Bitcoin falls as one of the world's biggest cryptocurrency markets readies a bill to ban trading

-

South Korea's justice minister said that the country is preparing a bill that will ban all cryptocurrency trading

-

Park Sang-ki told reporters that there are "great concerns" regarding virtual currencies

-

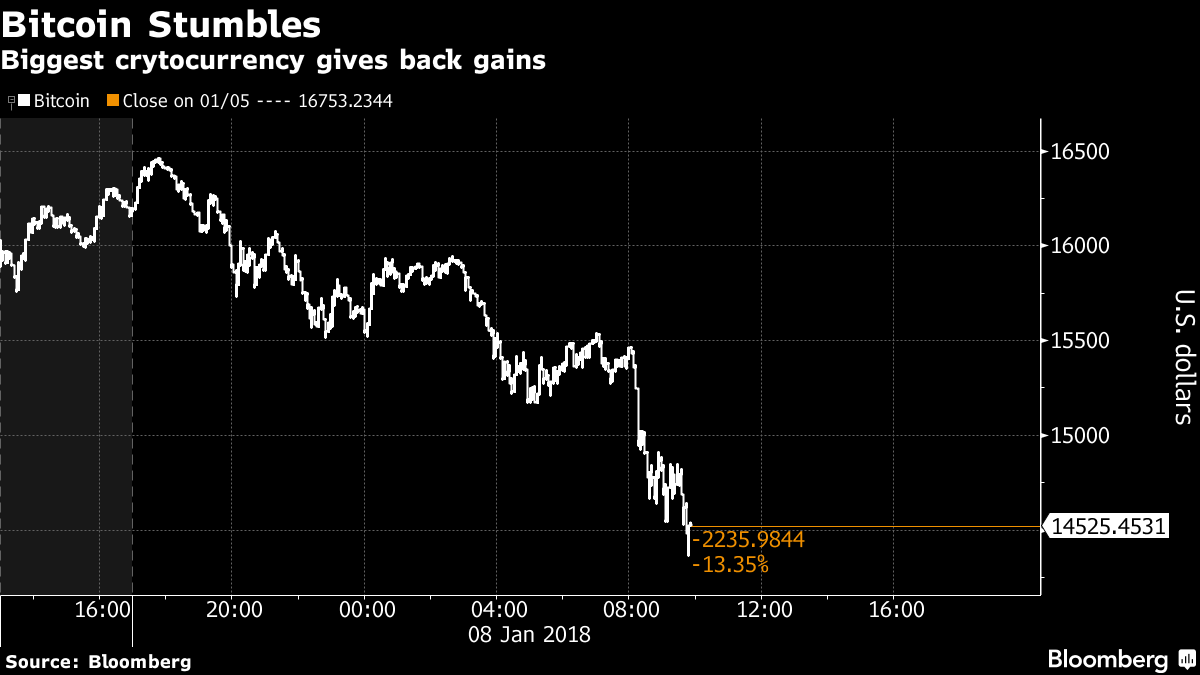

Bitcoin tumbled more than 12 percent following Park's remarks

South Korea's justice minister said on Thursday that a bill is being prepared to ban all cryptocurrency trading in the country.

That news is a major development for the cryptocurrency space, as South Korea is one of the biggest markets for major coins like bitcoin and ethereum.

According to industry website CryptoCompare, more than 10 percent of ethereum is traded against the South Korean won — the second largest concentration in terms of fiat currencies behind the dollar. Meanwhile, 5 percent of all bitcoin are traded against the won.

"There are great concerns regarding virtual currencies and justice ministry is basically preparing a bill to ban cryptocurrency trading through exchanges," Park Sang-ki said at a press conference, according to the ministry's press office.

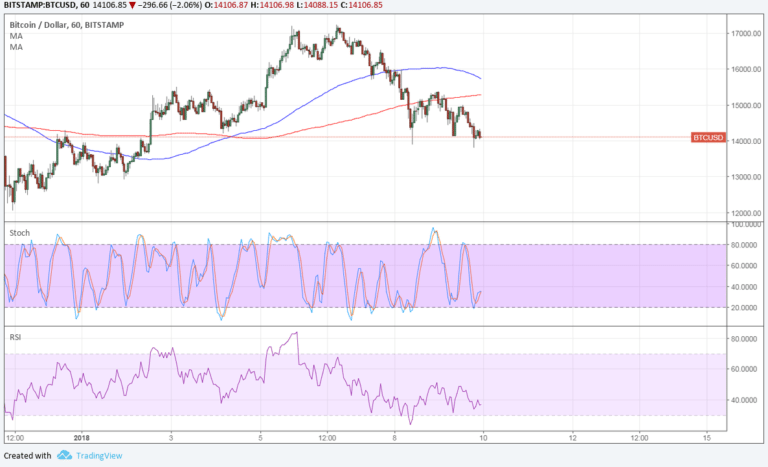

Bitcoin tumbled more than 12 percent following Park's remarks, according to CoinDesk's bitcoin price index that tracks prices from four exchanges. At 1:26 p.m. HK/SIN, the cryptocurrency price retraced some of its losses to trade at $13,547.7.

Park added that he couldn't disclose more specific details about proposed shutdown of cryptocurrency trading exchanges in the country, adding that various government agencies would work together to implement several measures.

Reuters further reported that a press official said the proposed ban on cryptocurrency trading was announced after "enough discussion" with other government agencies including the nation's finance ministry and financial regulators.

Cryptocurrency trading in South Korea is very speculative and similar to gambling. Major cryptocurrencies like bitcoin and ethereum are priced significantly higher in the country's exchanges than elsewhere in the world. For example, bitcoin traded at $17,169.65 per token at local exchange Bithumb, which was a 31 percent premium to the CoinDesk average price.

That difference in price is called a "kimchi premium" by many traders.

In fact, earlier this week, industry data provider CoinMarketCap tweeted that it would exclude some South Korean exchanges in price calculations due to the "extreme divergence in prices from the rest of the world" and for "limited arbitrage opportunity." The exchanges that were removed from the price calculation included Bithumb, Korbit and Coinone.

Last month, the South Korean Financial Services Commission said it was prohibiting cryptocurrency exchanges from issuing new trading accounts. If an exchange does allow new accounts, the government has the ability to take action to either stop trading or shut the exchange down, the commission said in a statement.

The commission added that, since much of the cryptocurrency trading was being done anonymously, users must use their real names.

The government also indicated it would closely monitor banks and would "swiftly" step in to limit fund flows into cryptocurrencies if necessary.

Bitcoin exposed stocks in South Korea took a major hit after the announcement. Shares of Omnitel, which has a bitcoin remittance business, crashed 30 percent, Vidente shares tumbled 29.96 percent, Digital Optics fell 13.46 percent and KPM Tech was down 5.19 percent.

That news from the justice minister comes after the country's largest cryptocurrency exchanges were raided by police and tax agencies this week for alleged tax evasion, people familiar with the investigation told Reuters.

Author : Saheli Roy Choudhury

Posted by David Ogden Entrepreneur

David Ogden – Http://markethive.com/david-ogden