Bitcoin Surges 5% in Minutes – Can it Lead to Bigger Rallies This Month?

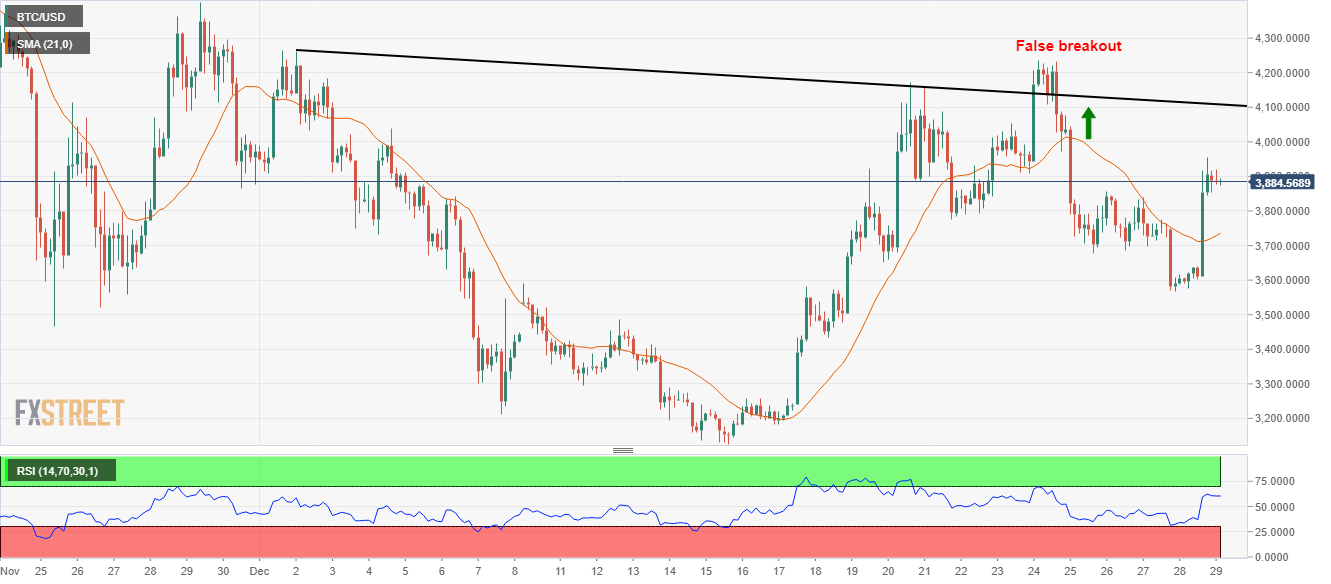

The Bitcoin price has surged by six percent on the day to $4,070, breaking out of the $4,000 mark comfortably for the first time since Christmas Eve.

Bitcoin’s strength does not convince many traders of a big short-term bull rally.

Could Bitcoin Engage in Bigger Rallies in January?

With a 20 percent increase in its daily trading volume, Bitcoin has been able to show some momentum above $4,000. But, as DonAlt, a cryptocurrency technical analyst said, the slight increase in the price of Bitcoin is not sufficient to declare a trend reversal even in the short-term.

The analyst said:

Finally an impulse. If today closes above resistance (4000) I’ll be looking for buy opportunities/close my hedge short. If it closes below resistance I’ll be looking for shorts. Dangerous to trade in any direction with the Finex maintenance coming up tomorrow.

Both BitFinex and BitMEX, two of the largest margin trading platforms for Bitcoin, are set to run maintenance on January 7, suspending trades.

If Bitcoin closes the day at $4,000 and shows some positivity in the short-term, it may allow the asset to prepare for upward price movements in tight ranges.

But, generally, traders saw the price movement of Bitcoin as a lackluster move following poor several days subsequent to Christmas Eve

“Another day, another lacklustre move. Is this the top? I’m looking for $180B if we can turn $140B into support, otherwise not much too get excited about just yet,” a cryptocurrency trader with the online alias “The Crypto Dog” wrote.

Bitcoin could engage in bigger rallies throughout January, potentially eyeing a breakout above $4,500. Still, without a breakout above $6,000 and resistance levels above it, it is challenging to justify a bottom.

One trader said that Bitcoin is likely to see a boring first two quarters in 2019. With volatility in a low price range, it will be unable to recover to key levels.

“The good news is that the low is likely in. The bad news is that we go sideways here for another 6+ months before moon mission starts again for new ATH’s. The good news about the bad news is that with BTC going sideways for 6+ months (If this Forecast Map is in anyway accurate) then we’re having a nice long [alternative digital asset] season,” one trader said.

Volume is Key

The short-term trend of Bitcoin is uncertain due to the scheduled maintenance of two major exchanges.

A key element in the dominant cryptocurrency’s performance over the next few weeks will be its daily volume. Throughout the past two weeks, Bitcoin has maintained a volume of over $4 billion. This is lower than its average volume at around $4.5 billion.

Currently, volume hovers at nearly $6 billion. If it can sustain such a high volume, BTC will be able to sustain its momentum.

AUTHOR

Joseph Young

Hong Kong-Based Finance and Cryptocurrency Analyst / Writer. Contributing regularly to CCN and Hacked. Offering cryptocurrency news and Insights Into Asian Market (South Korea, Japan, and more

David Ogden – Http://markethive.com/david-ogden

![Bitcoin [BTC] Technical Analysis - Bull carries coin to green pastures](http://seriouswealth.net/wp/wp-content/uploads/2019/01/vw-bus-1845719_960_720-e1546260811706.jpg)