Bitcoin Market Analysis: 24th February 2019

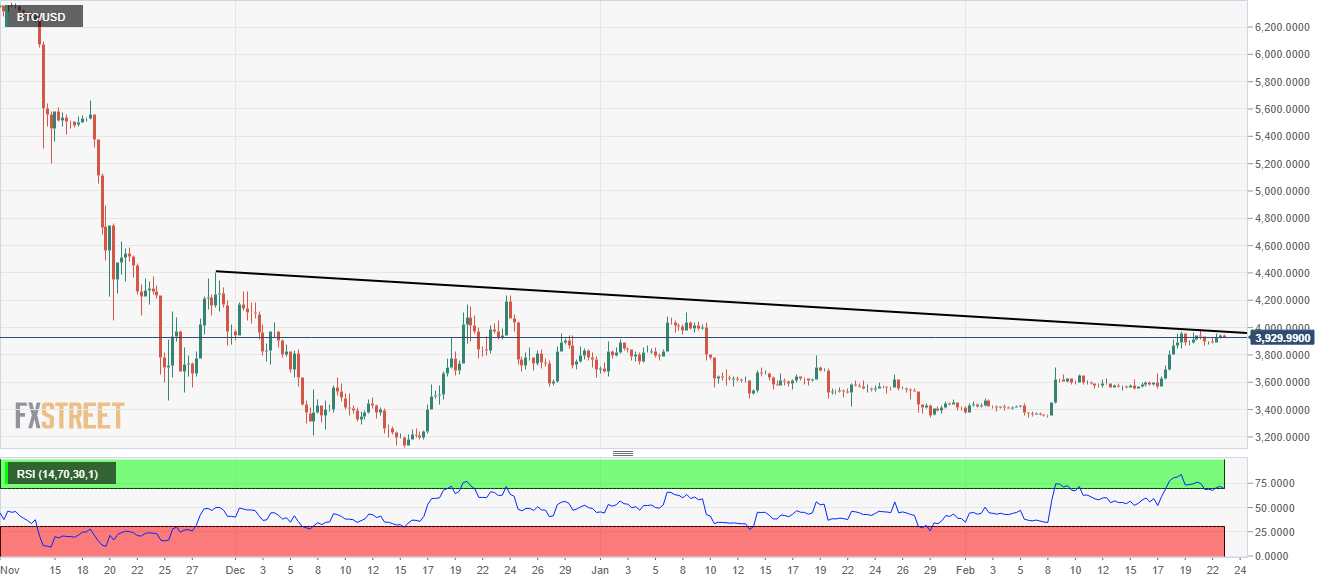

Today’s attempt by buyers to break through the price range of USD 4240-USD 4320 ended with big aggression on the part of sellers.

At hourly time frame, it is clearly visible that buyers did not make any effort to break through this price zone. Only as buyers approached this price zone – the volumes immediately decreased:

Now the price has stopped in the price zone of USD 3850- USD 3920. Looking at the length of the day candle, we think that the fall can continue up to USD 3500. In this case, it will be a final confirmation that the price is traded in the triangle from 15 December 2018. Buyers did not expect such an aggressive fall. However, buyers start to close their marginal positions during the growth:

Interestingly, during the fall, sellers close their positions as well, so they do not believe in the global continuation of the fall:

Therefore, at this moment, we do not expect the market to have a strong trend until the price goes beyond the triangle. The lower limit of the triangle is USD 3500, the upper limit is the price zone of USD 4240-USD 4320.

If we analyse the volumes on which the growth occurred then the local chart shows that they are enlarged. Though, if you do not take into account the consolidation volumes which were before growth and compare them with the volumes when the price was falling, then we can conclude that the volumes are significantly smaller:

If we analyze the structure of the waves, one can observe that each directed wave, up or down, consists of three smaller waves. According to the wave analysis, this only confirms the fact that the corrective wave continues to form ahead of the future impulse:

Therefore, with a high probability, sellers will test USD 3500. And if buyers find the strength to keep this price – the chance to continue the growth will remain high.

An interesting situation with an index of fear/greed. Before today’s fall, its value was 69. This is the highest figure for the whole year, starting from February 2018:

By Peter Posted on 25/02/2019 5 min read

David Ogden – Http://markethive.com/david-ogden