The Crypto Daily – The Movers and Shakers 24/07/19

The bears eye a 4th day in the red, with sub-$8,000 levels for Bitcoin investors likely to cause some angst for the broader market.

Bitcoin slid by 4.57% on Tuesday. Following on from a 2.29% fall from Monday, Bitcoin ended the day at $9,859.

A particularly bearish morning saw Bitcoin slide from an early intraday high $10,330.9 to an early afternoon intraday low $9,820.

Steering clear of the major resistance levels, Bitcoin fell through the first major support level at $10,188 and second major support level at $10,048.

Holding above the 38.2% FIB of $9,734 and third major support level at $9,657 was the only positive from the session.

Finding support through the afternoon, Bitcoin recovered to $10,200 levels before sliding back to sub-$10,000 levels.

It was Bitcoin’s first sub-$ 10,000-day end since 17th July.

Bitcoin’s market cap slid back from $183bn levels to $173.02bn at the time of writing.

The Rest of the Pack

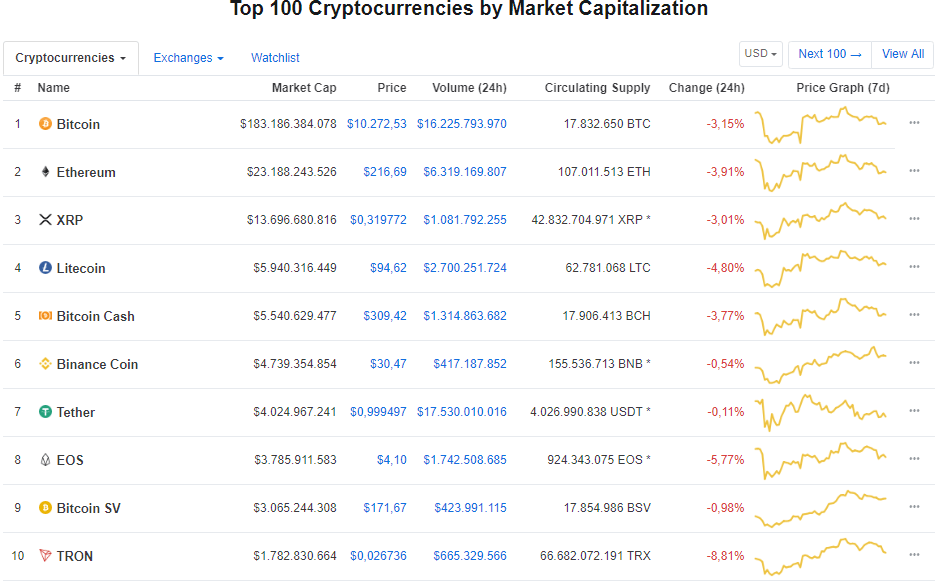

Across the rest of the top 10 cryptos, it was a mixed bag for the majors on the day.

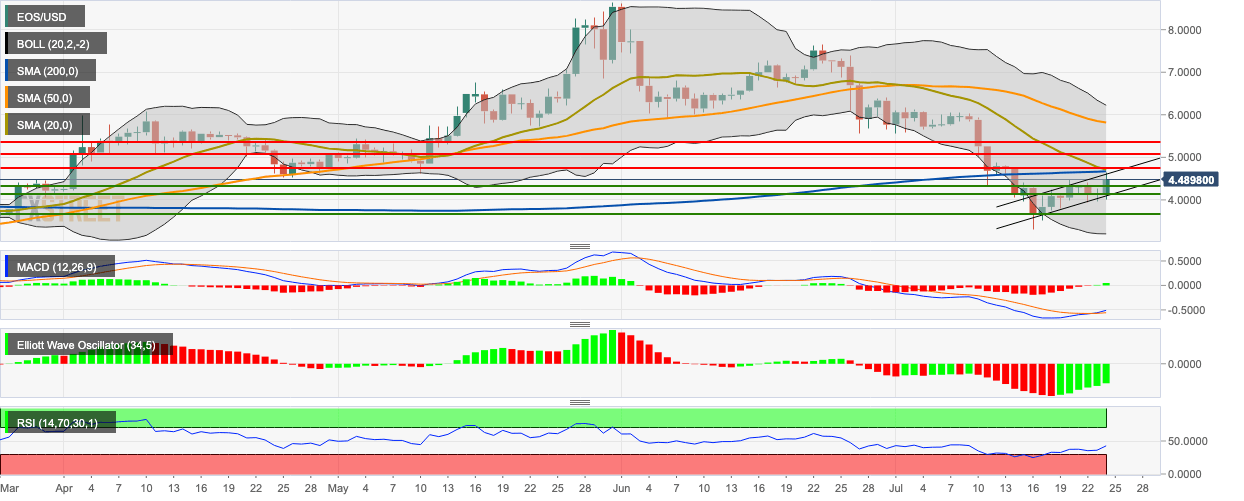

Bucking the trend on the day were Bitcoin Cash SV and EOS. Bitcoin Cash SV rallied by 2%, while EOS rose by 0.91%.

It was red for the rest of the pack, however. Tron’s TRX led the way down on the day, sliding by 8.95%.

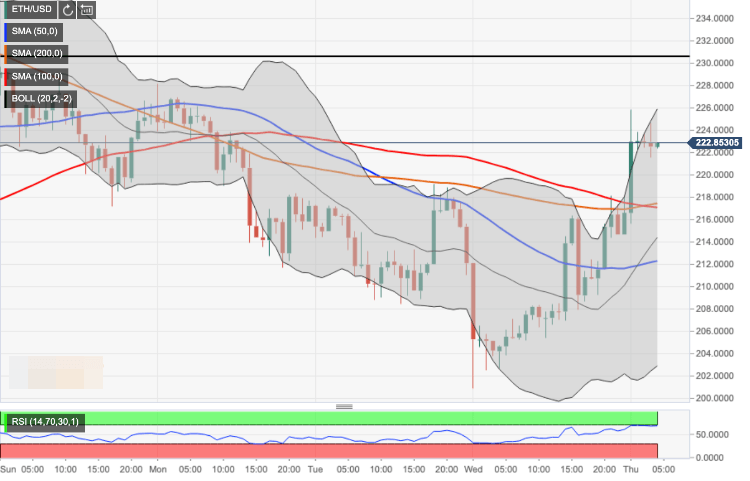

Litecoin (-5.36%) and Binance Coin (-4.51%) also saw heavy losses on the day. It was a somewhat better story for Ethereum, which fell by 2.39%.

Bitcoin’s dominance eased back to 64% levels before recovering to 65% levels. Bearish sentiment across the broader market outweighed the effects of Bitcoin’s losses over the course of the last day.

On the day, the total crypto market cap slide from $281.9bn levels to $265.97bn at the time of writing

This Morning,

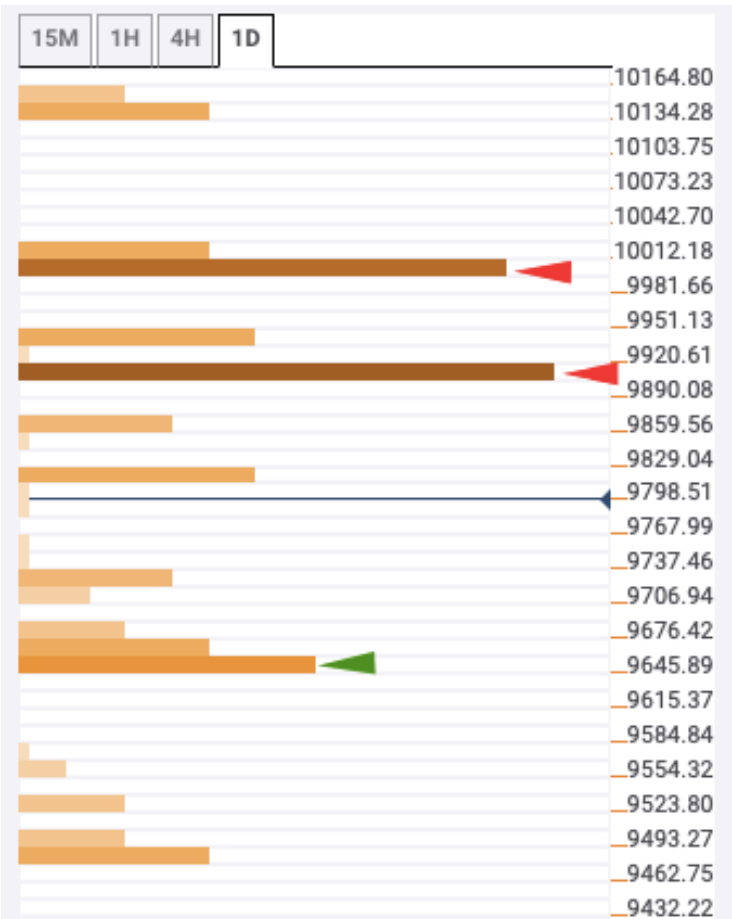

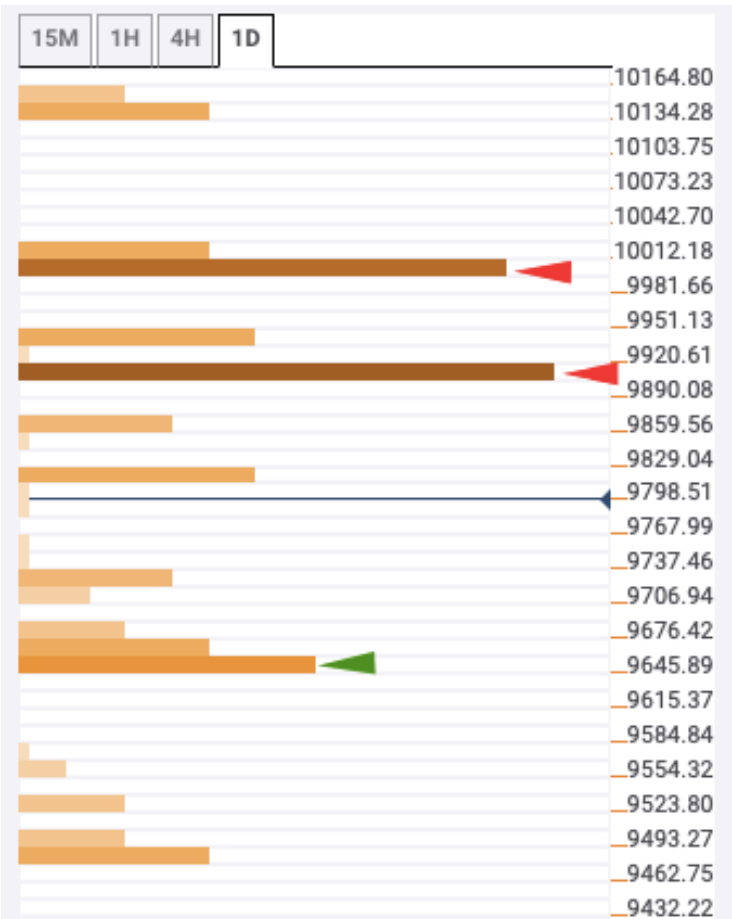

At the time of writing, Bitcoin was down by 1.94% to $9,667.3. A particularly bearish start to the day saw Bitcoin fall from a morning high $9,861.7 to a low $9,612.7

The early sell-off saw Bitcoin fall through the 38.2% FIB of $9,734 and first major support level at $9,675.70.

Bitcoin left the major resistance levels untested.

Elsewhere, Bitcoin Cash ABC (-4.02), Binance Coin (-4%), and Bitcoin Cash SV (-4.69%) also saw heavy losses.

The rest of the pack weren’t far behind, in the early part of this morning. Ethereum also struggled, down 3.77% at the time of writing.

For the Day Ahead

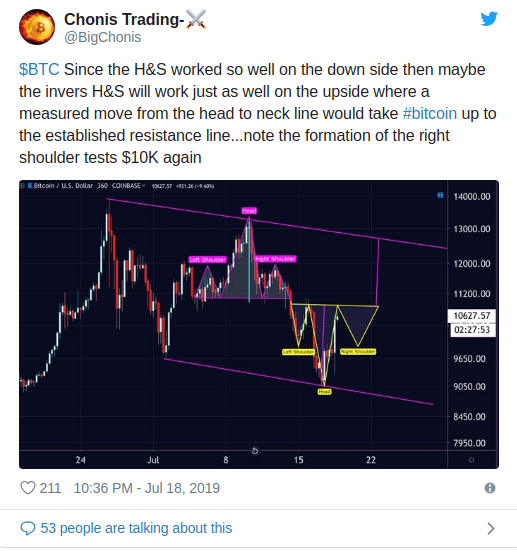

A move back through the 38.2% FIB of $9,734 would bring $10,000 levels back into play. Bitcoin would need the support of the broader market, however, to break out from the 38.2% FIB.

In the event of a broad-based crypto rebound, a move back through to $10,000 would bring the first major resistance level at $10,186.6 into play.

We would expect Bitcoin to fall well short Tuesday’s high $10,330.9, however.

Failure to move back through the 38.2% FIB of $9,734 could see Bitcoin fall deeper into the red. A fall through to $9,500 levels would bring the second major support level at $9,492.4 in play.

Barring an extended crypto sell-off through the day, the second major support level should limit any downside on the day.

Bob Mason

Jul 24, 2019 04:04 AM GMT

David Ogden – Http://markethive.com/david-ogden

Over the last 30 days, BTC has shown five major price variations. The first variation was a hike of 54.19% and the coin gained 4850 USD between 18th June and 26th June. This hike was followed by a steep fall of 28.96% between 26th June and 02nd July. This fall cost the coin 3999 USD. And over the next one day and 16 hours, the coin again gained 22.41%. The next variation happened over five days from 05th June. This hike added 20.68% to the coin. It was followed by a steep fall of 29.48% between 10th June and 17th June. This fall cost the coin 3853 USD. The Market Cap on 18th June was 162,798,824,411 USD, and the value of each coin was 8951.39 USD. The current market cap and the value of each coin are respectively 6.98% and 9.40% more than the figures for the last month.

Over the last 30 days, BTC has shown five major price variations. The first variation was a hike of 54.19% and the coin gained 4850 USD between 18th June and 26th June. This hike was followed by a steep fall of 28.96% between 26th June and 02nd July. This fall cost the coin 3999 USD. And over the next one day and 16 hours, the coin again gained 22.41%. The next variation happened over five days from 05th June. This hike added 20.68% to the coin. It was followed by a steep fall of 29.48% between 10th June and 17th June. This fall cost the coin 3853 USD. The Market Cap on 18th June was 162,798,824,411 USD, and the value of each coin was 8951.39 USD. The current market cap and the value of each coin are respectively 6.98% and 9.40% more than the figures for the last month.