Bitcoin buyers should be prepared to lose all their money, top UK regulator warns

-

Andrew Bailey, chief executive of the Financial Conduct Authority, told BBC's "Newsnight" on Thursday, "If you want to invest in bitcoin, be prepared to lose all your money"

-

Bitcoin's meteoric price rise has stunned critics and enthusiasts alike, leaving investors scrambling to understand the driving factors for the digital currency's runaway rally

-

Bitcoin traded at $17,159 on Friday morning, according to CoinDesk's bitcoin price index

Bitcoin buyers have been issued a "serious warning" from one of Britain's leading financial regulators.

Andrew Bailey, chief executive of the Financial Conduct Authority (FCA), told BBC's "Newsnight" on Thursday, "If you want to invest in bitcoin, be prepared to lose all your money."

Bailey said a lack of backing from governments and central banks for the world's most popular digital currency was evidence that putting money into bictoin was not a secure investment. He also said buying bitcoin was akin to gambling because it had the same level of risk.

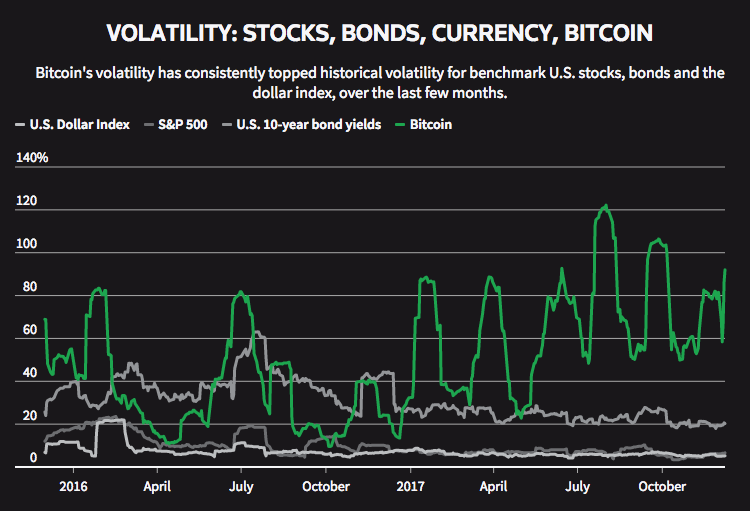

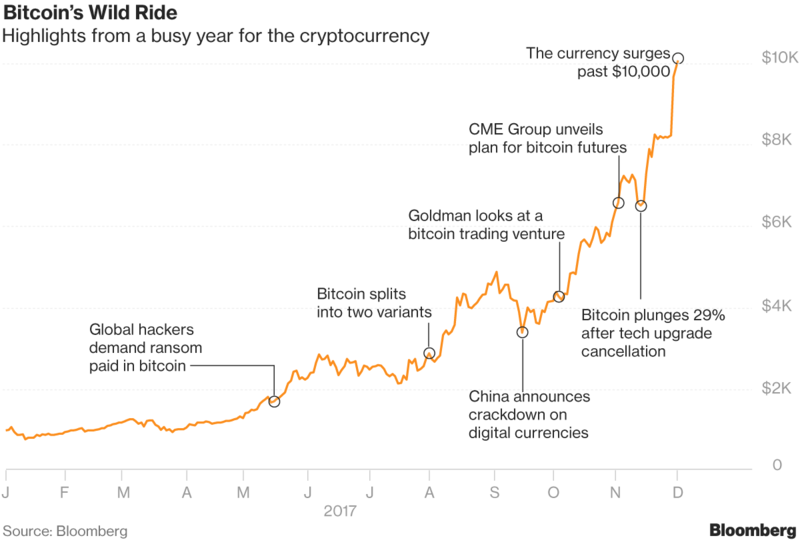

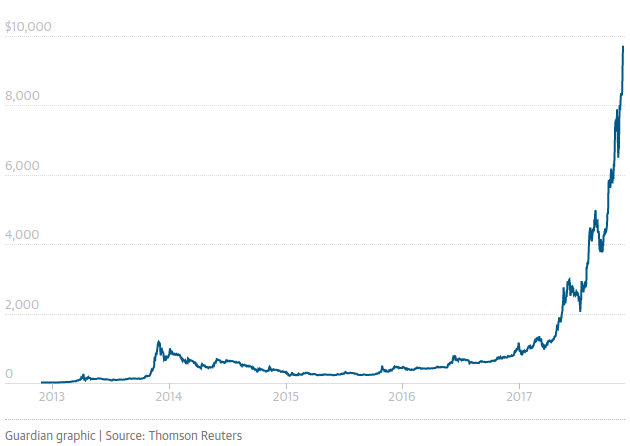

Bitcoin's meteoric price rise has stunned critics and enthusiasts alike, leaving investors scrambling to understand the driving factors for the digital currency's runaway rally.

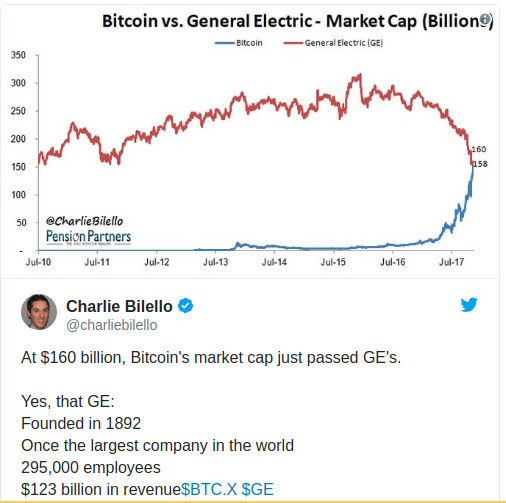

Bitcoin traded at $17,159 on Friday morning, according to CoinDesk's bitcoin price index. The digital currency has a market value of approximately $291 billion — the largest among the cryptocurrencies. A year ago, one bitcoin was worth around $780.

"If you look at what has happened this year, I would caution people … We know relatively little about what informs the price of bitcoin," Bailey told the BBC.

Bitcoin's staying power

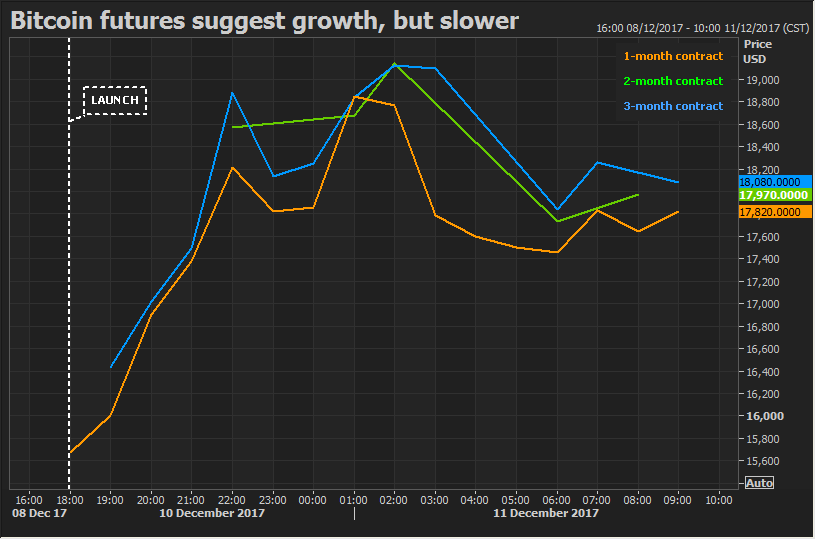

Soaring interest from institutional and retail investors has prompted global exchanges, such as the Cboe, to launch futures contracts. Meantime, CME Group is poised to a launch bitcoin futures contract on Sunday and a German stock exchange operator is reportedly considering whether to follow suit.

The launch of bitcoin futures contracts represents a significant step in the legitimization of cryptocurrencies, according to some market participants. Futures are derivatives, or financial instruments, that obligate a trader to either buy or sell an asset at a specified time and at a specified price.

Bitcoin bulls have frequently referenced the cryptocurrency's scarcity value as a primary reason for its staying power. Somewhat like gold, bitcoin supply grows at glacial and ever-decreasing fixed rates with only 21 million bitcoins set to be in existence.

But while the trading of bitcoin futures on two of the world's largest exchanges is expected to provide a layer of official oversight that had not previously existed, several leading voices have expressed skepticism.

JPMorgan Chase CEO Jamie Dimon called bitcoin a "fraud" that would eventually blow up, while billionaire investor Warren Buffett urged traders to "stay away from it," calling the rally a "mirage."

Author Sam Meredith – Digital Reporter, CNBC.com

Posted by David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden