Don't Expect New Bitcoin Highs in 2018

Many investors and advisors are on record stating that $5,700 was the bottom in bitcoin for this year, and that higher prices lie ahead. While we are very bullish on bitcoin's long-term prospects, we do heed caution for more short-term price optimism.

To find the starting point of the historic parabolic rally in bitcoin that ended at $20,000 we have to go as far back as August 2015, when bitcoin traded at below $200. This past rally was a stupendous, historic move. Even in secular bull markets, the collective of economic actors need time to absorb the information embedded in its characteristic high volume rallies.

As I've indicated in my 2018 outlook, I think chances are high for this year to be remembered as a shakeout year: a lemon market in altcoins, regulators catching up and infrastructure growing pains.

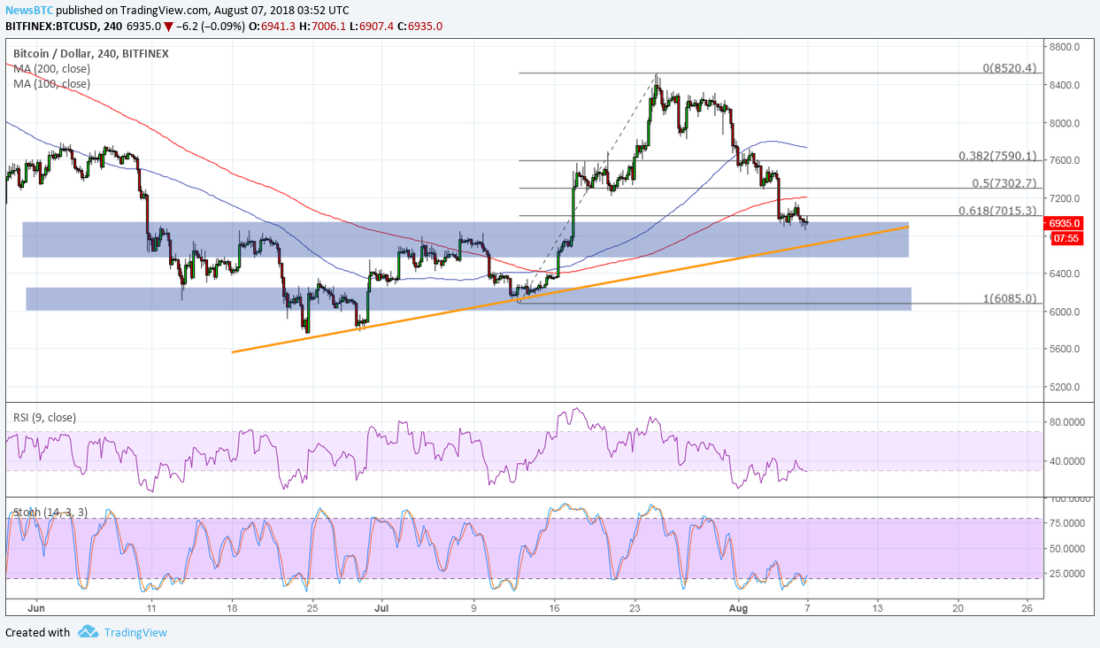

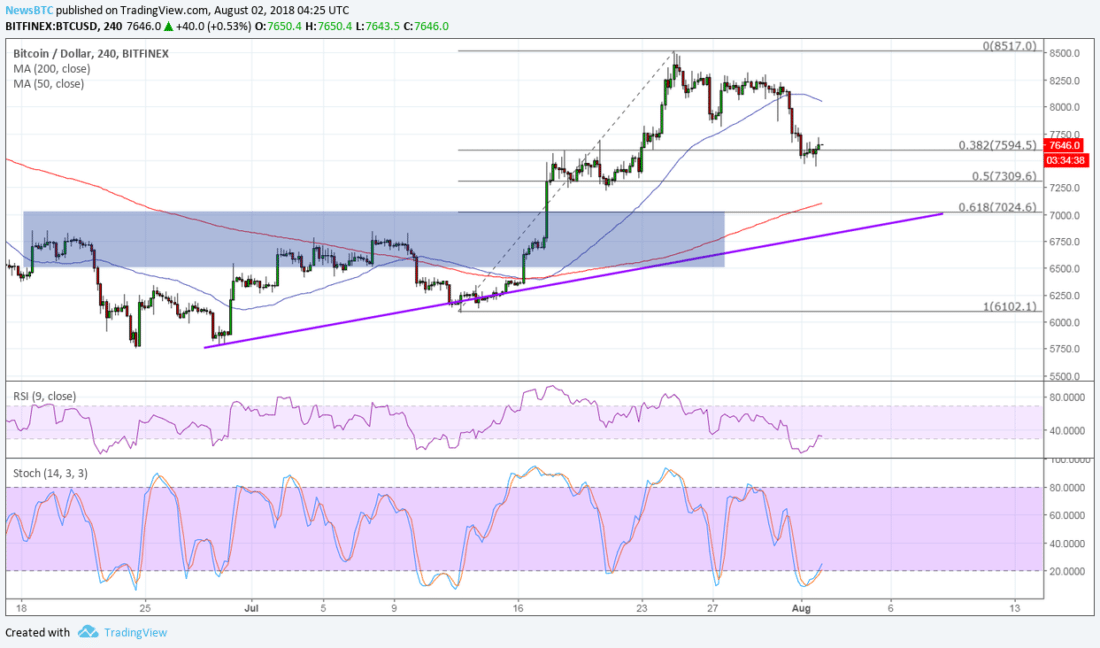

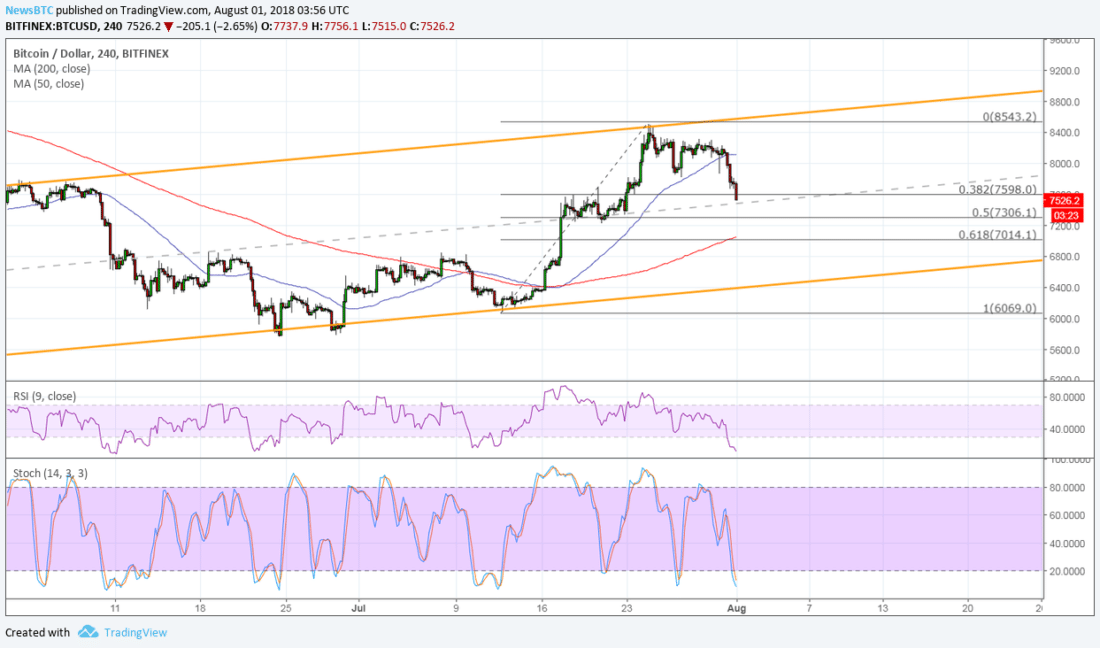

Short-term bearish signs

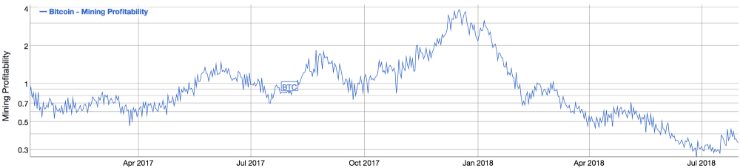

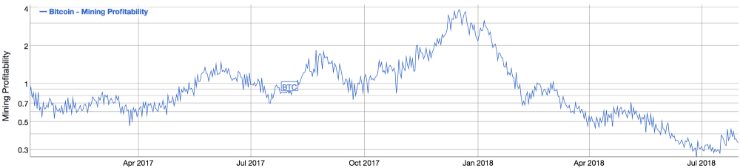

Since January, the bitcoin mining hashrate (aggregate computations per second made to secure the network ) has tripled, which means that a huge amount of new or more efficient mining rigs have come online. In combination with declining prices, this means that miners who weren't able to upgrade their machines or find cheaper electricity have been faced with a steep decline in profitability, a 90% drop in 7 months (altcoins have faced similar or steeper declines).

With profit margins under heavy pressure, it's not unlikely that miners are and will stay responsible for a significant amount of selling in the market.

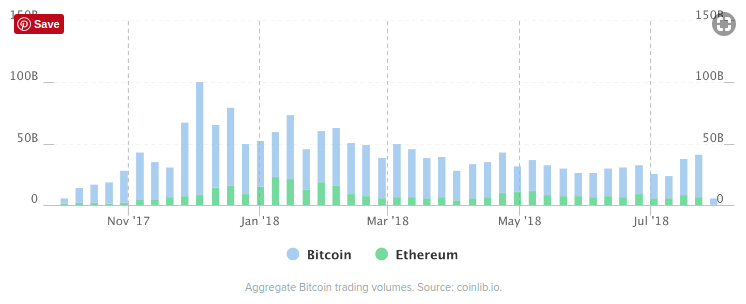

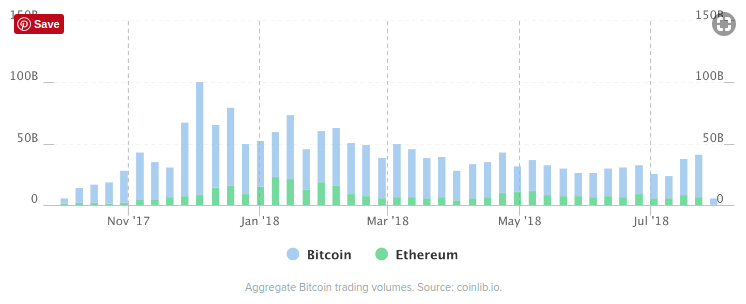

Next, trading volumes are not dead, but still below those seen during last winter and spring.

It's unclear how much of the recent pick-up in volumes are the result of a short squeeze and how much is coming from new long-term buyers coming in.

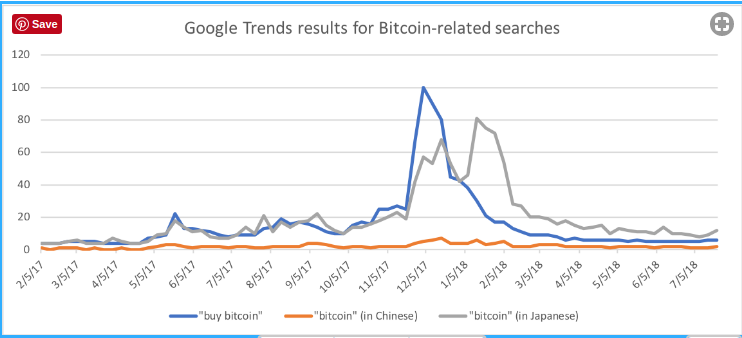

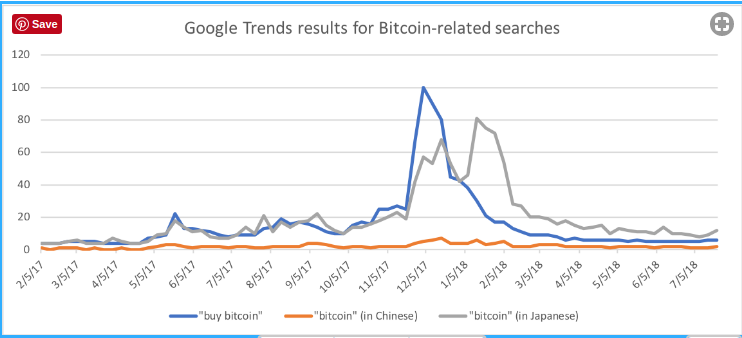

After last year's FOMO, retail interest in bitcoin has now become very sluggish:

A Gallup poll conducted three months ago suggested that less than 0.5% of U.S. investors "will probably buy bitcoin in the near future."

Despite transaction fees and volatility having dropped strongly, merchants are seeing +50% lower bitcoin revenues compared to last fall.

Google searches are not suggestive of a quick retail fueled recovery either:

Next, here are some comments we've gathered from bitcoin analysts, market makers and Wall Street insiders:

The first bitcoin ETF will likely not be approved before 2019. So any anticipation of approval by September will likely be met with disappointment.

While institutional investors are certainly getting involved in bitcoin, the vast majority of the firms are trading firms who are looking to make markets regardless of price: they're just as happy to take on short positions as they are to go long. Institutions who are known to be long-biased, such as mutual funds and pension funds are not ready to invest because they're not yet comfortable with the available custody solutions.

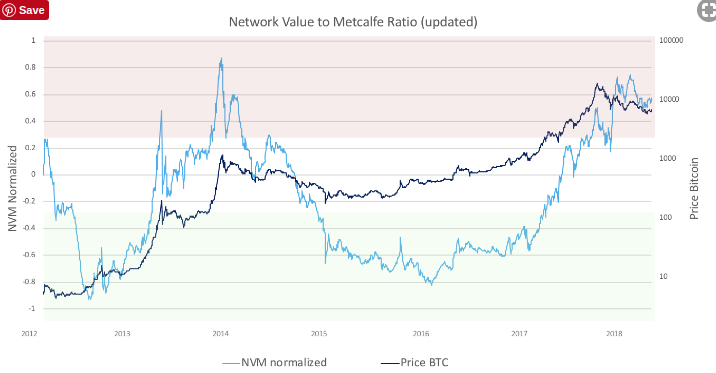

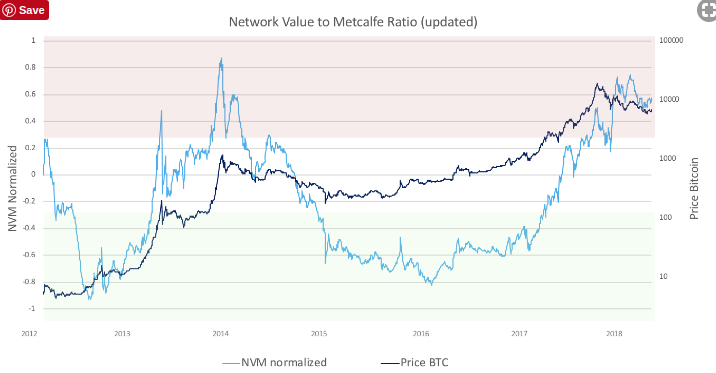

There's also the NVM Ratio, which is designed to reflect early stage adoption, now suggesting that there's now too little on-chain activity to justify bitcoin's current market cap:

The assumption here is that bitcoin's market value is mostly derived from it being a network that connects users around the world: the more people and entities use the bitcoin blockchain to settle transactions, the more it acquires the liquidity and utility that we'd expect from digital gold.

The NVM ratio approximates that by measuring daily active addresses on the blockchain. Similar valuation models have been made for growth companies such as Facebook and Linkedin, where the number of monthly active users reasonably correlates with enterprise value.

(There are several objections one could raise against the NVM Ratio: it doesn't take into account transaction amounts nor the difference between old an new addresses, it doesn't discount spam attacks, it doesn't acknowledge limitations to the block size and neither does it consider institutions coming into the market who build derivatives on bitcoin that rely on a small amount of high-value cold storage addresses. More work is needed to refine valuation models. That said, even though bitcoin's core value proposition is as a store of value, we do think we're still in the early adoption phase, and hence using a valuation metric that reflects this adoption makes sense to us. In that context, we think the NVM's on-chain activity based valuation method has merit.)

The related NVT ratio, which tries to measure if the daily dollar value of all bitcoin transactions is relatively high or low versus the market cap, also suggests overvaluation.

Finally, in the past few months, we've also seen a number of macro events that would appear to be bullish for bitcoin as a safe haven: the North Korea debacle, a spike in volatility, Chinese stocks breaking down, etc. However, these shocks didn't move the meter for bitcoin.

Some caveats

All this being said, lower bitcoin prices ahead are not a foregone conclusion:

-

The bitcoin price has already come down by 62 percent since December.

-

Since March, the Chinese Yuan has dropped by 8 percent against the dollar. If this slide continues, Chinese capital could flee into bitcoin.

-

Bitcoin dominance is gaining ground, which we think indicates the market's slow realization that there's a large moat around the bitcoin ecosystem now which will make it hard to dislodge.

-

The 2015–'17 rally was historic but not entirely unique for this ecosystem: between late 2011 and April 2013, the bitcoin price multiplied by 100x, and, after a six-month correction, it multiplied again by 10x.

-

Value investors are already anticipating the May 2020 block reward halving, which will cut down bitcoin's annual supply inflation from 3.7 percent to only 1.79 percent.

-

A bitcoin ETF approval, even if it's delayed, would be a huge deal because it makes the asset extremely accessible for the retail investor. After the first gold ETF went live in 2004, the gold price rallied by 350 percent (and it's still 200 percent higher today). The 2017 rally has also set in motion a flurry of corporate activity on the bitcoin infrastructure side, and the promise of established banks, brokers, payment processors, and security providers offering their own solution suites is catching the attention of value investors.

Conclusion

We think the market likely needs more time to absorb the recent 30-month rally, which could produce lower prices.

We don't foresee new all-time highs in bitcoin for 2018, and unless data starts suggesting differently, we are expecting mostly sideways or lower price action.

Author Tuur Demeester

Updated Aug 6, 2018 at 02:03 UTC

David Ogden – Http://markethive.com/david-ogden