Bitcoin Predictions – 10 parameters which will determine Bitcoin price in future.

Factors affecting Bitcoin price predictions

Is Bitcoin a bubble or a pin? Although the question is quite ambitious, there are various reasons that can be cited, to explain the highs and lows of Bitcoin. India emerging popularity of cryptocurrencies which one is asking the question what is Bitcoin what are cryptocurrencies and ultimately what is money. People tend to get quite relevant answers on the internet, but if you are looking for an easy explanation for Why does Bitcoin fluctuate so much? You have landed up at the right place. Is it the People, the team members, or Satoshi Nakamoto himself who is responsible for the ebbs and flows of Bitcoin prices. Let’s find out.

1. Bitcoin can be understood easily when it is compared to Gold. Assuming that you all are familiar with gold. Try to break down the attributes of gold. Gold is highly scarce in nature, it is difficult to mine, its value is constantly increasing, the same amount of gold has the exact same value anywhere around the world, huge chunks of good pieces can be broken down into smaller ones. No compare every attribute of gold with Bitcoin. Currently, even Bitcoin is scarce, as the number of users is more and the coins are less, even Bitcoins are difficult to mine, due to the scarcity of Bitcoins its value is high. Therefore, the future price prediction of Bitcoin is undoubtedly positive.

2. Bitcoin effectively overthrows the need of all the banks, which were very proud for the services they offered. It was only after the invention of Bitcoin, that people realized that the financial industry can be much more efficient than the fraudulent banks showcase them to be. Bitcoin has become a great alternative for the financial transactions, as the overall process has been brought down to a cheaper scale. Adding up on that is its lightning fast speed, imagine transferring funds from America to India within a matter of minutes. Therefore, the efficiency of Bitcoin is the backbone of its future prediction.

3. The Bitcoin prices and also given by a myriad of psychological factors. Investors, in particular, are driven by the market sentiments of the other investors or maybe their peers. The peer pressure is nothing much and everyone in your friend circle has purchased Bitcoin but you haven’t. The subconscious feeling that you get, is nothing but the peer pressure. This is one of the most notable driving force of Bitcoin.

4. Incorporation of Bitcoin buy Mini e-commerce companies, also needs to be kept in mind while predicting the Bitcoin prices. The future acceptance of Bitcoin is directly proportional to the amount of Companies accepting Bitcoin. How can you use your Fiat currency, when the accepting side is not even accepting it? Hence, from the now on a lookout for the “Bitcoin payments accepted” while shopping.

5. No government can take control of Bitcoin. It’s not like they are not authorized to do so but they inherently can do it. If they are really daring enough to play with the Bitcoin network, then they would be needed, all the supercomputers existing till date. The Bitcoin network is so huge that even if all the supercomputers are combined together, they would not even be capable of controlling half of the Bitcoin network too. In other words, they are very tiny before the massive Bitcoin network. Therefore, regulations do not affect the Bitcoin price prediction.

6. As the Blockchain Technology, in general, gains popularity even Bitcoin prices would be affected, as everything is interrelated to each other.

7. Even the decisions of various social media platforms with respect to the Crypto domain affects the Bitcoin value. Consider a friend of yours spreading the news of Bitcoin price fall on WhatsApp and Facebook. It is very obvious that some speculations would be fed into the minds of Bitcoin enthusiasts. In a nutshell, self-regulation also must be kept in mind for Bitcoin price prediction.

8. The online nature of Bitcoin transactions have bought the entire financial market into the hands of people. You can sit back and relax on your sofas, to buy or sell Bitcoins, within a few taps without undertaking extensive form filling procedures. Convenience is the driving factor here.

9. Bitcoin is highly valuable when seen collectively. In other words, what’s the value of using Facebook when you have no friends. Apply the similar analogy to Bitcoin too. Its social connections and engagement by millions of people is its driving force.

10. Further developments in the Bitcoin world, would accelerate its acceptance and indirectly the value of Bitcoin. Bitcoin ATMs and ETFs are a most significant model developed for the convenience of users.

Published 54 mins ago on September 27, 2018 By Layla Harding

David Ogden – Http://markethive.com/david-ogden

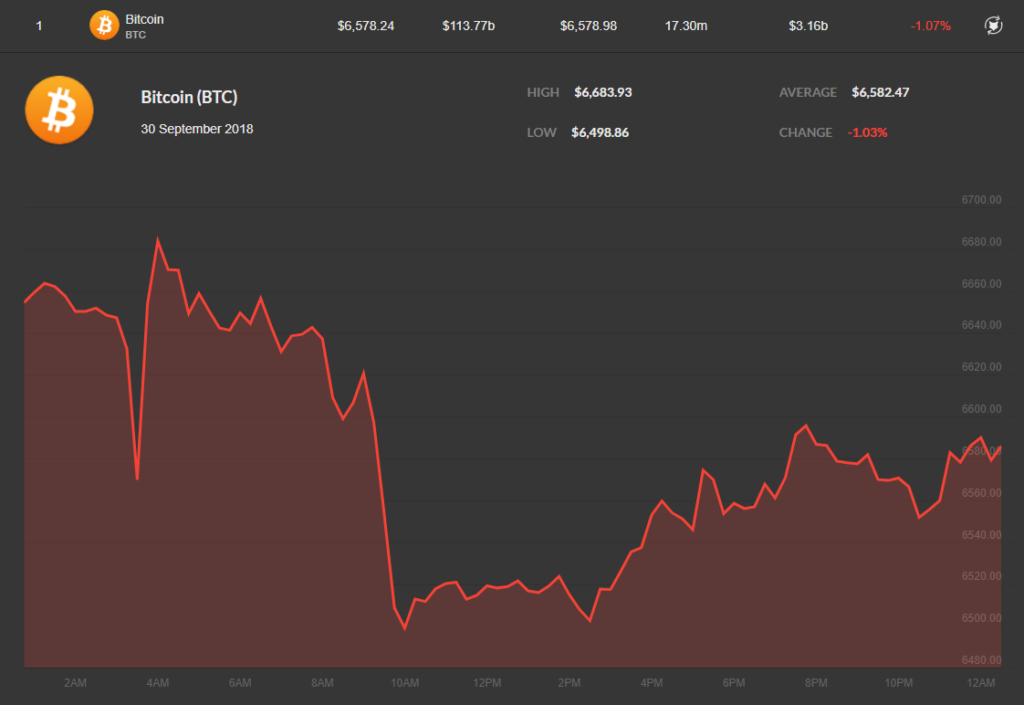

Bitcoin daily price chart on September 30, provided by Coincap.io

Bitcoin daily price chart on September 30, provided by Coincap.io