Down 80 per cent in just over a year: Why Bitcoin’s bubble burst

Bitcoin was the first of the crypto currencies and invented by a mysterious computer genius. This is how it’s taken a massive dive.

A little over a year ago we looked at Bitcoin and the whole crypto currency phenomenon.

Eerily, it turned out to be the same week as Bitcoin traded at its peak of $US19,891 on the Bitfinex exchange.

We were being accused of ignoring the “new age” investment darling.

We concluded it was an investment bubble waiting to burst. Our aversion to the whole crypto currency fad was based on a few reasons;

• We had no idea who was behind the Bitcoin business.

• The trading market was unregulated.

• It was too easily replicated by other crypto currencies

• People couldn’t work out what was fair value.

Around the same time the Australian Securities and Investments Commission issued this warning: “ICOs (initial coin offerings) are highly speculative investments, are mostly unregulated, and the chance of losing your investment is high. Consumers should understand the risks involved, including the potential for these products to be scams, before investing”.

We just weren’t convinced that Bitcoin and other crypto currencies were a legitimate investment option for average Australians.

THE BIG FALL

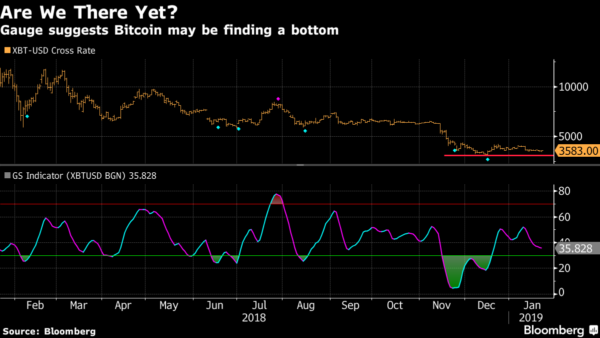

Since that week, Bitcoin and the whole crypto currency market has dropped 80 per cent in value. That’s bigger than the dotcom bubble and crash of 1995-2000.

As a couple we invest in start-ups and alternative investments so are pretty open minded about new trends. As we said at the time, crypto currencies had all the signs of an investment bubble, and reports of people mortgaging their house to invest was just plain crazy.

You can make big bucks investing in a fad. Just don’t be the sucker at the end when the crash comes. Always take profits along the way, try to get back your original investment and then just play with the profits.

HOW IT WORKS

As background for those who weren’t caught up in the hype, Bitcoin was the first of the crypto currencies and invented by a mysterious computer genius called Satoshi Nakamoto who decided there would only be 21 million ever created.

Bitcoins are created or “mined” by supercomputers which solve complex algorithms and, in return, receive a unit. The closer the number of Bitcoins gets to 21 million units the harder it is to mine and the bigger the supercomputers need to be to solve the puzzles.

The Bitcoins are then held in digital wallets of investors which are numbered and password protected. Some describe it as a peer-to-peer electronic cash system. No names are used so it’s very secretive and investors anonymous.

The Bitcoins are then traded on markets using “blockchain” technology. This is simply a decentralised network of computers around the world which monitor and record all transactions.

Basically a Bitcoin is a means of trading value. Think of it as a digital version of money. Before that there were shells or rum during the Rum Rebellion when Australia was an early colony. It’s used as a means to pay for good and services.

Its value is determined by good old supply and demand.

While Bitcoin is acknowledged as the first major crypto currency, at the peak of the boom there were around 1700 different electronic currencies being traded. Everyone was getting in on the action.

So what happened?

Like a lot of new investments, when they start to get popular, and move toward the mainstream, they attract scrutiny. Experts say the market has been hit hard by a number of factors.

REGULATOR CRACKDOWN

Regulators and traditional financial institutions are always spooked by new investment schemes. But when that new product is an electronic currency which is decentralised with no central regulating authority and avoids the regular payments process, it is going to get a lot of attention from authorities.

Governments and central banks around the world have hit the market with a series of regulations and warned against anyone investing in crypto currencies.

INADEQUATE SECURITY

Cyber thieves have attacked a number of the crypto trading exchanges and stolen money from investors. How much has been stolen is not clear because there are no formal tracking of these exchanges, but some estimates are that over $1 billion went missing in 2018.

That’s a lot of money, even for investors at the extreme of the risk profile, and undermines confidence.

TAX OFFICE STAKES A CLAIM

Where there are people making big money out of investing, government revenue agencies are not far behind to get their share of the action.

Despite the secretive nature of crypto currency investing, the Australian Taxation Office (and its counterparts around the world) ruled gains would be subject to tax.

One of the reasons given for the current market collapse is that US investors are cashing in to pay their tax bills on the big gains they made in 2017. The Internal Revenue Service ruled crypto currencies were property and would be taxed on capital profits.

GOOGLE’S ADVERTISING BAN

At its peak, the crypto phenomenon was fuelled by huge marketing dollars spruiking the different “coins” and their incredible investment returns. Most of our online screens were flooded by advertising showing we were fools not to get involved.

But Google turned off the tap by banning online advertising of crypto currencies and the marketing machine ground to a halt.

Originally published as Why the Bitcoin bubble burst

DAVID & LIBBY KOCH

David Ogden – Http://markethive.com/david-ogden