Bitcoin (BTC) Transaction Count Has Crypto Community Bullish

Bitcoin Transaction Counts On The Up-And-Up

Although Bitcoin (BTC) has continued to struggle in recent weeks, posting harrowing losses day-in, day-out, there are some optimists that are adamant that investors shouldn’t be alarmed.

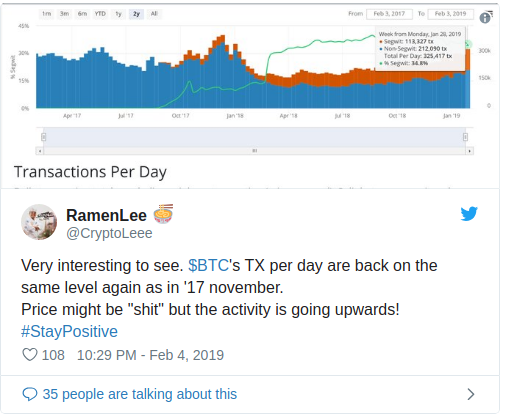

Case in point, Ramen Lee, a crypto designer, recently took to Twitter to note that the number of BTC transactions per day has risen to the same levels seen in November 2017, when the digital asset boom was posting new all-time highs day-over-day.

As put by Ramen, the “price may be ‘s*it’, but the activity is going upwards.” This only underscores the ever-swelling fundamentals of the Bitcoin network.

Per previous reports from Ethereum World News, data compiled by Jameson Lopp, the chief technology officer of Casa, accentuated that from a fundamental perspective, 2018 was Bitcoin’s best year yet. Hashrate doubled, while a cumulative $410 billion in value was transacted on the “world’s most secure transactional settlement layer.” Bitcoin’s scaling solutions also saw notable levels of adoption. SegWit, a short-term, ‘bandaid-esque’ solution that squeezes more transactions into blocks, saw use swell from 10% to 40% over 2018. The Lightning Network, a long-term scaling solution that takes advantage of off-chain ledgers to facilitate effectively free, low cost, scalable, immutable, and private transactions, swelled to 500+ BTC capacity.

The Other Side Of The Coin

Although the swelling transaction count is evidently a sign that should spark optimism, there are other indicators that accentuate that the crypto community should be concerned. Murad Mahmudov, a leading Bitcoin trader with hopes of launching a crypto hedge fund, recently took to Twitter to touch on social metrics, and how they show that interest in the flagship cryptocurrency just isn’t present.

Mahmudov, who is a long-term believer in the potency of this asset class, divulged that as per BitInfo, tweets regarding the flagship cryptocurrency have reached 2014 levels, lower than any point in 2016.

Explaining the importance of this statistic, Mahmudov remarked that it’s almost as if “nothing has changed,” adding that this is an “absolute disaster for the price in the medium-term.” He noted that this accentuates how there are “far fewer people who care about decentralized, sovereign, uninflatable currency” than it may seem from the surface, and how little effect 2017’s parabolic run-up had on this community’s size.

In fact, Mahmudov quipped that more than 99% of all humans on Earth, whether poor, rich or from any other socioeconomic background, don’t care about the values that Bitcoin’s raison d’etre exemplifies. And as such, Bitcoin’s popularity boils down to its potential as a speculative asset, rather than libertarian, anarcho-capitalist, or cypherpunk ideologies. And as such, he concluded that this bear market could last longer than many may expect, with BTC potentially even falling to $1,700 apiece.

Chris Burniske, a partner at the blockchain-focused Placeholder Ventures and the co-author of “Cryptoassets,” noted that the mainstream “has almost entirely forgotten about Bitcoin again.” Gone are the days that “Bitcoin” was a popular word at the dinner table, as mainstream media outlets, the CNBC Fast Money segment, in particular, have slowed their coverage to a near-halt. Burniske touched on this, noting that via “conversations with people from home,” the crypto boom is still tangible in their minds, but the subsequent bust wasn’t observed.

But, while there seem to be few active industry participants quipping about Bitcoin on Twitter, some would argue that the cryptocurrency has reached mainstream adoption. Alistair Milne, the chief investment officer of the Digital Currency Fund, recently explained that millions, if not billions across the globe has heard the word “Bitcoin” in some context. And as such, when FOMO kicks in, for both institutions and retail investors alike, buying pressure is likely going to be stronger than ever.

Nick Chong February 5, 2019 in Bitcoin News, Crypto Analysis

David Ogden – Http://markethive.com/david-ogden