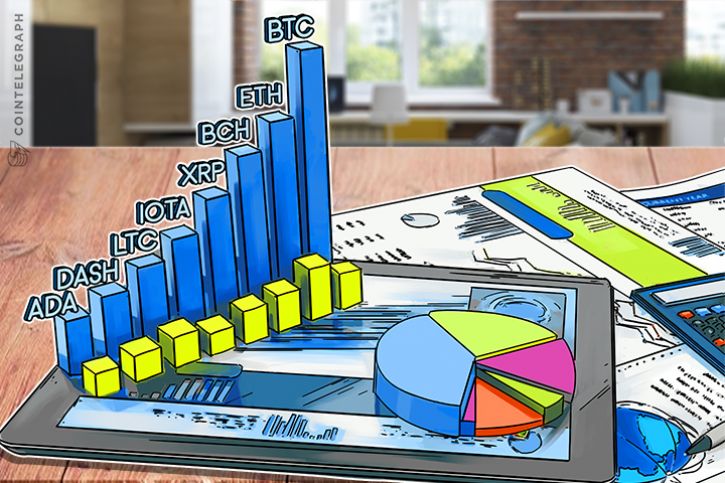

Bitcoin, Ethereum, Bitcoin Cash, Ripple, IOTA, Litecoin, NEM, Cardano – Price Analysis, Jan. 25

The massive upwards movement in cryptocurrencies over 2017 has not gone unnoticed. The participants at the World Economic Forum (WEF) in Davos are being questioned about cryptocurrencies and Cointelegraph has been one of the main voices representing the fraternity.

The traditional investors are still not willing to accept the rising clout of the cryptocurrencies and are pushing for tighter regulation. Only recently, Nordea Bank banned its employees from owning Bitcoin by Feb. 28. However, this move is facing strong opposition from the large unions.

Even the fears of a cryptocurrency ban by South Korea gathered a massive petition opposing the move. Finally, the Korean government only banned the traders from using anonymous bank accounts for cryptocurrency trading.

The classical investors and regulators fail to understand that these kinds of bans are unlikely to dent the popularity of the cryptocurrencies.

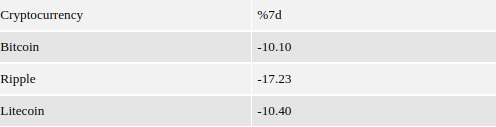

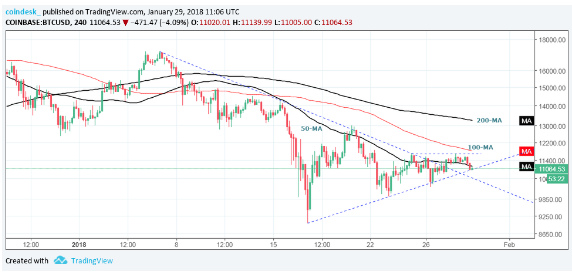

BTC/USD

Bitcoin is currently in no man’s land. It is facing resistance at the down trendline one. If the bulls succeed in breaking out of this resistance, we can expect a rally towards the down trendline two. Aggressive traders can trade this pullback.

Others should wait for a confirmation of a bottom formation because, if the bulls fail to sustain above the down trendline one, the likelihood of $10,000 levels breakdown increases.

Unlike the previous falls, this time, the BTC/USD pair is struggling to hold on to higher levels. With the price quoting below both the 20-day EMA and the 50-day EMA, the trend remains down to range bound.

The downtrend will reassert itself if the price breaks down to $10,000 levels. So, the swing traders should wait and watch for the next few days for the trend to change from down to up before initiating any long positions.

ETH/USD

Ethereum is in a pullback in an uptrend because it is still quoting above both the 20-day EMA and the 50-day SMA. Additionally, it has successfully held on to the uptrend line, which is another positive sign.

But the 20-day EMA has flattened out, which points to a range bound trading action for the next few days. The support of the range is likely to be at $900 levels, whereas, the resistance will be at $1,160 levels.

The ETH/USD pair will become negative only after it breaks down of the trendline and the 50-day SMA, which is at $845.

Long positions for the medium-term can be initiated on dips to $1,000 levels, with a stop loss at $840. We believe that if the 50-day SMA holds, the cryptocurrency will attempt to resume its uptrend and rally to the highs. This is a risky trade, hence, please keep the position size small.

BCH/USD

The traders, both the bulls and the bears, are not taking any keen interest in Bitcoin Cash. As a result, it has been trading in a small range since Jan. 23.

Support on the downside exists at the Jan. 17 low, $1,364.9657. On the upside, as the moving averages have completed bearish crossover, the 20-day EMA is likely to act as a resistance. Additionally, the $2,072 levels and the downtrend line will also act as a strong overhead resistance.

We don’t find any tradable setup on the BCH/USD pair.

XRP/USD

Ripple has formed a doji candlestick pattern on both Jan. 23 and Jan. 24. Even the price action currently points to a very small range day.

As forecast in our previous analysis, the XRP/USD pair is likely to remain range bound between $0.87 and $1.74. A trading opportunity will pop up only if the supports of the range hold or if the cryptocurrency breaks out of the overhead resistance. We should wait until then.

IOTA/USD

IOTA’s range has been shrinking for the past two days. It has formed successive inside day candlestick patterns on Jan. 23 and Jan. 24. Today, it is trying to resume the downtrend.

On the downside, support exists at $1.9232 levels. If this breaks, the IOTA/USD pair can extend its losses to the Dec. 22 low of $1.1.

The first signs of a recovery will be seen once the price breaks out of $3.032 and the down trendline of the descending triangle.

If the support and the overhead resistance levels hold, we may see a few days of range bound action.

LTC/USD

Litecoin has held on to the critical support level of $175.199. However, the bounce doesn’t have any strength, which shows a lack of interest in buyers.

If the bears succeed in breaking down the supports, a fall to $140.001 is likely.

On the other hand, the first signs of a recovery will be on a breakout above $215 levels.

Aggressive traders can buy the LTC/USD pair at $187, which is just above the high of past couple of days. The stop loss for the trade can be kept at $163 and the target objective is $215.

However, this is a very risky trade, hence, please place it only with less than 50 percent of the usual allocation.

XEM/USD

NEM has held on to the 0.86 levels for the past few days, but the bulls are unable to push prices above the down trendline.

This is likely to lead to another attempt to break down of $0.86 within a couple of days. If the bears succeed, a fall to the Jan. 16 lows of $0.55134 is likely. The 20-day EMA has turned down and is likely to complete a bearish crossover if the support breaks.

We don’t find any bullish setups on the XEM/USD pair with price trading below the trendline and both the moving averages. A change in trend will be signaled once it rallies above $1.21.

ADA/BTC

Cardano is again attempting to break out of the 0.00006 levels. If successful, it is likely to rally to the overhead resistance at 0.00006915. A very short-term trader can buy at 0.00006 with a stop loss of 0.00005. This is a risky trade, hence, please attempt it with less than 50 percent of the usual position size.

Swing traders should wait for a breakout of the 0.00006915 levels to initiate any long positions. We believe that unless the sentiment turns bullish for the cryptocurrencies, the ADA/BTC pair will find it difficult to breakout of the overhead resistance and may drift down to 0.000047 to 0.000049 levels again, which can be a good level to initiate long positions.

Author Rakesh Upadhyay

Posted By David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden

:format(webp)/cdn.vox-cdn.com/uploads/chorus_image/image/58444563/906814164.jpg.0.jpg)