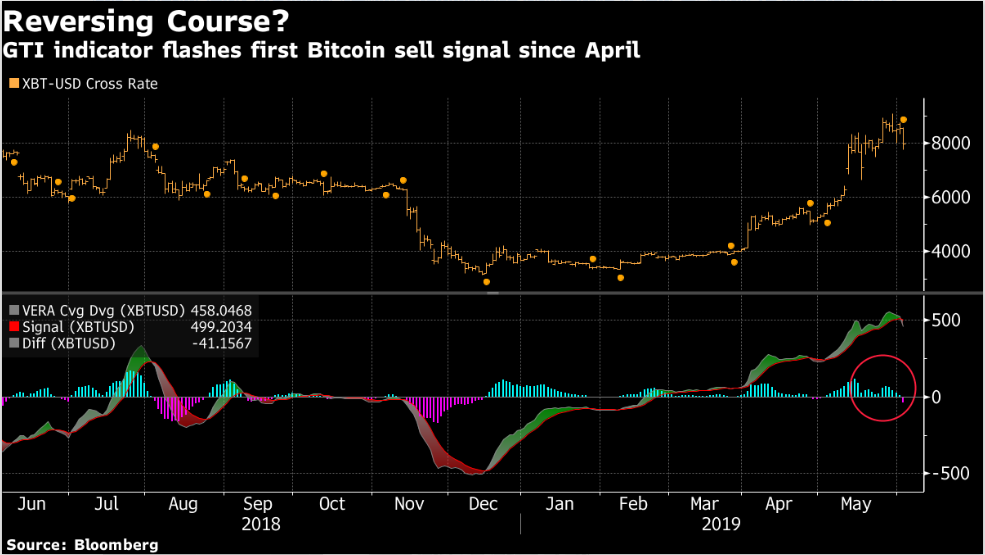

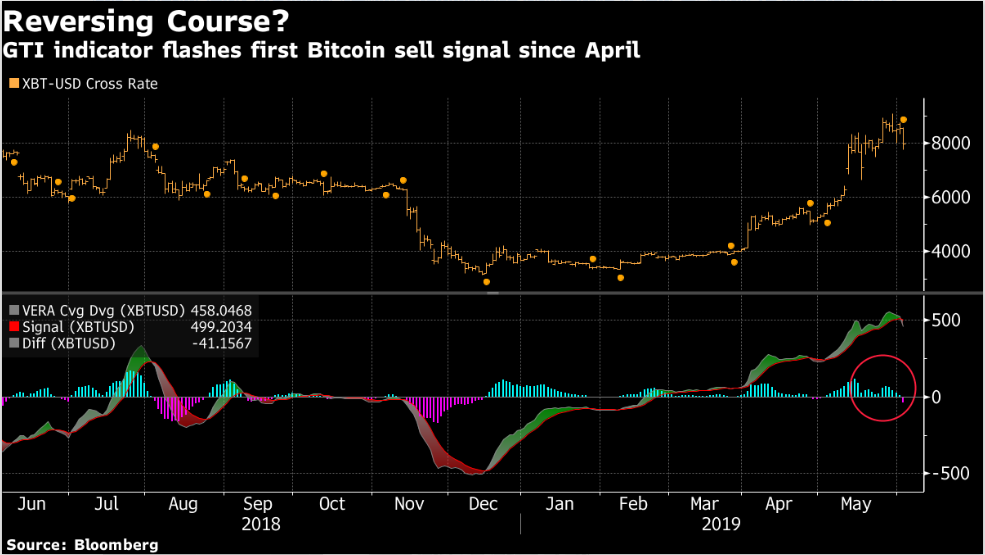

Bitcoin indicator flashes a sell signal as slump accelerates

As euphoria over cryptocurrencies deflates in the wake of Bitcoin’s biggest monthly surge in almost two years, technical indicators are showing there could be more pain ahead.

The GTI Vera Convergence-Divergence indicator, which detects positive and negative trends, flashed a sell signal for the first time since April, suggesting there could be further downside as Bitcoin halts its recent monster rally.

“The market is in an identity crisis, trying to find a place to stabilize,” said Jake Stolarski, senior trader at Greenwich, Connecticut-based Cipher Technologies. “The key technical levels have been creating market volatility, for sure, due to sudden shifts in sentiment.”

Bitcoin fell as much as 12 per cent to $7,544.42 in New York trading. The slump follows the coin’s 62 per cent surge in May, the biggest monthly gain since the height of the crypto bubble in August 2017.

It’s been a swift retreat for Bitcoin, which is down more than 12 per cent since last Tuesday to trade below the $8,000 level for the first time in more than a week. The recent stumble is among its first downtrends of the year, which had so far seen a huge rally in digital assets on the back of expectations of greater mainstream acceptance and new developments in the blockchain space.

Though Bitcoin briefly topped $9,000 last week, it has not retested that level since. That’s a key trend-line for the coin, said Stolarski.

“People are seeing where the resistance is, where the stops are both up and down,” Stolarski said. “People are trying to find a stabilizing point where they can layer into a core position.”

By Vildana Hajric

David Ogden – Http://markethive.com/david-ogden