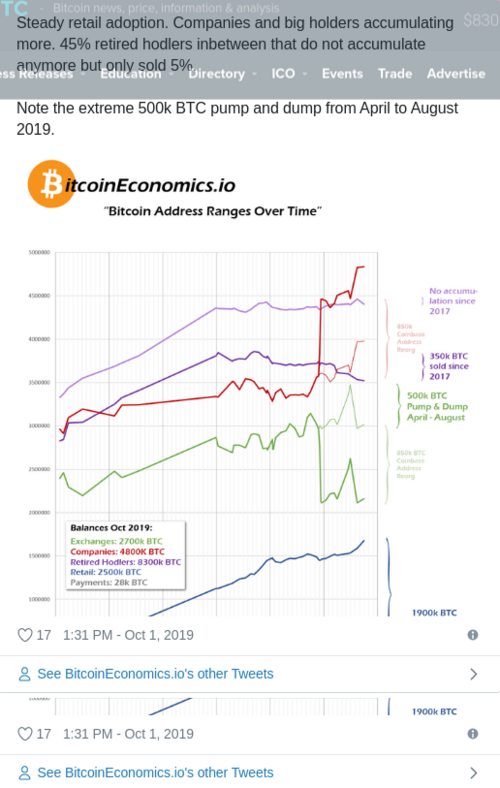

It seems that technical analysts have a wide range in terms of their target price for bitcoin this year. On the contrary, those who look at the fundamentals seem confident that bitcoin will reach $20,000.

$20,000 Attainable Due to Bitcoin’s Growing Fundamentals

While poring over charts might give analysts a target between $10,000 and $16,000, those who focus on bitcoin’s strengthening fundamentals are looking at $20,000 or higher.

For instance, Sean Barger, managing director of CPUcoin, said,

I believe BTC will pierce $20,000 by the end of the year. There’s simply too much being built on BTC as the foundation for the universal world currency, and there are signs of deep adoption from enterprise and consumers alike.

Tomàs Sallés a financial writer at FXStreet supports Mr. Barger’s call. He said,

If [bitcoin] resists above $7,750 we could see [it] closing in the $17,000 zone or above historical highs and $20,000 price level.

Nick Hellman, the president of LearnCrypto, was ready to up the ante but he extended the timeline. He told CCN,

Let’s just say new highs before May of 2020, probably somewhere from $24,000 – $32,000.

For those who are not aware, May 2020 is when the next bitcoin halving takes place. This is an ultra bullish event that even a German bank sees the cryptocurrency trading at $90,000 after the halving.

Thus, if a financial institution sees bitcoin valued at $90,000 after the May halving, it may not be so far-fetched to think that the cryptocurrency could be priced at $20,000 before the turn of the calendar.

Disclaimer: The above should not be considered trading advice from CCN. The writer owns bitcoin, Ethereum, and other cryptocurrencies. He holds investment positions in the coins but does not engage in short-term or day-trading.

By

Kiril Nikolaev @kirilnikk123

October 2, 2019

David Ogden – Http://markethive.com/david-ogden