Bitcoin Passes $5,500 – Facebook Plans Crypto Payment Service

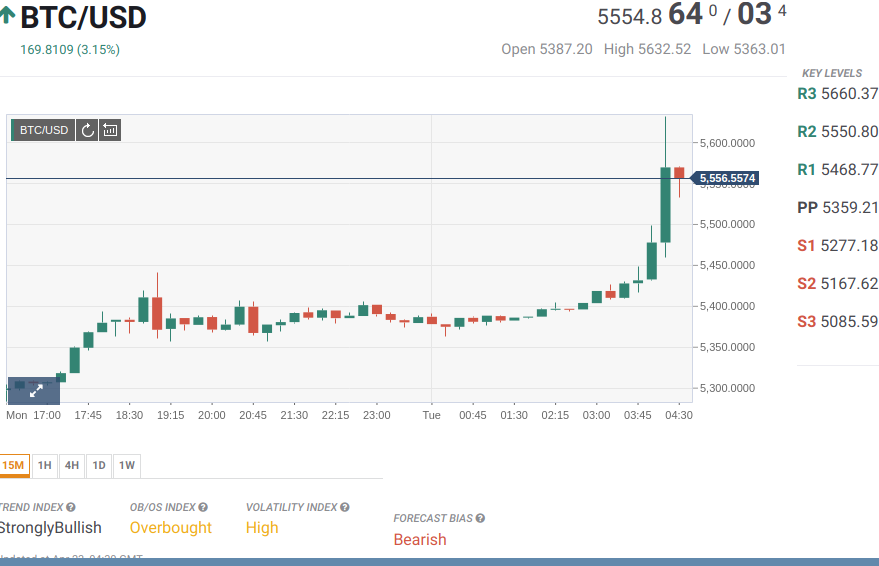

Investing.com – Top cryptocurrencies gained momentum on Friday morning in Asia, with Bitcoin spiking above the key level $5,500. Social media giant Facebook (NASDAQ:FB) is reportedly seeking partners for its planned crypto payment service.

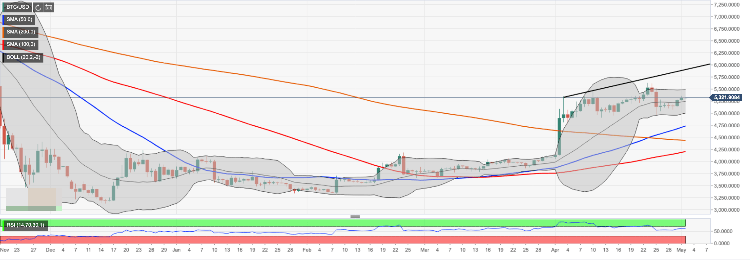

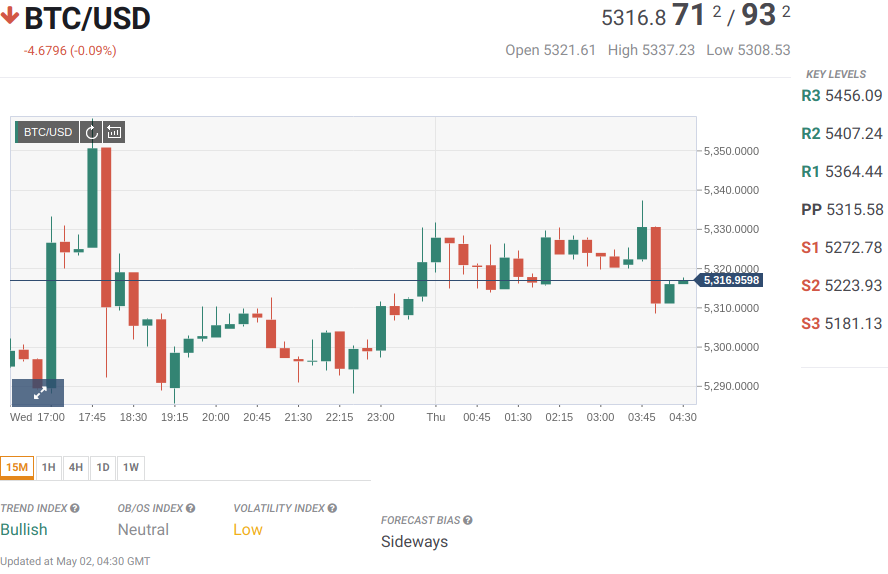

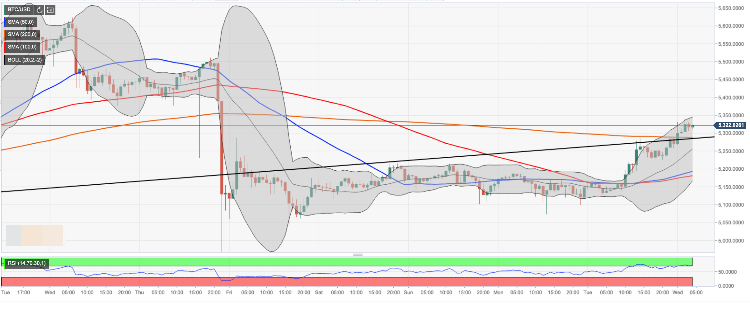

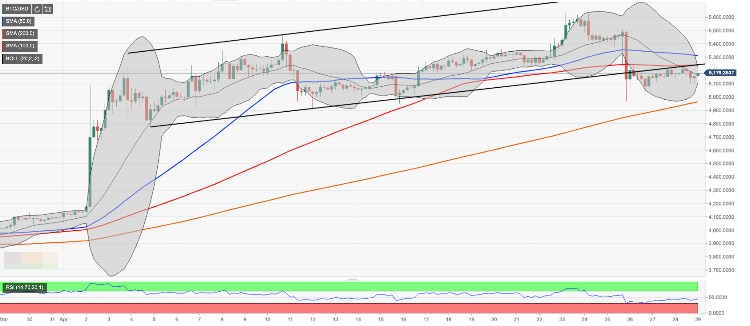

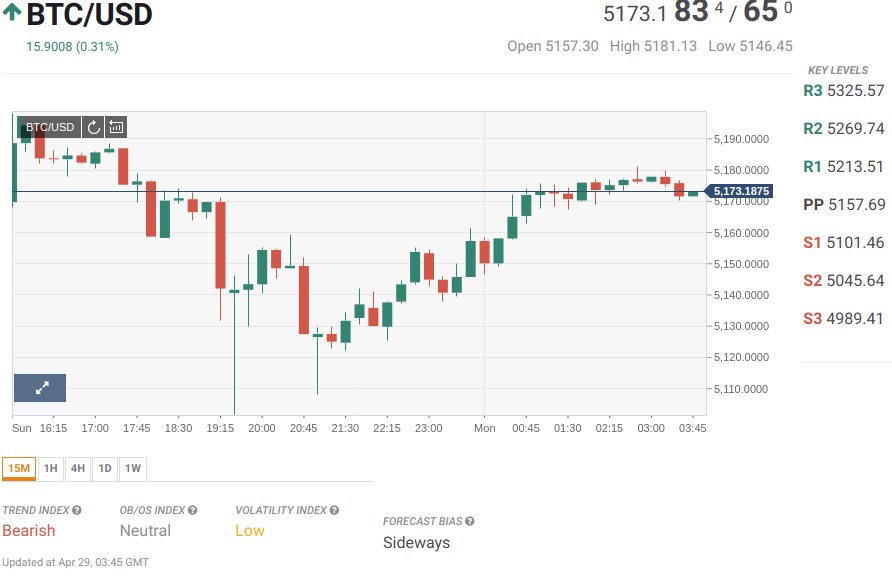

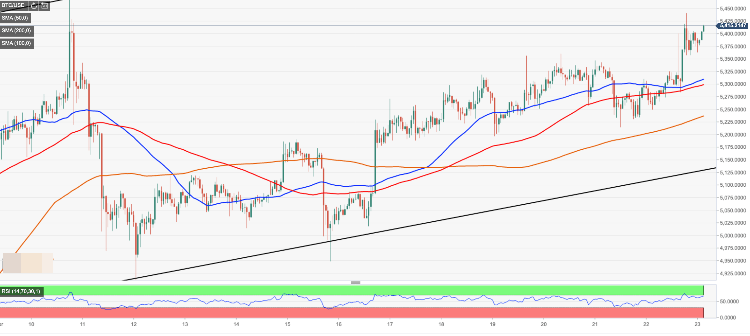

Bitcoin gained 6.08% to $5,581.5 by 11:46 PM ET (03:46 GMT), reaching a one-week high. The digital token climbed back to the $5,500 level after losing its grip on it on April 24.

Ethereum added 3.32% to $160.38, XRP edged up 0.18% to $0.30446, and Litecoin rose 7.23% to $74.698.

The total market cap rose further to $179.6 billion from $175 million the day before.

The biggest news in the crypto community today concerned Facebook and its crypto payment service that is under development.

The Wall Street Journal reported that the social media giant is discussing with financial firms and e-commerce companies such as Visa (NYSE:V) and MasterCard to support the payment service known internally as Project Libra.

The project involves launching a digital token that would be underpinned by blockchain technology and pegged to the U.S. dollar. A possible way to promote its adoption is that Facebook users can gain fractions of the token by looking at advertisements. Users of Facebook’s messaging app WhatsApp can also use this digital token to send money to one another.

“Payments and commerce are Facebook’s only way out from its freemium, advertisement business model,” said Henry Liu, a former Facebook employee.

Separately, independent nonprofit institute The Information Technology & Innovation Foundation (ITIF) gave suggestions on how to regulate blockchain technology, which drew some attention among the crypto investors.

ITIF urged the policymakers to uphold principles such as technology neutrality and public-sector adoption. It also encouraged the regulators to support legitimate blockchain innovation and adoption without setting rules that could limit blockchain-based applications.

David Ogden – Http://markethive.com/david-ogden