Examining Both Sides of Bitcoin Bulls and BTC Bears – What Separates Supporters from Opponents?

Of Bulls and Bears: What Distinguishes Bitcoin Supporters from BTC Opponents?

Bitcoin (BTC) is the first and largest cryptocurrency in the market that currently features over 2,100 digital coins. However, ever since it appeared, BTC had those who supported it and those who did everything in their power to discourage others from dealing with it. While it is true that BTC has its own problems, it is still interesting to notice that those who support it tend to be people who understand new technologies, while the new trend's opponents are mostly those who represent the current financial structure.

What Separates Bitcoin Bulls from the Bears?

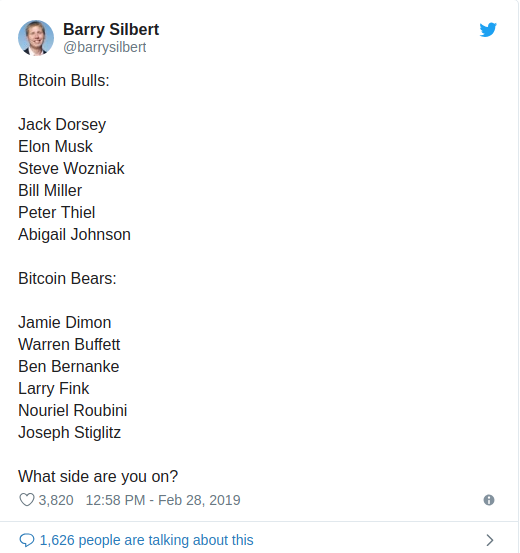

According to a recent tweet by Digital Currency Group's CEO, Barry Silbert, it is very clear to see what separates Bitcoin bulls from Bitcoin Bears.

The list of bulls mainly consists of some of the best-known names in the tech industry, such as Jack Dorsey, the CEO of Twitter and Square, who expressed interest in digital currencies several times. He has also supported many crypto-based projects, such as the browser extension that would bring Lightning Network tipping to the Twitter platform. He also provided monetary support to a leading firm in the area of Lightning Network development, indicating that Dorsey wishes to see Bitcoin's scalability problems resolved.

He even said many times that he believes that the internet will have its own currency some day. As far as he is concerned, it might as well be Bitcoin.

Then, there is the CEO of Tesla and SpaceX, Elon Musk. Musk has mostly been neutral regarding the whole crypto and Bitcoin dilemma, although his attitude seemingly started to change recently. Not long ago, Musk said that he thinks that Bitcoin is quite a brilliant innovation, while he also found many altcoins to be just as interesting.

Then, there is the co-founder of Apple, Steve Wozniak. Wozniak had the misfortune to be a victim of a crypto-related scam some years ago, during which he lost a number of coins. Even so, he still believes in the idea of Bitcoin, and crypto, in general. After 2018 was struck by a crypto winter and the markets turned bearish, Wozniak stated that it should now be seen in a negative light, as there were many positive developments in other areas of the crypto industry, even though the prices were continuously dropping.

The Opposing Side: Bears Strike Down and Bulls Strike Up

Now, let's take a look at who is opposing the cryptocurrencies. Names like Jamie Dimon and Warren Buffett are well known in the anti-Bitcoin team. They, as well as many others who are against cryptocurrencies, are quite interestingly all coming from the world of traditional finances. Considering Bitcoin's potential to disrupt this world and bring radical changes to how money is used, controlled, and transferred, it is hardly surprising that they found themselves endangered and did everything in their power to bash Bitcoin whenever possible.

Dimon and Buffet have called Bitcoin a fraud, a delusion, and Buffet even went as far as to call it ‘rat poison squared.' Meanwhile, they never gave any clear arguments as to why they believe this to be true, and they simply continued to repeat their claims.

There is also Ben Bernanke, the former Federal Reserve Chair, who was also mentioned on the Bitcoin bears list. However, while Bernanke opposed Bitcoin from the start, at least he found the concept of blockchain technology to be interesting. He still sees BTC as an attempt to evade regulations and expects the government to crack down on it, which is unlikely to happen since the SEC itself confirmed the Bitcoin is not a security.

Finally, there is Nouriel Roubini, the lecturer from the New York University, who criticized Bitcoin many times, even calling it a ‘stinking cesspool.' Of course, this is not the end, and there are many others who took a swing at Bitcoin, but Barry Silbert's point remains — BTC is mostly attacked by those who are not familiar with new and advanced technologies.

One recent development indicates that even these people may end up changing their mind, provided that they understand the benefits of cryptocurrencies. That is, of course, the announcement of JPM Coin, a supposed cryptocurrency (which is not a real cryptocurrency), and which is launchedby JP Morgan, despite Jamie Dimon's previous claims and criticisms. It is unknown whether Dimon actually changed his mind about cryptocurrencies, but the move means that the institutions are learning, and that they are taking steps towards crypto, instead of continuously running away from them.

Cryptocurrencies still have a long way to go before reaching mass adoption, and bears are unlikely to stop that process. They may slow it down, as there are many who respect their opinion, and will likely be more hesitant to go crypto becouse of it. However, the crypto trend is rising continuously, the coins are developing further, becoming better, faster, and their issues are slowly but surely being taken care of. It may take years, or even another decade, but it is highly unlikely that Bitcoin and the rest of the coins are going away.

By Bitcoin Exchange Guide News Team – March 11, 2019

David Ogden – Http://markethive.com/david-ogden