Markets Hit Six Week High as Altcoin Rally Adds Another $10 Billion

Yesterday’s crypto market rally has continued for a second day adding a further $10 billion to total market capitalization.

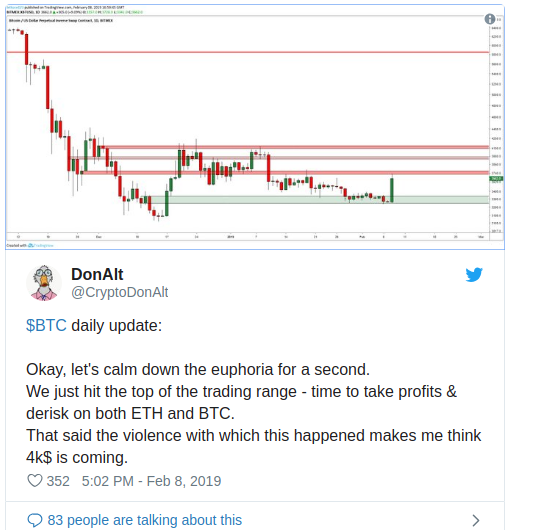

The push has driven markets over $134 billion which is the highest they have been since the big dump on January 10, almost six weeks ago. Around ten days ago crypto markets were depressed at $111 billion, since then they have recovered around 20% to current levels. The big question is can this rally turn into a longer term uptrend or is another mega dump imminent.

Ethereum initiated the run yesterday when it pumped 12%, outperforming most of the top altcoins, and Bitcoin itself. Today’s big performer is EOS which has jumped 24% to $3.60 at the time of writing. EOS hit a high of $3.79 a few hours ago which is its best price since late-November’s big market purge. Daily volume has surged to over $2.3 billion pushing EOS market cap to $3.25 billion taking fourth place back from Litecoin. There does not appear to be anything specific driving EOS at the moment aside from fear of missing out (fomo) so a pullback is expected.

Bitcoin Cash has had another solid day’s performance as it gains 13% taking it to $147, chasing down LTC just above it with a climb of 7% to $47.50. Ethereum has also made a further 7% on the day taking its price up to $147 and pushing it over $2 billion clear of XRP in terms of market cap.

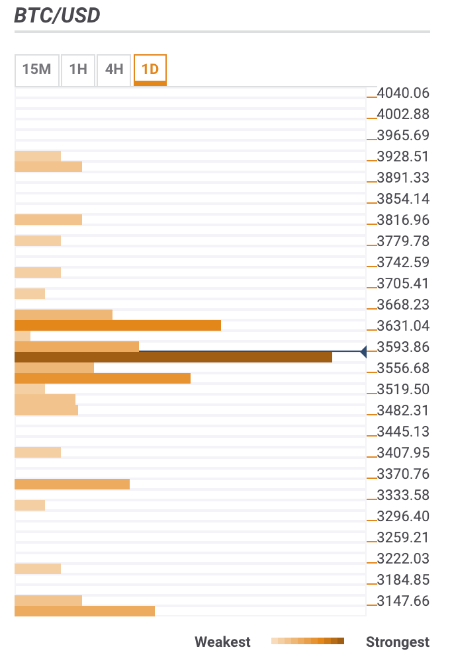

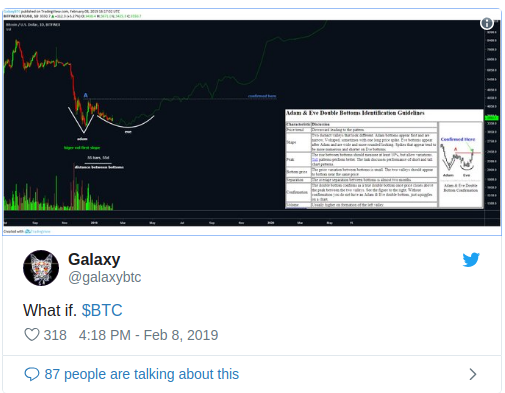

Bitcoin is approaching heavy resistance at $4,000 but it is still climbing at the moment with a 5% gain on the day to a high of $3,970 a few hours ago. BTC has since pulled back to $3,920 where it is holding for now.

Other top performers are altcoins which have been hit the hardest in recent weeks namely Cardano, IOTA, Dash, and Ethereum Classic, all climbing 6 to 8 percent on the day. At the moment it is the altcoins which are enjoying the biggest gains over the past 48 hours. Some analysts have predicted the beginning of the “altseason” by looking at total market cap for them without Bitcoin. It has just broken the yearlong trend line and Bitcoin dominance is falling back towards 50%.

At the moment things are looking positive for the majority of altcoins and for once Bitcoin is playing catch-up. It is a pattern repeated countless times though and big brother BTC will have its day sooner or later.

Luke Thompson February 19, 2019

David Ogden – Http://markethive.com/david-ogden