Bitcoin is a rollercoaster ride

hen we started work on this article, we were going to talk about the explosive growth in Bitcoin value. But as we prepared to publish, the cryptocurrency experienced a massive devaluation that could have serious implications for investors.

The highs of cryptocurrency investment

In December 2018, Bitcoin (BTC) reached its lowest point of the year, with each virtual coin worth about $3,200. Over the next sixth months, demand helped to raise values significantly.

By the end of May, BTC breached the $10,000 mark. Four weeks later and coins were worth $12,867. The currency quadrupled in value over the course of a few months, helping to create some seriously rich cryptocurrency investors.

The lows of cryptocurrency investment

Within the span of a few hours today though, everything changed. In the span of one hour, Bitcoin lost $1,000 in value. By the end of the day, BTC was trading below $9,500.

This is not a record low, but around $10 billion was lost from the BTC market in just one day.

The problems with cryptocurrencies

Cryptocurrencies like Bitcoin, Ethereum and Ripple are designed to be free of the control by central banks like the Federal Reserve or the Bank of England. As a result, these virtual currencies are free from the control placed on traditional ‘fiat’ currencies like US Dollars, British Pounds and Euros.

But it is precisely this lack of control that allows the massive swings in value as we have seen recently. Without the normal financial mechanisms used to stabilise currency value fluctuations, Bitcoin can swing wildly. Although unlikely, it is entirely possible that BTC could be worth $25,000 tomorrow, and nothing at all by the end of the week.

Gaming the system?

Without central bank controls and foreign exchange regulators, Bitcoin value is open to manipulation by unscrupulous investors. It is entirely possible that the value of Bitcoin has been artificially inflated, allowing speculators to sell their coins for a massive profit. And once the value crashes, they can buy more BTC, wait for the value to increase, and then sell for another large profit.

For most people, Bitcoin manipulation isn’t a problem because they simply don’t use them. However, many financial experts believe that cryptocurrencies will become more mainstream – Facebook’s Libra coin is sure to gain plenty of attention once it finally launches.

Trading Bitcoin

If you’re interested in trading Bitcoin, you should seek professional guidance from an independent financial adviser. You should also ensure your computer is properly protected by an anti-malware tool to ensure your digital wallet (used to store cryptocurrency) cannot be stolen by cybercriminals. You can download a free Panda Dome trial here.

For everyone else, you can expect to see more headlines about the crazy Bitcoin rollercoaster in the near future.

July 22, 2019

David Ogden – Http://markethive.com/david-ogden

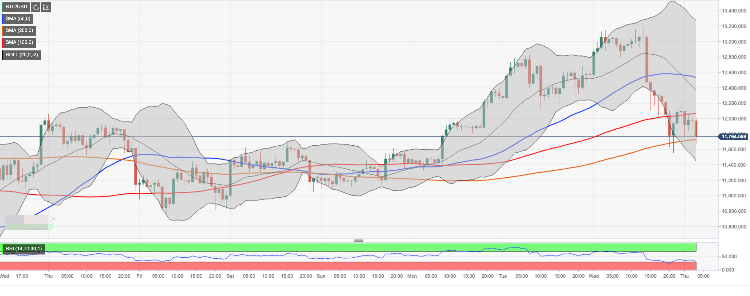

Over the last 30 days, BTC has shown five major price variations. The first variation was a hike of 54.19% and the coin gained 4850 USD between 18th June and 26th June. This hike was followed by a steep fall of 28.96% between 26th June and 02nd July. This fall cost the coin 3999 USD. And over the next one day and 16 hours, the coin again gained 22.41%. The next variation happened over five days from 05th June. This hike added 20.68% to the coin. It was followed by a steep fall of 29.48% between 10th June and 17th June. This fall cost the coin 3853 USD. The Market Cap on 18th June was 162,798,824,411 USD, and the value of each coin was 8951.39 USD. The current market cap and the value of each coin are respectively 6.98% and 9.40% more than the figures for the last month.

Over the last 30 days, BTC has shown five major price variations. The first variation was a hike of 54.19% and the coin gained 4850 USD between 18th June and 26th June. This hike was followed by a steep fall of 28.96% between 26th June and 02nd July. This fall cost the coin 3999 USD. And over the next one day and 16 hours, the coin again gained 22.41%. The next variation happened over five days from 05th June. This hike added 20.68% to the coin. It was followed by a steep fall of 29.48% between 10th June and 17th June. This fall cost the coin 3853 USD. The Market Cap on 18th June was 162,798,824,411 USD, and the value of each coin was 8951.39 USD. The current market cap and the value of each coin are respectively 6.98% and 9.40% more than the figures for the last month.