Bitcoin Climbs Above 9,231.6 Level, Up 0.86%

Investing.com – Bitcoin rose above the $9,231.6 threshold on Tuesday. Bitcoin was trading at 9,231.6 by 00:54 (04:54 GMT) on the Investing.com Index, up 0.86% on the day. It was the largest one-day percentage gain since June 17.

The move upwards pushed Bitcoin's market cap up to $164.6B, or 57.12% of the total cryptocurrency market cap. At its highest, Bitcoin's market cap was $241.2B.

Bitcoin had traded in a range of $9,199.2 to $9,336.1 in the previous twenty-four hours.

Over the past seven days, Bitcoin has seen a rise in value, as it gained 16.39%. The volume of Bitcoin traded in the twenty-four hours to time of writing was $15.3B or 29.04% of the total volume of all cryptocurrencies. It has traded in a range of $7,805.7661 to $9,438.1270 in the past 7 days.

At its current price, Bitcoin is still down 53.54% from its all-time high of $19,870.62 set on December 17, 2017.

Elsewhere in cryptocurrency trading

Ethereum was last at $270.01 on the Investing.com Index, up 0.81% on the day.

XRP was trading at $0.44702 on the Investing.com Index, a gain of 3.81%.

Ethereum's market cap was last at $28.9B or 10.04% of the total cryptocurrency market cap, while XRP's market cap totaled $19.2B or 6.65% of the total cryptocurrency market value.

Prices of the major cryptocurrency were mostly higher on Tuesday in Asia, with Bitcoin hovered above the key $9,000 level on Facebook’s reported move into cryptocurrency.

Bitcoin rose 2.1% to $9,267.4 by 11:30 PM ET (03:30 GMT). Ethereum gained 0.7% to $270.23. XRP jumped 4.3% to 0.44642, but Litecoin underperformed and lost 1.5% to $133.058.

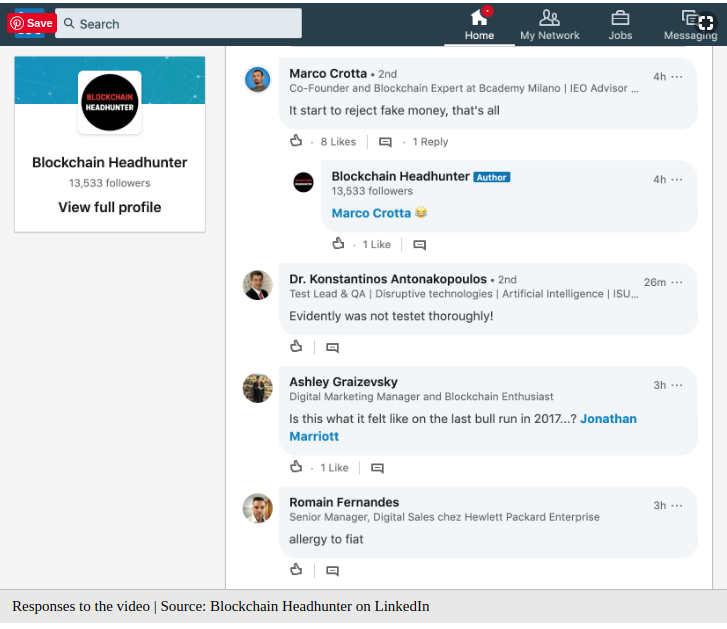

Facebook (NASDAQ:FB) is reportedly launching a new digital asset to be used as a peer-to-peer payment within messenger apps. Bitcoin surged immediately following the news, as some analysts said the news could be the biggest boost for virtual coins in history.

Cryptocurrency News10 minutes ago (Jun 18, 2019 12:54AM ET)

David Ogden – Http://markethive.com/david-ogden