The Crypto Week – Bitcoin Leads the Way as Volatility Grips the Majors

Bitcoin is on the move early but will need the support of the broader market to take a run at $13,000 levels…

While the Bitcoin bulls maintained control, it has been a mixed week for the rest of the pack.

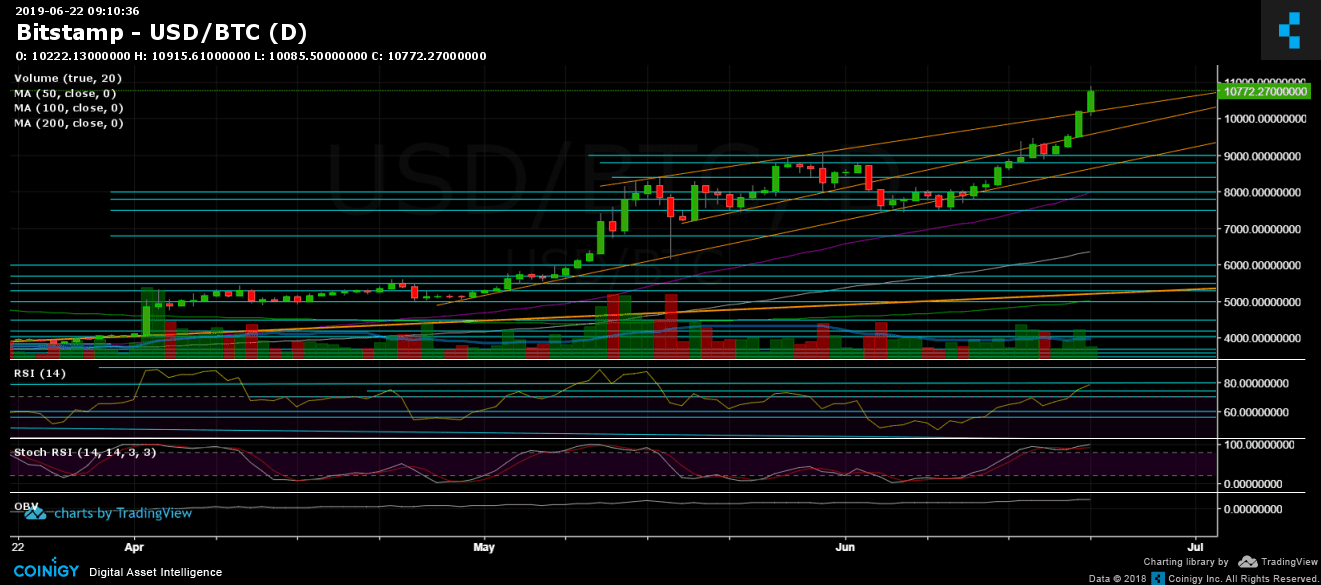

Bitcoin fell by 3.38% on Saturday. Partially reversing a 10.18% rally from Friday, Bitcoin ended the day at $11,920.

A bearish start to the day saw Bitcoin slide from an intraday high $12,338 to an early morning intraday low $11,354.

Bitcoin steered clear of the first major support level at $11,285.67 and the 23.6% FIB of $11,275 before finding support.

Recovering through the remainder of the day, Bitcoin moved back through to $12,000 levels before a late pullback.

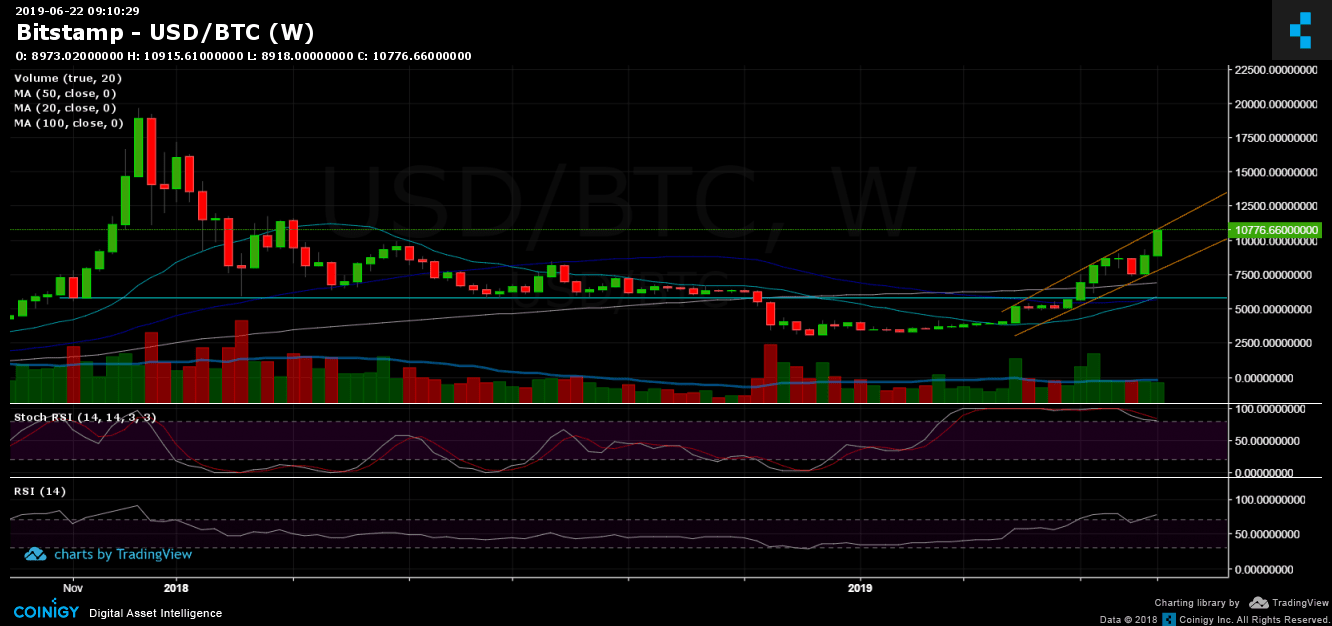

For the current week, Bitcoin was up by 9.3%, which came off the back of 4 days in the green out of the last 6.

The Rest of the Pack

Across the rest of the top 10 cryptos, it was a bullish start to the weekend, leaving Bitcoin to buck the trend on the day.

Across the rest of the majors, Litecoin led the way, rallying by 11.6% to reverse most of a Thursday 12.6% sell-off.

Stellar’s Lumen (+3.87%), EOS (+2.59%), and Ethereum (+2.46%) saw solid gains on the day.

For the current week, Bitcoin led the way with its 9.3% rally, Monday through Saturday.

Stellar’s Lumen and Ethereum were also in the green for the current week, with gains of 8% and 3.3% respectively.

The rest of the pack were in the red, however, with a broad-based crypto sell-off doing the damage on Thursday.

Leading the way down was EOS, which tumbled by 13%. Bitcoin Cash SV and Ripple’s XRP also saw heavy losses, with declines of 10.2% and 9.4% respectively.

Bitcoin Cash ABC (-6.34%), Binance Coin (-4.35%) and Litecoin (-2.52%) saw more modest losses on the week.

A choppy week saw the total crypto market cap rise from $324bn to a Thursday high $386.6bn before easing back. At the time of writing, the total crypto market cap stood at $344.83bn.

24-hour trading volumes were also on the up, rising from $70.7bn levels to hit $140bn levels on Thursday. At the time of writing, 24-hour trading volumes stood at $88.43bn.

This Morning

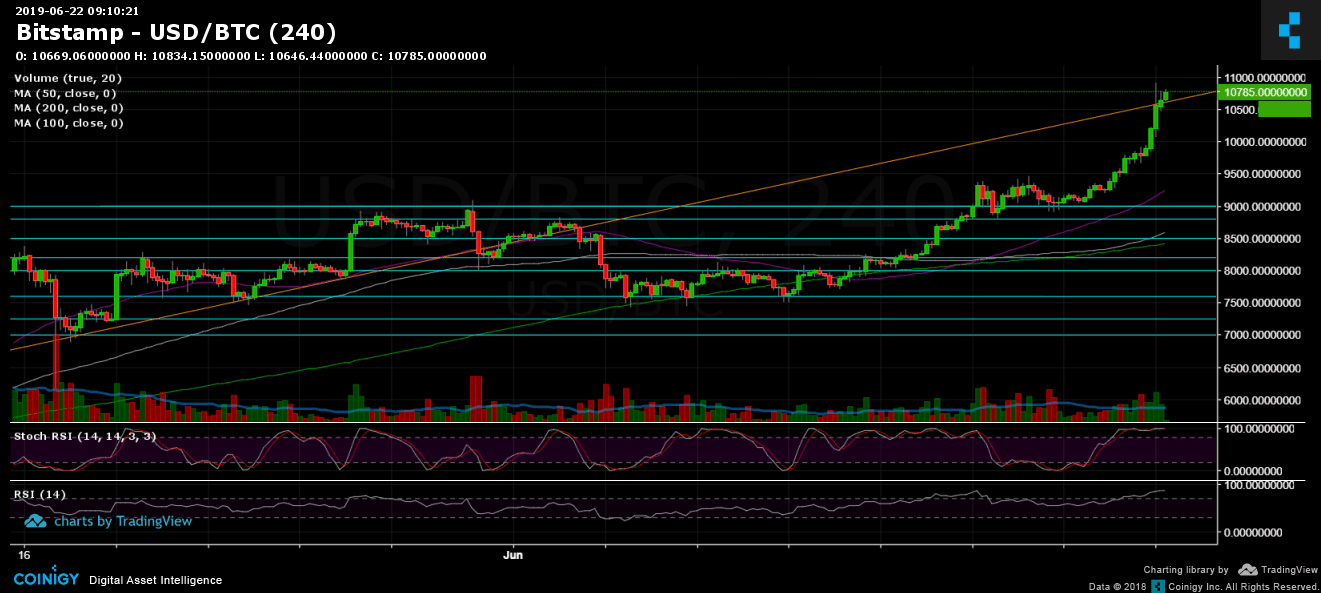

At the time of writing, Bitcoin was up by 1.88% to $12,144.0.

A bullish start to the day saw Bitcoin rise from a morning low $11,920 to a high $12,193 before easing back.

Bitcoin left the major support and resistance levels untested early on.

Across the rest of the majors, it was a mixed start to the day. Ethereum (+0.71%), EOS (+0.22%), Ripple’s XRP (+0.22%) and Bitcoin Cash ABC (+0.66%) were in positive territory.

On the slide, however, were Stellar’s Lumen (-1.2%), Litecoin (-0.98%), and Binance Coin (-1.64%).

Bitcoin Cash SV was flat with just a 0.05% loss at the time of writing.

For the Day Ahead

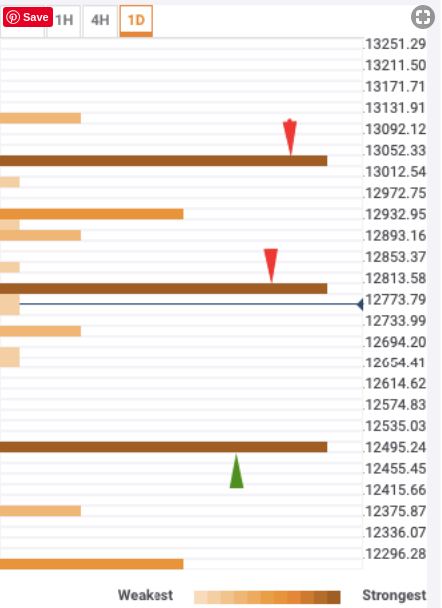

Bitcoin would need to hold onto $12,000 levels through the morning to support another run at the first major resistance level at $12,390.33.

An early move through the morning high $12,193 to $12,200 levels would signal the start of a more material rally on the day.

Bitcoin would need the support of the broader market for a break out from the first major resistance level. Barring a broad-based crypto rally, Bitcoin will likely come up short of the second major resistance level at $12,860.67.

Failure to hold onto $12,000 levels could see Bitcoin hit reverse. A fall through to $11,850 levels would bring the first major support level at $11,397.33 into play.

Barring a broad-based crypto sell-off, Bitcoin should steer clear of sub-$11,000 support levels on the day.

Bob Mason

Jun 30, 2019 3:32 AM GMT

David Ogden – Http://markethive.com/david-ogden