Bitcoin {BTC} breaches the 10.5k mark – Switzerland and U.S. politicians meet following release of LIBRA

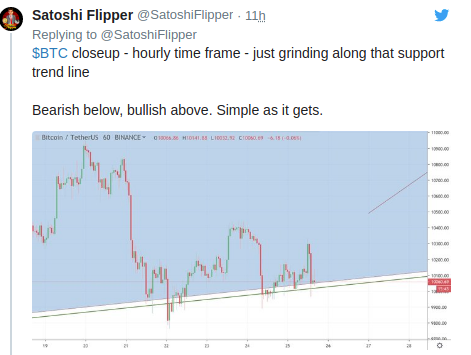

After bears had brought BTC all the way down to $10,000 a trend reversal occurred. This had helped Bitcoin rally along with the majority of the altcoins. Once again, Bitcoin proved its worth over Gold [in spite of the latter facing much less volatility], which indicates that Peter Schiff along with the rest of the “Gold Barons” is wrong.

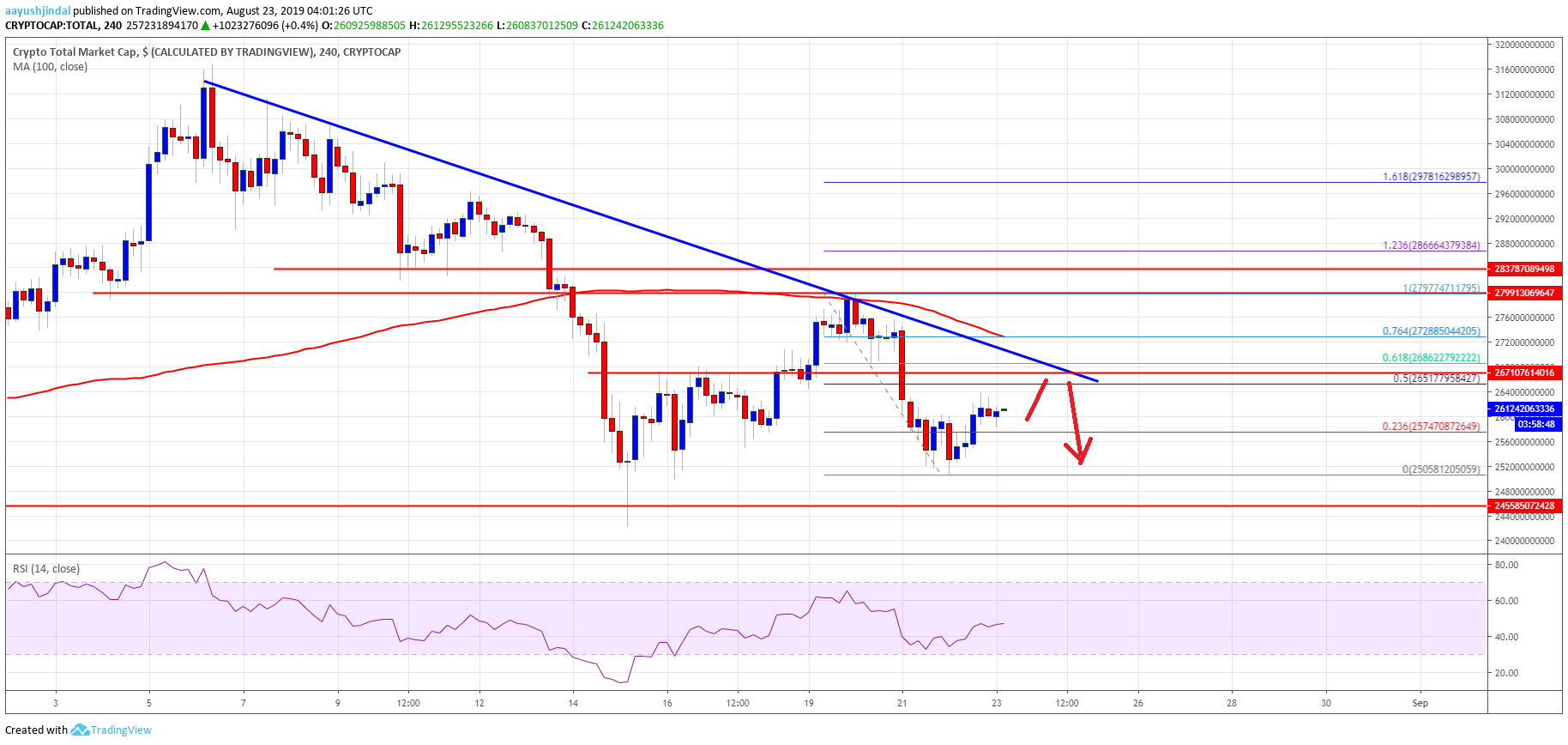

However, BTC has a long way to go, as the market capitalization is nowhere near that of the precious metal. Although, the latter has generally reacted to events transpiring around the world in a gradual manner.

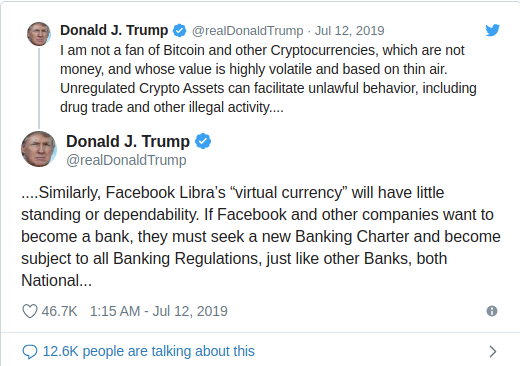

The lawmakers hailing from the United States had conducted an interactive session with authorities in Switzerland. It seems that the Trump administration is still unsure with regards to the LIBRA project of Facebook.

Maxine Waters, a representative of America, expressed her dismay at a “privately controlled” global currency. Well, the Dollar is manipulated by powerful entities associated with numerous financial bodies in the U.S.A. So her point on the centralization of LIBRA is moot. Because banks have been responsible for economic dilemmas for ages.

While the mainstream community of crypto-enthusiasts is yet to be optimistic about the latest venture of Facebook, David Marcus of Calibra [previously PayPal] has said that LIBRA intends to abide by all regulations in place. Let’s hope that we don’t come across a “Cambridge Analytica data scandal” type of situation this time.

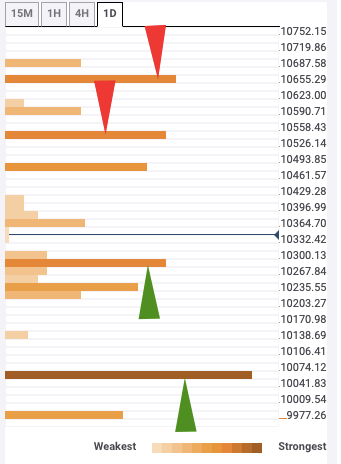

Bitcoin is the top-ranked digital currency in the market. The eleven-year-old king coin rose at a rate of 2.82% in the course of the past 24-hours. The trading volume recorded is $17.132 billion, while the supply has 17,897,337 BTC coins in play. At present, the total market cap of Bitcoin is $186.279 billion. As of this moment, BTC is priced at $10,408.22

BY ADITYA CHATTERJEE ON AUGUST 26, 2019

David Ogden – Http://markethive.com/david-ogden