Pay Attention

Pay Attention

The Final Private Group Offer

Alexa has broken through to 27,400, 18,650 Membership subscriptions have risen past 12,000 16,500, 1/3rd of our projected funding ($100,000) has been reached!

We have built a social and market network on the blockchain. Over 20 years of developing, 4 years in beta, now we are listed on an exchange and ready to come out of beta with nearly 10,000 members, an Alexa ranking of 30,020 over 50,000 followers on our social networks.

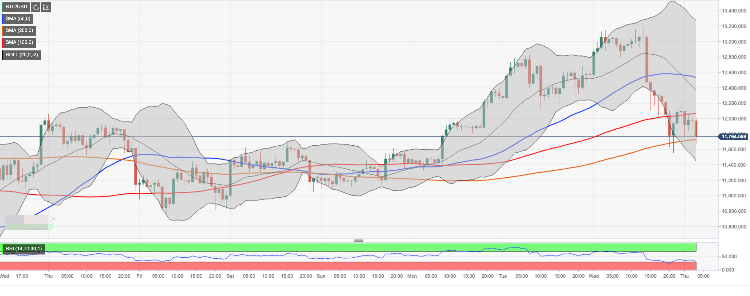

Markethive coin has increased in value from 1 penny $.01 to a dime $.10 to $.21 in a short amount of time (giving MMV coin a $18.7B market cap). The crypto Bull Market has returned and will continue to grow in magnitude for the rest of the year.

By summers end the growth of the industry should be staggering. Two well know protagonist billionaires agree, Tim Draper and Tom Lee.

https://markethive.com/group/marketingdept/blog/bitcoin-price-will-hit-4-million

This is one of the indications it is time to launch Markethive. After nearly a year with the new engineering firm and new engineers on the team, the platform is now stable and the next two months will be focused on bringing on many new upgrades, enhancements and new services.

The Offer.

What is an ILP?

The ILP is well defined in this article titled: What in heck is a Markethive ILP?

Buy $1,000 worth of MHV coin through our Markethive account (Markethive will transfer the coin to your Markethive account or your MEW wallet) and receive a .12 share of an ILP.

Buy $2,500 worth of MHV coin through our Markethive account (Markethive will transfer the coin to your Markethive account or your MEW wallet) and receive a .35 share of an ILP.

Buy $5,000 worth of MHV coin through our Markethive account (Markethive will transfer the coin to your Markethive account or your MEW wallet) and receive a .8 share of an ILP.

Buy $10,000 worth of MHV coin through our Markethive account (Markethive will transfer the coin to your Markethive account or your MEW wallet) and receive 2 shares of an ILP (one ILP and one shadow ILP).

A rotator: Plus earn an equal share of new ILP purchases in our official crowd funding launch of Markethive this summer (proposed)

Additional bonus: Existing ILP owners will also receive equal shares in the rotator Crowd Funding Launch and if you purchase an additional ILP via this offer we will double an equal amount of shares (not shadow shares) you currently hold.

ie: [If you currently hold 3 ILP shares, and purchase 2 ($20,000) new ILP accounts “receiving 2 x 2 ILPS = 4” 2 of your 3 existing ILPs will also be doubled. Giving you a new total of 9 ILPs.] 3 + 1 now equals 9!

This offer ends when 30 ILP shares have been acquired. Several members have already taken us up on this.

Again if you do not know: What in heck is a Markethive ILP?

The following budget is what determined my decision to do one more private crowd funding before we launch our official Blockchain Crowd Funding and the Markethive Awareness campaign.

We need to raise the money to launch a huge ICO (like) public crowd funding campaign (AWARENESS CAMPAIGN) and need to raise $300k or more to make it a huge campaign. 60% of this money goes to launching our crowd funding campaign in June of this year. 40% goes to Markethive enhancements to prepare for the onslaught of new membership. We need to finish our Markethive.io site. It needs to be replicated. Our front page of Markethive is also getting a new face lift. And Markethive.net will be retrofitted as an ICO rating system

An online form to sign up for this offer is found at the bottom of this article or by tapping this link

ILP SIGNUP

Phase One ($20,000):

We will need to publish large Press Release campaigns to the following Crypto News Sites

- BUSINESSINSIDER.COM (via Prlog.com $350) Alexa: 327

- CCN.COM Press Release $349 Alexa: 1,458

- COINTELEGRAPH.COM Press Release $3500 Alexa: 4,496

- BITCOIN.COM Press Release $1,995 Alexa: 11,763

- COINTRAFFIC.IO (Scheduled Crowd Funding Campaign $25) Alexa: 15,823

SEE MEDIA KIT PDF - BENZINGA.COM Press Release $500 Alexa: 21,239

- NEWSBTC Press Release $799 Alexa: 25,740

- LIVECOINWATCH PR via Coinzilla $200 Alexa: 33,268

- ETHEREUMWORLDNEWS.COM Press Release: $350 Alexa: 40,325

- BITCOINIST.COM Press release $999 Alexa: 41,709

- THEBITCOINNEWS.COM press release $990 Alexa: 41,493

- BITSONLINE.COM Press Release via Coinzilla $300 Alexa: 49,562

- BLOCKONOMI.COM Press Release is $199. Alexa: 56,128

- BITCOINMAGAZINE.COM Sponsored Article + EMAIL $4000 Alexa: 51,480

- INVESTINBLOCKCHAIN.COM Press Release is $199. Alexa: 58,846

- DAILYHODL.COM Press Release $150 Alexa: 60,654

- NULLTX Press Release $300 Sponsored Article $600 Alexa: 65,887

- CRYPTOGLOBE.COM Press Release via Coinzilla $220 Alexa: 79.744

- CRYPTODAILY.CO.UK Press Release via Coinzilla $400 Alexa: 80,870

- CRYPTOSLATE FEATURED LISTING: $199 PER MONTH Alexa: 81,131

- PORTALDOBITCOIN.COM PRESS RELEASE VIA COINZILLA: $200 Alexa: 91,297

- SMARTEREUM Press Release: $249 Alexa: 97,553

- SMARTEREUM SPONSORED STORY: $999 Alexa: 97,553

- BTCMANAGER.COM Press Release $500 Alexa: 112,197

- ZYCRYPTO.COM Press Release $100 Alexa: 121,487

- BLOKT.COM Press Release $200 Alexa: 164,593

- SLUDGEFEED.COM Press Release $100 Alexa: 222,695

- CRYPTOCURRENCYNEWS.COM Press Release $197 Alexa: 376,032

- CRYPTORADAR Press Release $59 Alexa: 1,304,572

SUB TOTAL $19,000.00 Primary campaign

Phase Two ($75,000):

Secondary Marketing Assets

- COINMARKETCAP (3days banner at top of page $14,500) Alexa: 485

SEE MEDIA KIT PDF - CCN (sponsored story for $1499 + emailed to 100,000 $1.799) Alexa: 1458

- COINTELEGRAPH.COM (Publish package $20,000) Alexa: 4,544

- COINDESK.COM Minimum $10,000 Newsletter $10,000 per Alexa: 6.294

- CRYPTOCOMPARE (Sponsored Guide Sponsored Newsletter) Alexa: 11,189

- BITCOIN.COM (500,000 Impressions Banner $5700) Alexa: 11,988

- Ivan Liljeqvist YOUTUBE CHANNEL ($11,000 interview) 198k subscribers

- AMBCRYPTO (ICO form submitted $8,000) Alexa: 22,118

SEE MEDIA PACKAGE PDF - ETHEREUMWORLDNEWS.COM (Native Article: $1200) Alexa: 40,325

- THEBITCOINNEWS.COM (Press Release $990) Alexa: 41,493

- BITCOINIST.COM Sponsored Article + Social Network $1,950 Alexa: 41,709

SUB TOTAL $75,000.00 Secondary package

ICO Launch and Rating Sites ($16,000):

We will need to register and publish to the portfolio of ICO benches and ICO revue sites. They all charge fees to do it “right”.

- COINGECKO.COM Banner Ad program $3500 per month Alexa: 6,595

- ICOBENCH Consultation, Mass Press Release and Listing $5000 Alexa: 38,516

- ICOMARKS.COM ICO Promotion Premium $500 Alexa: 73,714

- ICOHOLDER.COM PUBLISH ICO: $500 Alexa: 124,622

- ICORATING.COM Listing + investment rating, publication $3,500 Alexa: 155,355

- AIRDROPRATING.IO Rocket PR to massive social networks $600 Alexa: 163,761

SEE MEDIA PACKAGE PDF ON FILE - BLOCKCHAIN INVESTOR COMMUNITY Free Submission Alexa: 238,472

- ICOBAZAAR.COM Free submission

- COINSTAKER.COM Full campaign package $2000 Alexa: 345,864

- ICOALERT.COM CONSULTING (Have Reached Out) Alexa: 380,596

- COINIST.IO Listing and Press Release $2,600 Alexa: 664,338

- COINLAUNCHER.IO PREMIUM LISTING: .75 Bitcoin Alexa: 805,035

- FINDICO.IO ONE MONTH PREMIUM: 3ETH Alexa: 1,172,488

- ICOTOP.IO ICO Rating Agency Free to Add your ICO Alexa: 2,270,743

- THETOKENER.COM Full Ad package $2220 Alexa: 2,279,375

SUB TOTAL $16,000.00

Advertising Channel for Email distribution, Social Networks Broadcasting, Banner advertising

- BUYSELLADS.COM Crypto Bundle to 16 high ranked domains, social networks and email distribution runs $17,000 Alexa: 60,163

Required Development before Launch ($52,000)

Final Leg Project Priorities

1. New Root Domain front page to qualify us for a banner account – $4200

2. Floating video on home page. Replaces video in Upgrade Level page. Videos 1:Tutorials | 2:Entrepreneur | 3:Social Account Setup with associated links to the designated pages, sections or groups. – $840

NewsFeed Upgrade: New signup notification on all newsfeeds. Notification alerts to a new signup, their name and link to the Profile Page, ability to friend request and send a tip and (who signed them up?) $1400

4. NewsFeed repair: Anyone who is a friend should see your Newsfeed posts on their Newsfeed, This is broken and inconsistent. Mostly with new members. When a post is deleted by the author or Group admin, it should be deleted for all. I can show you where this is not working. $560

5. When a friends Group is posted to, it should not appear on my News Feed unless I am a member of that group. Right now that is broken and appears on my NewsFeed $560

6. NewsFeed Upgrade: We need a search and filter. Search allows searching keywords, members, date range, group posts, and GEO. Filter determines what default displays. Same ranges. $3500

7. Blocking a member. Hides all newsfeed posts from being viewed both ways, removes the blocked member from the group and deletes all posts in owners groups, removes all comments from owners blogs and hides all blog comments from member to owner and owner to member. Prevents blocked member from commenting on a blog, but allows viewing, and subscribing, but not SWIPING. $2800

8. Gateway: Payment Methods “Bitpay”, “AuthNet”, “Paypal”, “Amazon”, “Apple Pay”. All, payment processing is used for Entrepreneur monthly and yearly subscriptions and purchase of Markethive Ad Credits. Ad Credits can be used to purchase Markethive Coin to be used to purchase Advertising Services, such as News Feed Ad boosts, Banners, sponsored articles, Press Releases, Markethive Social Account broadcasts. $4200

9. Entrepreneur “Upgrade Level” redesigned $350

10. Picwic Tracking Broken: IT BUDGET $350

a. Capture Pages

b. Capture Widgets

c. WP Plugins

d. Profile Page

e. Rotator

f. Mini Url

11. Leads Control Panel broken IT Budget $140

a. Empty folders disappear.

12. Autoresponder issues IT BUDGET $140

a. Drag and drop reorganizing is broken

13. Markethive.io (Crowd Funding Promo Site)

a. Secure Certificate

b. New ICO like template

c. Finish Markethive IO videos

14. API coin transfer (First wallet) – IT BUDGET $32,500

15. Remove Paypal, designate verified when the phone number has been verified. Replace the image with a new Image – IT BUDGET $70

16. Super Groups

a. Press Release Group. Customer built as a super group for just Press Release publishing and payment to publish standard, advanced and master levels. IT BUDGET $10,000

b. Sponsored Articles Super Group payment options for published to front page, distributed to social networks, distributed to WP blogs IT BUDGET $10,000

c. Curation function in all groups to add 3rd party RSS feeds and a deliver keyword(s) filter IT BUDGET $10,000

17. Automated Tutorial System IT Budget $5000

Proposed budget for IT upgrades is $90,000

Total proposed cash required ($193,000)

is a conservative estimate and we also want a treasure chest for additional development unforeseen at the moment.

Summary:

As Bitcoin Surges, so will the Markethive Coin and subscriptions and paid services. Our timing could not be better. We survived the Crypto Winter and it is now time to go to the moon.

Bitcoin Surging 19% Only the Beginning, Halving Will Propel to Meteoric Gains

https://www.ccn.com/bitcoin-surging-19-only-the-beginning-halving-will-propel-to-meteoric-gains

Markethive is this hybrid symbiotic phenomenon. Unique, exponentially powerful and will be a major driving force in unbelievable revenue generation as well as widespread respected service.

A Case study: Let’s look at the Media Content suppliers for the Crypto media. They have very big traffic and they publish banners, press releases, sponsored articles, ICO analysis all for fees and many make over a $million a year. The tools they use are not unlike the tools we deliver to you in Markethive. That being said, it is not difficult to grasp the fact many Markethive members can build a similar success with our system like we are building for you @ http://aboutbitco.in/

Keep in mind, we have not promoted it nor finished it, but it will be no different than a WordPress portal you could build using the same tools found in Markethive

https://www.worthofweb.com/website-value/aboutbitco.in/

Markethive is a market network and these tools are equally commanded by each individual which means any member at Markethive could produce similar traffic and revenue because of Markethive but not by Markethive. It is the entire vision to empower our members to achieve great heights.

Click here for ILP registration and purchase

Sincerely,

Thomas Prendergast

CEO Founder

Markethive

The Markethive White Paper

David Ogden – Http://markethive.com/david-ogden