How Does Markethive Create Token Velocity?

What Is The Difference Between A Token And Coin?

Firstly, let’s set the stage to determine what the terms Coin and Token really mean. They are often used interchangeably however they are fundamentally different. A crypto coin such as Bitcoin, Ethereum and Markethive Coin have their own Blockchain, otherwise known as an Independent Distributed Ledger used for transactional purposes. Coins have the same characteristics as money. They are fungible, divisible, acceptable, portable and durable with a limited supply.

Tokens are a representation of a particular asset or utility. It usually resides on top of another blockchain. Generating a token does not require creating a blockchain from scratch. They are fundamentally made possible through a smart contract and are created to fund project development or start-up company as is the case with the Markethive ILP. (Incentivized Loan Program)

To sum it up, coins are a method of payment, while tokens represent a company’s share or provide access to a product or service within the company. Coins are fundamentally currencies that are used for buying and selling things. You can buy a token with a coin, but you cannot buy a coin with a token.

Coins operate independently while a token has a specific use in a project's ecosystem.

How Important Is Coin Or Token Velocity?

What is Velocity? Velocity is the speed at which transactions take place and is a key aspect that affects the value of the coin in the future. Velocity is correlated to transactional volume so a level of currency movement is needed in a healthy economy.

In attempting to describe token or coin velocity, there are a few different explanations that vary in their solution. It’s a whole new way of looking at value creation that requires a different level of abstraction as illustrated in this blog post.

Low velocity essentially means people are holding on to the coin which minimizes the velocity, in the hope the price increases. In actuality, if you hold all coins and nobody trades or utilizes it then the transactional volume collapses and so does the price of the coin simply because there is no demand.

People may store it simply due to speculation of a price increase. More speculation drives the price up further, however, the process also works in reverse as people start to sell the coin. The more people sell, the further decrease in price. Fundamentally, because there is no need to hold the coin as the price is only linked to speculation.

Velocity that is too high can also be detrimental to the coin. There are currently many token economies being projected as purely a medium of exchange token.

Let’s look at a hypothetical example. A decentralized Cab company creates a token to be used within its economy, so all passengers using their service need to acquire their token for payment. So the passenger converts Fiat or BTC to the company’s “Cabcoin” to pay the driver. The driver immediately converts it back into Fiat or BTC as no member wants to hold the coin because all other expenses are in fiat. After all, they have bills to pay.

If the company grew as big as Uber, then the transactional volume would be very high and so would the velocity. Overall, the company may have $40 billion in value, but their Cabcoin would not accrue this value.

Velocity – Not Too Hot, Not Too Cold – JUST RIGHT

Goldilocks Zone – Clearly the ideal velocity needs to be maintained within a range. Too low is damaging and so is too high. There needs to be a balance between holding, circulating, and transacting to maintain a healthy ecosystem and sustainability to ensure the coin value.

Token Economies are still very new technology so more research needs to be performed. Even the financial experts in the field of economics have conflicting analogies at present. They are calling it an economic tautology, however, it stands to reason we at Markethive are on the right track here.

Not only is Markethive Coin a medium of exchange, but it also has great utility value in its products and services. It is a consumer coin so there is a need to hold it and consume it within the ecosystem of Markethive.

Maintaining The “Just Right” Velocity

There are different scenarios that can be used to adjust velocity. These involve incentivizing members or coin users to hold at least some of their coins for an extended period of time and also use them within the ecosystem. If the consumer or utility benefit of the ecosystem doesn't go beyond the holding cost, then the system will struggle to achieve adoption. These include:

Products and Services

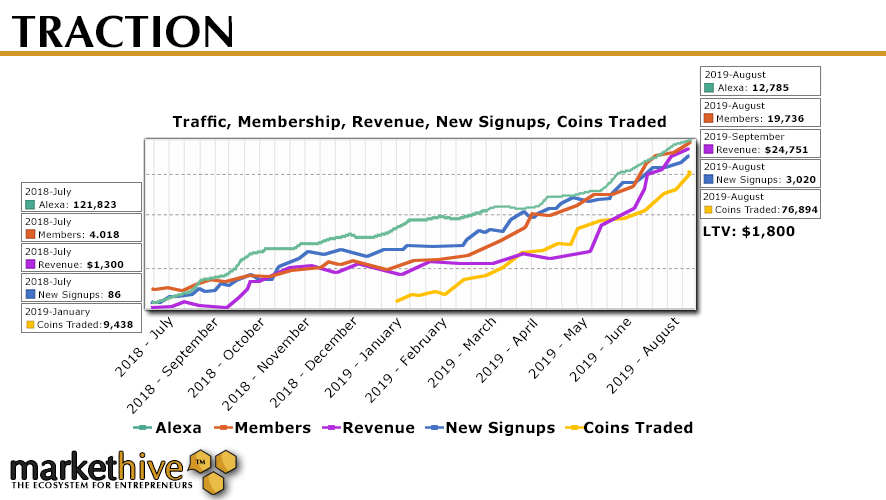

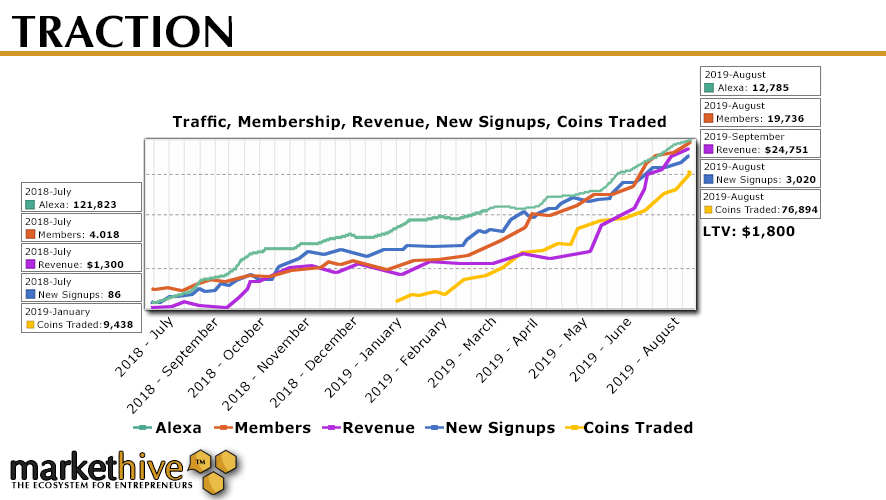

As Markethive is a Social Network with much sought after products and services, the traction and membership are ever-increasing at an exponential rate, therefore, creating more demand, which in turn diminishes supply which leads to an increase in the coin price.

Faucet/Micropayments

This gives all members an opportunity to accumulate their coins just by taking part in daily activities where they consistently earn MHV on the platform thus creating velocity. As the demand increases, the supply drops which in turn increases the price.

Tipping is another way to keep the coin circulating within the ecosystem.

Gamification is fun and creates incentives for members to accumulate and hold the coin.

Become a Store Of Value

When people see real value in a token or coin, they are more willing to hold on to excess tokens for longer rather than selling them.

Become A Cryptocurrency

When people trust the stability of the coin compared to other alternatives they hold the currency so they can purchase goods and services with the coin within that ecosystem at any given time. If the users of the network are also providers of the network, they are not likely to sell their coin.

The Vault – Staking

The Vault will be designed and implemented prior to the wallet being added. Once the wallet is active, Markethive Ad Credits and MHV Coins can be purchased and transferred over into the Vault. So this is like an online banking system. It’s a savings account with interest paid on it. This is an ingenious way to ensure the long-term sustainability of the Markethive Ecosystem. That’s a whole other blog for a later time.

Profit-Sharing – Loyalty Program

Markethive’s Incentivized Loan Program (ILP) is another perfect example and trumps the issue of an unbalanced velocity. In this case, you’re not buying a safe with a limited number of tokens, you’re buying a field full of oil wells. As the Markethive Coin (MHV) is already active on the blockchain and in exchanges, this makes it possible to purchase a percentage of an ILP with the Markethive Coin.

An added advantage is the fact that we are a meritocracy and all Markethive members are able to take part in and own a portion of an ILP which means they share in the success and wealth of Markethive.

You will be able to buy MHV from exchanges (open market) and transfer into Markethive to buy ILP before the wallet is launched.

- 1 ILP will cost 1 million MHV

- ½ ILP will cost 600,000 MHV

- ¼ ILP will cost 350,000 MHV

- 1/10 ILP will cost 200,000 MHV

- 100thILP will cost 5,000 MHV

All the way to a 1000th ILP (to be advised)

Once the wallet is launched you will then be able to sell your ILPs to the many who want them. As the velocity and the price of the coin increases the number of ILPs will reduce. They will diminish just as the airdrops and micropayments will reduce.

There will always be a percentage of people “cashing out” their coin, however, given the nature, utility and consumer value of Markethive will ensure a healthy combination of transactional, and holding activity.

Conclusion

After much research, I have discovered the velocity of tokens and coins to be a very complex topic, with very little data to draw analogies from. From what I understand and agree with is there has to be a Goldilocks Zone to maximize the complete economy of any given token or coin and its ability to capture and essentially hold its value.

A token that is only a medium of exchange has a very strong chance of falling victim to price manipulation. Alternatively, Markethive has in place, numerous velocity stabilizers including staking, (The Vault), network utility expansion, and the fact it is a cryptocurrency coin, will keep the balance of velocity. This ensures that the velocity is maintained for the initial and long term price of MHV and is indicative of a healthy Markethive Ecosystem. A strong economy will in turn sustainably increase MHV’s price.

Coins or Tokens that are structured to capture a significant portion of the economic value generated by the network will reward both the investors who took on early-stage risk as well as the platform who can continue to fund development through the retention of now valuable tokens.

There is a huge market looking for what Markethive does. You’re not just buying or earning to accumulate a coin, you’re buying an oil field. Markethive is an eternal economy that has more demand than supply, therefore, the demand will continue to outstrip the supply. The bottom line being the Markethive Consumer Coin (MHV) and Incentivized Loan Program or ILP Token (HFS) will only become increasingly more valuable.

David Ogden

Entrepreneur One @Markethive, a global Market Network, and also a strong advocate for technology, progress, and freedom of speech. I embrace "Change" with a passion and my purpose in life is to help people understand, accept and move forward with enthusiasm to achieve their goals.

David Ogden – Http://markethive.com/david-ogden

t

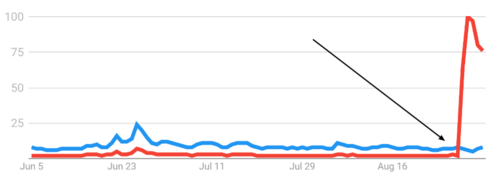

t Searches for "BTC" (red) have never been higher, with Romania a possible the source of the surge. GOOGLE TRENDS

Searches for "BTC" (red) have never been higher, with Romania a possible the source of the surge. GOOGLE TRENDS