Why you should be patient for a big Bitcoin payoff

Cryptocurrency remains the subject of much speculation amongst investors and regulators, and the prices of major tokens remain volatile enough for traders to make decent profits trading at the right times.

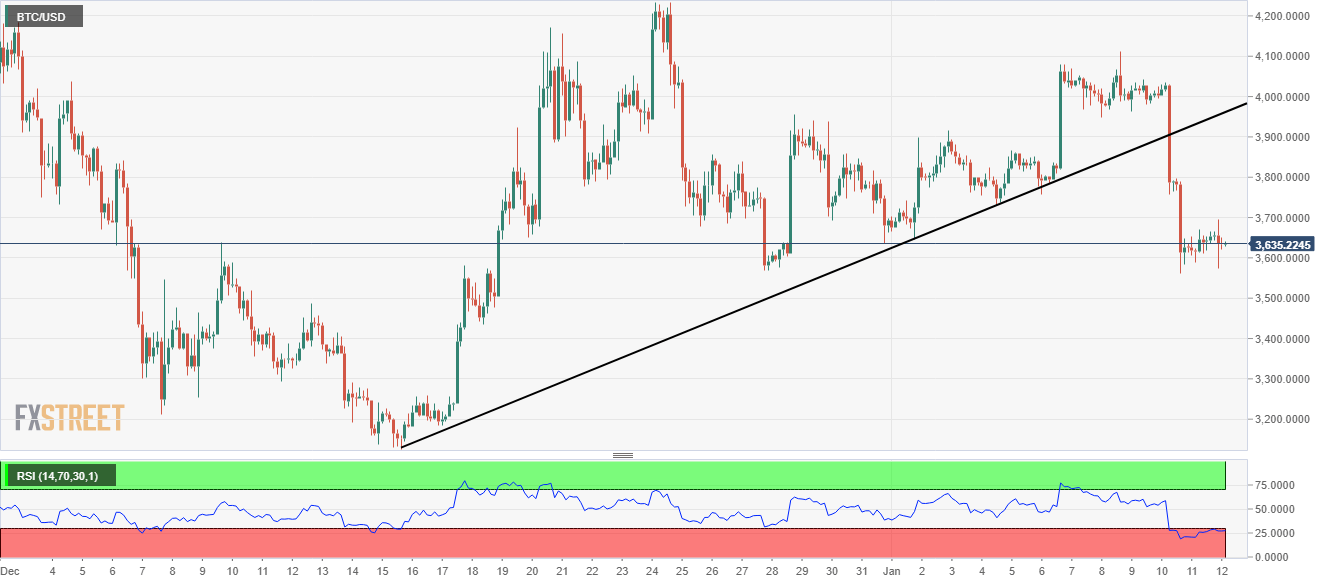

Popular cryptocurrencies Bitcoin and Ethereum have shown significant growth recently, increasing by 16.26% and 67.77% respectively from 9 December 2018 to 9 January 2019.

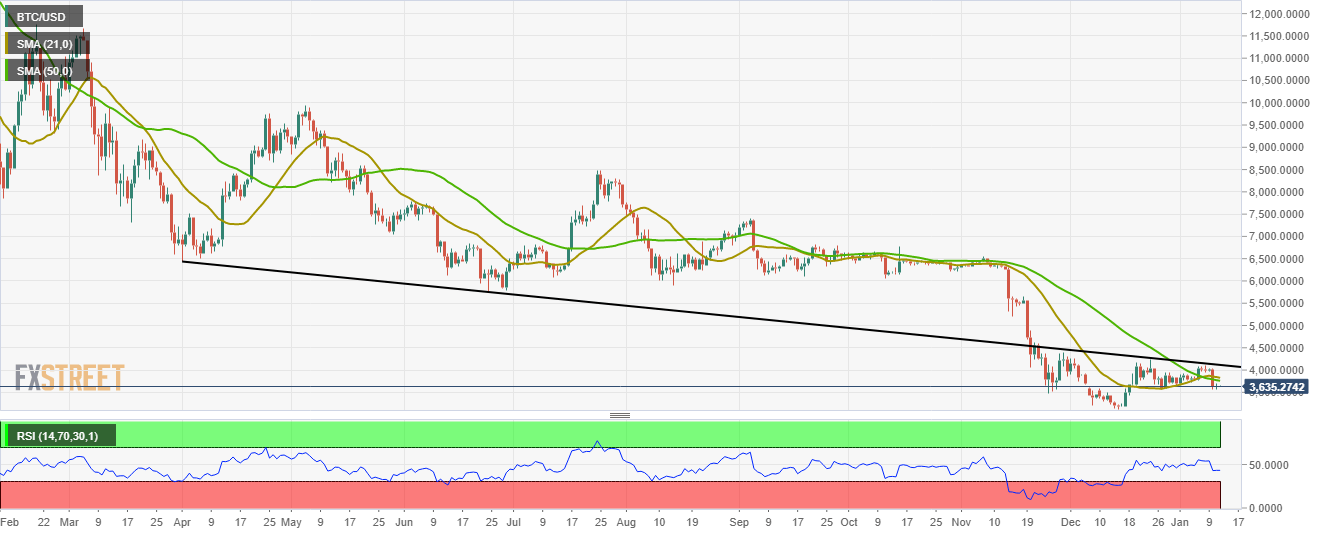

These surges in value may have helped to placate investors following the dismal performance of the overall cryptocurrency market throughout 2018.

Hopeful investors – like those who purchased Bitcoin in 2017 to cash in on the currency’s meteoric price rise – should not hope for a similarly quick return on their buy-in, however.

Cryptocurrency expert Simon Dingle and South African exchange Luno have both cautioned against buying cryptocurrency for quick returns, and instead urge buyers to learn more about the technology behind it to better understand their investment.

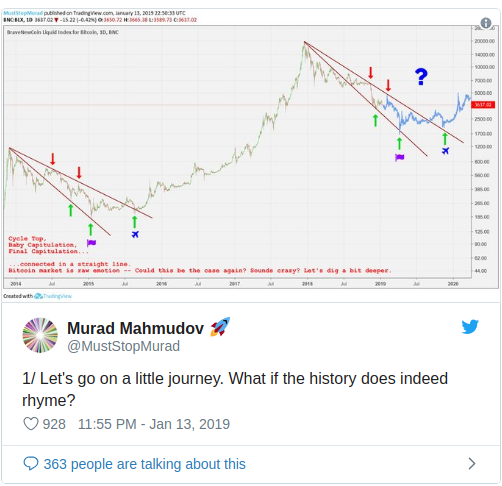

Expert predictions

A collection of predictions for 2019 by industry experts compiled by Forbes also paints an outlook which focuses on the development of technology and its subsequent effect on cryptocurrency prices.

Some investors, such as venture capitalist Tim Draper, state that Bitcoin will skyrocket over the next few years – reaching up to $250,000 by 2022.

Those involved in the cryptocurrency industry have also expressed excitement surrounding the new products coming to market, and the subsequent increase in adoption and price.

“2019 will be an exciting year. We will see several great products shipped to market, especially from our Binance Labs incubation programme, now taking place on five continents,” said Binance Labs head Ella Zhang.

“The projects and teams who are focused on building and achieving product-market fit will bring more real use cases to our lives. This will open the gateway to the mass adoption of crypto.”

Most agreed that the age of ICO hype, scams, and get-rich-quick schemes had passed, with more long-term investments now becoming the focus of the market.

Technology and development

While the prices of Bitcoin, Ethereum, and other digital currencies plummeted over the last year, the blockchain technology behind them has been under constant development.

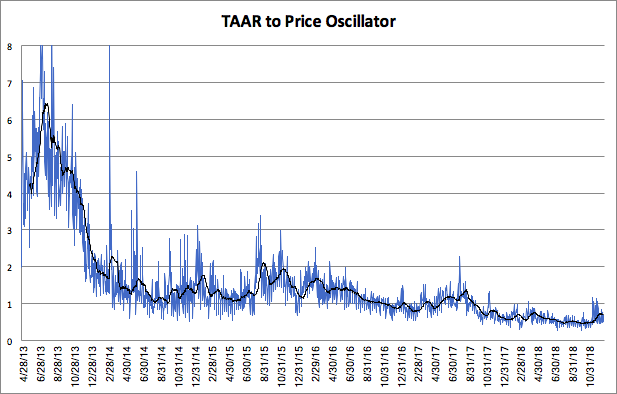

This underlying trend of continued improvement will be the true driving force behind the steady increase of Bitcoin’s price, according to industry experts.

Luno recently stated in a blog post that one big challenge the cryptocurrency community still faces is that of instant gratification.

“The reality is that the existing financial system was built over hundreds – if not thousands – of years and we’re not going to build a new financial infrastructure overnight,” the company said.

“We need to be patient and take it one step at a time. The stakes are high and it would be irresponsible and potentially outright dangerous to rush things.”

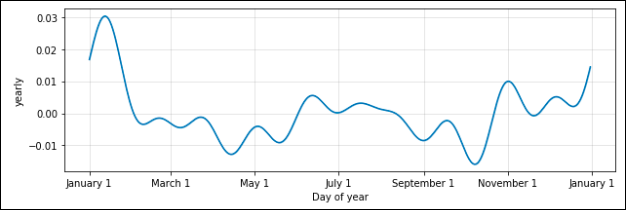

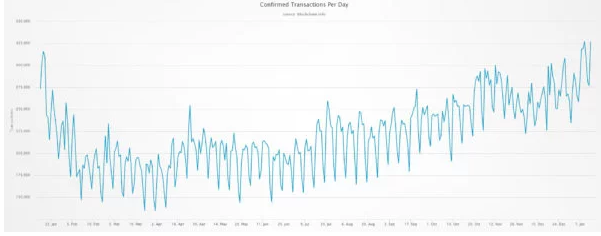

The number of Bitcoin transactions taking place per month have been steadily increasing, showing that despite price decreases, the technology’s adoption continues to grow.

Luno said that despite criticism of the cryptocurrency industry and the falling price of digital tokens, it is optimistic about Bitcoin in 2019 – particularly its increased adoption and the development of blockchain scaling options.

Price movements

When it comes to price predictions, Dingle previously told MyBroadband that while he does not like to make them, he does not expect any more sudden surges to all-time highs this year.

Instead, he said that technological developments and positive changes would continue to steadily drive the average price of Bitcoin and other major cryptocurrencies higher.

He also stated that Ethereum was undervalued and may have a powerful recovery, after which the price of Ethereum increased by around 60%.

While it has deterred many investors, the recent long-term bear market has aided in forcing out scammers and flakey ICOs, and has allowed the cryptocurrency community to focus on creating value and developing technology.

Dingle expects cryptocurrency to continue its steady pace of growth throughout the year, although investors will need to be patient until they are able to take advantage of its potential for meteoric growth again.

Jamie McKane 17 January 2019

David Ogden – Http://markethive.com/david-ogden