The Crypto Daily – The Movers and Shakers 24/07/19

The bears eye a 4th day in the red, with sub-$8,000 levels for Bitcoin investors likely to cause some angst for the broader market.

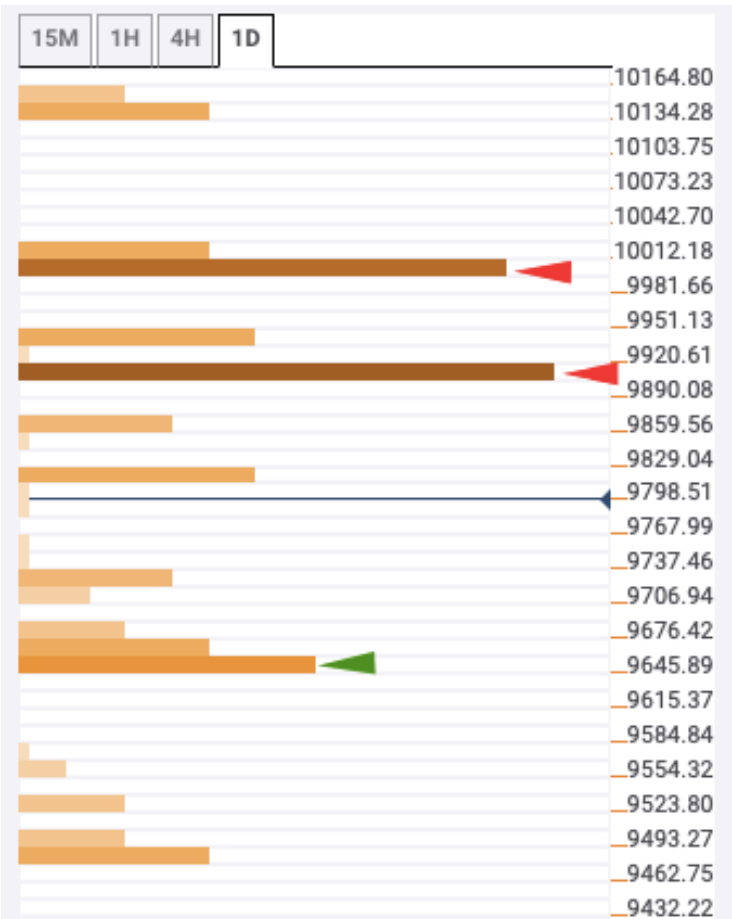

Bitcoin slid by 4.57% on Tuesday. Following on from a 2.29% fall from Monday, Bitcoin ended the day at $9,859.

A particularly bearish morning saw Bitcoin slide from an early intraday high $10,330.9 to an early afternoon intraday low $9,820.

Steering clear of the major resistance levels, Bitcoin fell through the first major support level at $10,188 and second major support level at $10,048.

Holding above the 38.2% FIB of $9,734 and third major support level at $9,657 was the only positive from the session.

Finding support through the afternoon, Bitcoin recovered to $10,200 levels before sliding back to sub-$10,000 levels.

It was Bitcoin’s first sub-$ 10,000-day end since 17th July.

Bitcoin’s market cap slid back from $183bn levels to $173.02bn at the time of writing.

The Rest of the Pack

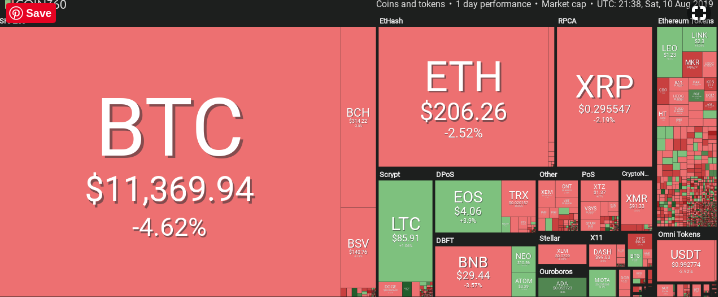

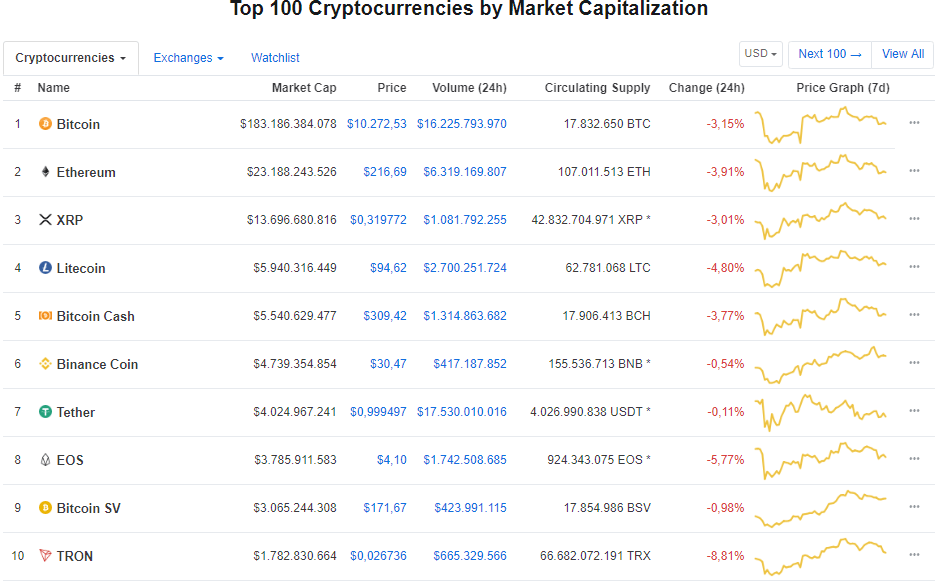

Across the rest of the top 10 cryptos, it was a mixed bag for the majors on the day.

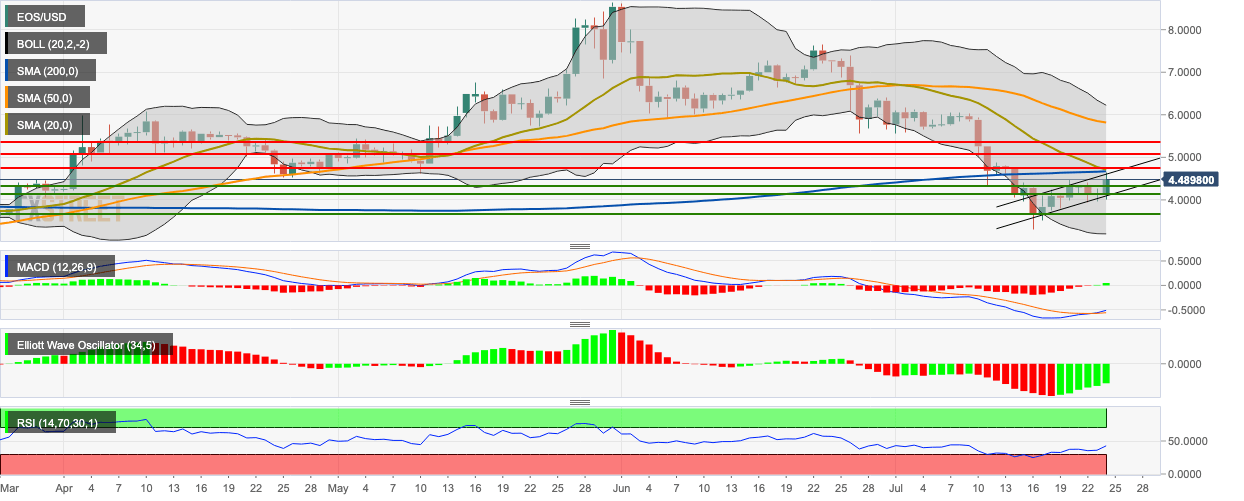

Bucking the trend on the day were Bitcoin Cash SV and EOS. Bitcoin Cash SV rallied by 2%, while EOS rose by 0.91%.

It was red for the rest of the pack, however. Tron’s TRX led the way down on the day, sliding by 8.95%.

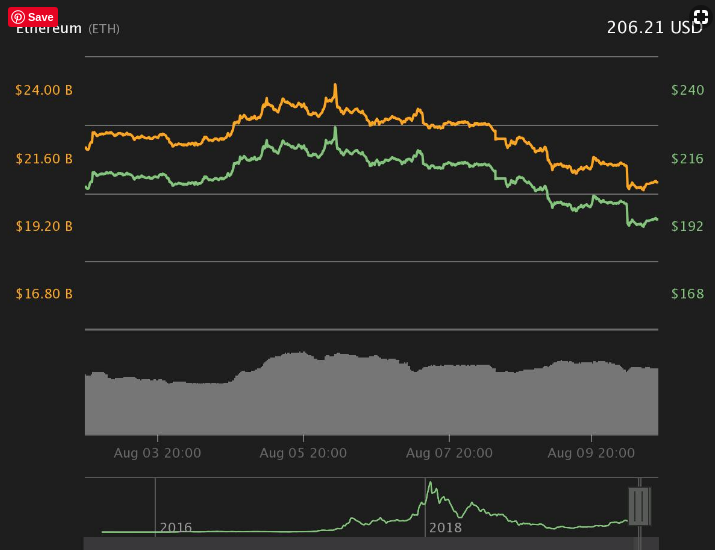

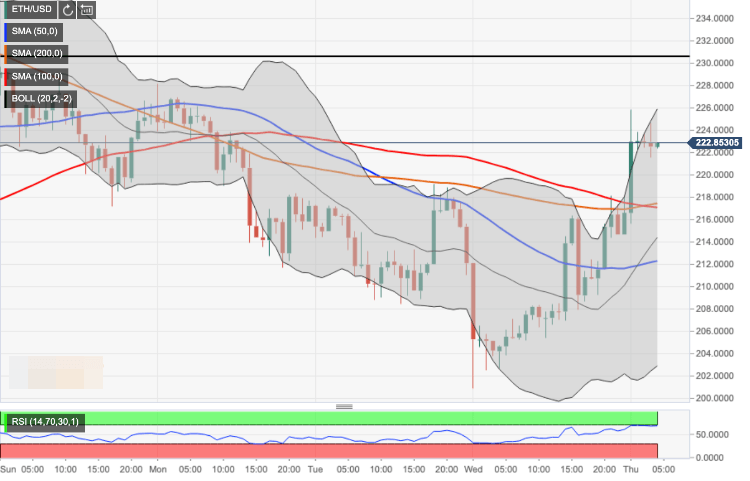

Litecoin (-5.36%) and Binance Coin (-4.51%) also saw heavy losses on the day. It was a somewhat better story for Ethereum, which fell by 2.39%.

Bitcoin’s dominance eased back to 64% levels before recovering to 65% levels. Bearish sentiment across the broader market outweighed the effects of Bitcoin’s losses over the course of the last day.

On the day, the total crypto market cap slide from $281.9bn levels to $265.97bn at the time of writing

This Morning,

At the time of writing, Bitcoin was down by 1.94% to $9,667.3. A particularly bearish start to the day saw Bitcoin fall from a morning high $9,861.7 to a low $9,612.7

The early sell-off saw Bitcoin fall through the 38.2% FIB of $9,734 and first major support level at $9,675.70.

Bitcoin left the major resistance levels untested.

Elsewhere, Bitcoin Cash ABC (-4.02), Binance Coin (-4%), and Bitcoin Cash SV (-4.69%) also saw heavy losses.

The rest of the pack weren’t far behind, in the early part of this morning. Ethereum also struggled, down 3.77% at the time of writing.

For the Day Ahead

A move back through the 38.2% FIB of $9,734 would bring $10,000 levels back into play. Bitcoin would need the support of the broader market, however, to break out from the 38.2% FIB.

In the event of a broad-based crypto rebound, a move back through to $10,000 would bring the first major resistance level at $10,186.6 into play.

We would expect Bitcoin to fall well short Tuesday’s high $10,330.9, however.

Failure to move back through the 38.2% FIB of $9,734 could see Bitcoin fall deeper into the red. A fall through to $9,500 levels would bring the second major support level at $9,492.4 in play.

Barring an extended crypto sell-off through the day, the second major support level should limit any downside on the day.

Bob Mason

Jul 24, 2019 04:04 AM GMT

David Ogden – Http://markethive.com/david-ogden